Osaka is a vibrant hub for international businesses and expats, making it essential to have a trusted tax professional who understands local and global financial landscapes. Whether you’re a foreign company setting up operations in Osaka or an individual navigating Japan’s complex tax system, finding the right tax accountant can make all the difference. From income tax filing to corporate tax compliance, a qualified tax accountant in Osaka offers invaluable expertise to ensure you stay compliant with Japanese tax laws while maximizing your financial efficiency. Let’s explore how a professional tax accountant can support expats and businesses in Japan’s second-largest metropolitan area.

- The Role of a Tax Accountant in Osaka, Japan, and Why You Need One

- What are the Types of Taxes in Japan?

- How to Choose the Right Tax Accountant in Japan?

- What are the Common Tax Issues Faced by Expats in Japan?

- What Tax Services are Available in Osaka?

- How to Ensure Tax Compliance in Japan?

- Conclusion

- FAQs

The Role of a Tax Accountant in Osaka, Japan, and Why You Need One

Navigating Japan’s intricate tax system can be challenging, especially for expats and international businesses operating in Osaka. A tax accountant is critical in ensuring your financial obligations are met while providing peace of mind. From understanding Japanese tax laws to streamlining the preparation and filing process, these professionals are essential for individuals and businesses. Below, we’ll explore the responsibilities of a tax accountant, the benefits of hiring one, and how they simplify the often complex tax filing process.

Understanding the Role of a Tax Accountant in Japan

A tax accountant is more than just someone who handles your taxes; they are trusted advisors who guide you through the complexities of Japan’s tax system. Their responsibilities typically include:

- Advising Japanese tax laws: Tax accountants stay updated on evolving regulations to ensure compliance.

- Preparing and filing tax returns: They assist with everything from individual income tax to corporate tax obligations.

- Representing clients before tax authorities: In cases of audits or disputes, tax accountants act as intermediaries.

- Providing financial insights: They offer guidance to help you optimize tax efficiency and reduce liabilities.

For expats and businesses in Osaka, having a local tax accountant ensures compliance and confidence in managing Japan’s unique tax requirements.

Benefits of Hiring a Professional Tax Accountant

Working with a professional tax accountant offers numerous advantages, particularly for ex-pats and foreign companies:

- Expert Knowledge: Japan’s tax regulations are complex and can vary based on individual or corporate status. A professional accountant ensures accuracy and compliance.

- Time Savings: Filing taxes in a foreign country can be overwhelming. A tax accountant streamlines the process, saving you time to focus on other priorities.

- Cost Efficiency: Proper tax planning by a professional can reduce unnecessary tax liabilities, helping you retain more of your income or profits.

- Multilingual Services: Many tax accountants in Osaka cater to international clients, offering services in English to bridge language barriers.

Hiring a knowledgeable tax accountant gives you access to tailored solutions that make tax compliance stress-free and efficient.

How a Tax Accountant Can Simplify Your Tax Filing

Filing taxes in Japan involves several steps, including understanding deductions, filling out forms, and adhering to strict deadlines. This process can become overwhelming for individuals and businesses without expert assistance.

A tax accountant can simplify tax filing in the following ways:

- Customized Support: They analyze your financial situation to determine the most effective filing strategy.

- Error Prevention: Mistakes in tax filings can result in penalties or audits. Accountants ensure everything is accurate.

- Adherence to Deadlines: They ensure your returns are submitted on time, avoiding late penalties.

- Guidance on Deductions: Tax accountants identify deductions and credits you may not know, helping reduce your tax bill.

For expats in Osaka, these professionals bridge your financial needs and Japan’s tax regulations, making the entire process seamless.

What are the Types of Taxes in Japan?

Japan’s tax system is comprehensive and applies to both individuals and businesses, encompassing a wide range of tax categories. Understanding the types of taxes and their respective obligations is crucial for compliance, especially for expats and companies operating in Osaka. The three primary types of taxes in Japan are income tax, consumption tax, and corporate tax. Below, we’ll explore each of these categories and their implications for individuals and businesses.

Income Tax in Japan: A Guide for Expats and Businesses

Income tax in Japan is levied on individuals and companies based on their earnings. For individuals, the tax system operates on a progressive rate, meaning the more you earn, the higher your tax rate. For businesses, corporate income is taxed at fixed rates depending on the company’s size and revenue. Key aspects of income tax include:

Individual Income Tax:

- Residents of Japan are taxed on their worldwide income, while non-residents are only taxed on Japan-sourced income.

- Filing requirements vary depending on residency status, income source, and employment type.

- Deduction options, such as social security contributions and dependent deductions, help reduce taxable income.

Corporate Income Tax:

- Corporate entities operating in Japan are subject to national and local income taxes.

- Companies must report their revenue and deduct allowable expenses, such as operating costs and depreciation.

Navigating these rules can be challenging for expats and businesses in Osaka. A tax accountant can clarify your obligations and ensure compliance with filing deadlines.

Understanding Consumption Tax and Its Impact

Consumption tax in Japan is similar to a value-added tax (VAT) in other countries and applies to most goods and services purchased within the country. Currently, the consumption tax rate is 10%, with a reduced rate of 8% for certain essential items like food and beverages. Key points include:

- Who Pays Consumption Tax?

- The final consumer bears the cost of consumption tax, but businesses are responsible for collecting and remitting it to the authorities.

- Impact on Businesses:

- Businesses with annual taxable sales exceeding 10 million yen must register for consumption tax and comply with strict reporting requirements.

- Non-compliance can lead to penalties, making professional tax guidance essential.

Consumption tax significantly impacts both individuals and companies. A tax accountant can help businesses in Osaka manage this obligation efficiently.

Corporate Tax Obligations for Businesses

Corporate tax is one of the most significant tax burdens for businesses operating in Japan. Companies must pay several types of taxes, including national corporate tax, local corporate tax, and enterprise tax. Here’s what companies need to know:

National Corporate Tax:

- This is a standard tax on a company’s taxable income, with rates depending on the company’s size and classification.

Local Corporate Tax and Enterprise Tax:

- Osaka-based companies must also pay taxes to local prefectures and municipalities, which fund regional infrastructure and services.

Special Rules for Foreign-Owned Companies:

- Branches of foreign corporations in Japan are taxed only on Japan-sourced income.

- Subsidiaries of foreign companies are taxed similarly to domestic companies, with national and local obligations.

Managing corporate tax obligations can be daunting, especially for foreign businesses unfamiliar with Japan’s tax landscape. Professional accountants in Osaka provide essential support to navigate these complexities.

How to Choose the Right Tax Accountant in Japan?

Selecting the right tax accountant in Japan is crucial for ensuring compliance with Japanese tax laws and optimizing financial operations. For expats and businesses in Osaka, finding a tax professional who understands your needs can save you time, money, and stress. Below, we’ll discuss the key qualities to look for, essential questions to ask, and why local expertise in Japanese tax law is indispensable.

Essential Qualities to Look for in a Tax Accountant

When evaluating tax accountants in Osaka, prioritize the following qualities to ensure you receive the best service:

- Expertise in Japanese Tax Laws:

- A qualified tax accountant should have in-depth knowledge of Japanese tax regulations, including the nuances of corporate, individual, and international tax laws.

- Multilingual Communication Skills:

- For ex-pats, working with a professional fluent in English can make complex tax matters more manageable.

- Experience with International Clients:

- Look for an accountant who has experience assisting foreign individuals and businesses. This ensures they understand the unique challenges faced by non-Japanese clients.

- Strong Attention to Detail:

- Accuracy is critical in tax filings to avoid costly errors and penalties.

Focusing on these qualities can help you identify a tax accountant in Osaka who is equipped to handle your specific needs.

Questions to Ask When Hiring a Tax Accountant

Before hiring a tax accountant, ask the following questions to assess their suitability:

- What services do you specialize in?

- Ensure they offer services relevant to your needs, such as international tax advice or corporate tax filing.

- Do you have experience with expats or foreign-owned businesses?

- Their expertise in dealing with international clients is essential for non-Japanese taxpayers.

- What are your fees, and how are they structured?

- Confirm their pricing model to avoid surprises later.

- How do you ensure compliance with the latest tax regulations?

- An up-to-date accountant will help you avoid legal issues.

- Can you provide services in English?

- For expats in Osaka, language compatibility is a significant factor.

Asking these questions will help you find an accountant who meets your expectations and can provide valuable insights into Japan’s tax system.

The Importance of Local Expertise in Japanese Tax Law

Japanese tax regulations vary significantly depending on location, making local expertise invaluable. Here’s why choosing an accountant with knowledge of Osaka’s tax landscape is essential:

- Understanding Local Tax Rates and Obligations:

- Tax rates and requirements can differ across prefectures. Osaka-based tax accountants are familiar with regional variations and can provide tailored advice.

- Connections with Local Tax Authorities:

- A local accountant often has established relationships with Osaka’s tax offices, streamlining communication and resolving issues.

- Familiarity with Osaka’s Business Environment:

- An accountant who understands the city’s economic and regulatory landscape can offer strategic guidance for foreign companies operating in Osaka.

- Personalized Support:

- Local professionals can provide in-person consultations and support, ensuring a more personalized service.

Partnering with a tax accountant in Osaka who possesses local expertise ensures compliance and offers peace of mind for expats and businesses alike.

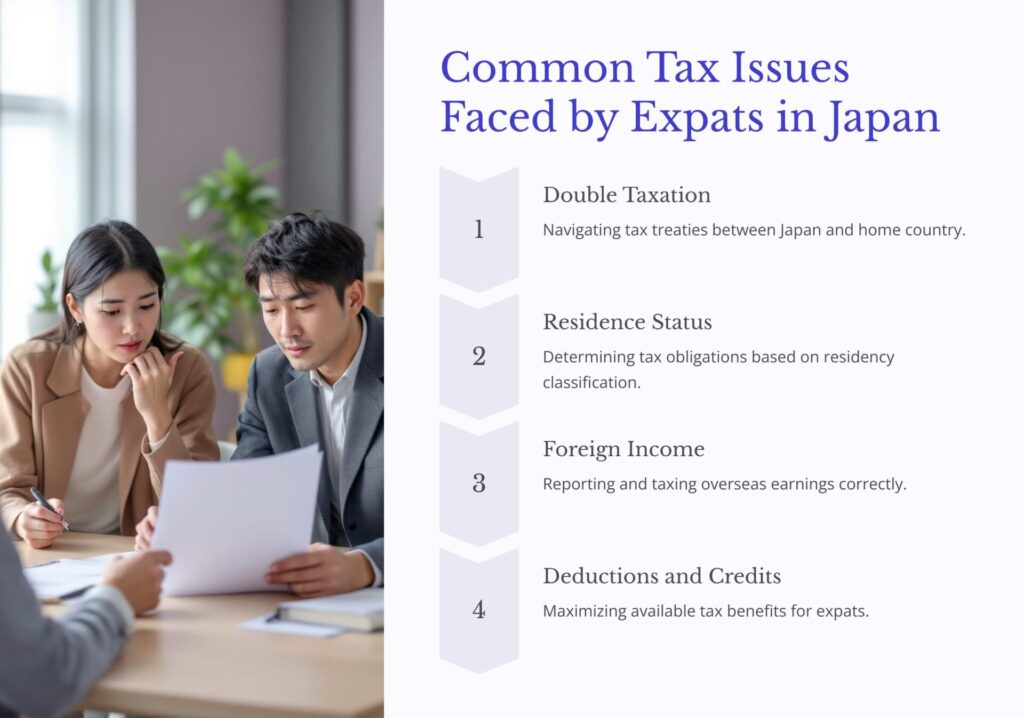

What are the Common Tax Issues Faced by Expats in Japan?

Understanding Japan’s tax system can be daunting for expats living and working in Japan. The complexity of Japanese tax laws, language barriers, and unique filing requirements often leads to confusion and errors. Expats in Osaka, in particular, face common challenges such as navigating income tax obligations, understanding withholding tax regulations, and managing year-end filings. Below, we address these issues and provide practical solutions to help expats stay compliant.

Navigating Individual Income Tax as a Foreigner

Individual income tax in Japan is one of the most challenging aspects for expats to navigate. The Japanese tax system classifies taxpayers into three categories: non-residents, non-permanent residents, and permanent residents, with different tax obligations for each group. Key issues include:

Determining Residency Status:

- Residency determines whether you are taxed only on Japan-sourced or worldwide income.

- For example, expats who have lived in Japan for more than one year are typically classified as non-permanent residents.

Taxable Income Sources:

- Expats often have multiple income sources, including salaries, bonuses, and foreign investments, which must be declared correctly.

- Double taxation can occur if global income is not managed appropriately.

Claiming Deductions and Exemptions:

- Expats may not be aware of deductions available for dependents, housing, and social insurance contributions.

With the help of a tax accountant in Osaka, expats can navigate these complexities, ensure compliance with Japanese tax laws, and optimize deductions.

Understanding Withholding Tax Regulations

Japan has strict withholding tax regulations, which often catch expats by surprise. This tax is deducted at the source by employers or payers, covering salaries, dividends, and other types of income. Common challenges include:

Salary Withholding by Employers:

- Employers in Japan are responsible for deducting taxes from salaries and bonuses. Expats may find it challenging to understand how these amounts are calculated.

Cross-Border Withholding:

- For expats receiving income from abroad, such as rental income or dividends, understanding Japan’s treaties to avoid double withholding taxes is critical.

Filing for Refunds:

- Overpaid withholding taxes are standard, especially for expats unaware of how to claim refunds.

A knowledgeable tax accountant can assist with reviewing withholding tax amounts, claiming refunds, and ensuring compliance with international tax agreements.

How to Handle Year-End Tax Filing as an Expat

Year-end tax filing (年末調整) is a process unique to Japan and can be particularly challenging for expats unfamiliar with local tax laws. Here’s what you need to know:

What is Year-End Tax Filing?

- This process involves reconciling the total tax amount owed with the tax withheld by your employer throughout the year.

- It typically takes place in December and is managed by your employer if you’re a salaried employee.

When Do Expats Need to File Taxes Independently?

- You must file a separate tax return if you have additional income outside of your salary (e.g., rental income, freelance earnings).

- Independent filings are also required for self-employed individuals or those not covered by the employer’s year-end adjustment process.

Common Pitfalls:

- Missing significant deductions or credits.

- Not filing on time can result in penalties.

How a Tax Accountant Can Help:

- They ensure all deductions and credits are applied, such as those for dependents, medical expenses, or education costs.

- Accountants also handle the preparation and filing of additional returns for non-salaried income.

By working with a professional tax accountant in Osaka, expats can easily navigate year-end filings and avoid costly errors.

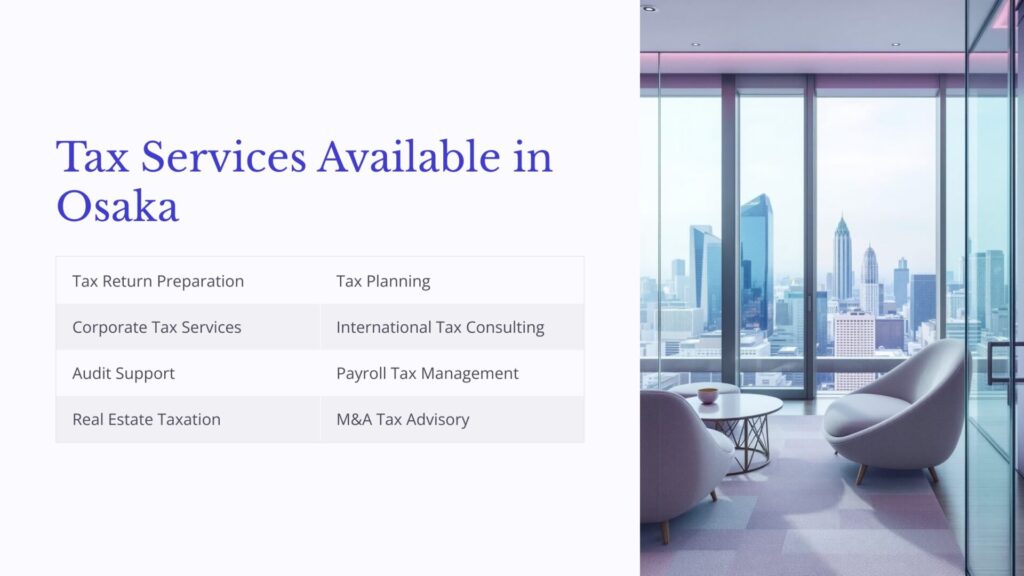

What Tax Services are Available in Osaka?

Osaka is home to various tax and accounting services tailored to meet the needs of expats and international businesses. Whether you require help with tax consulting, accounting for foreign companies, or year-end filing, the right tax professionals in Osaka offer customized solutions. Below, we’ll explore the range of services available to support your financial and tax needs in Japan.

Overview of Tax Consulting Services

Tax consulting services in Osaka are designed to help individuals and businesses navigate Japan’s complex tax system. These services include:

- Tax Planning and Advisory:

- Professionals assess your financial situation to provide strategic advice for minimizing tax liabilities while remaining compliant.

- Compliance Support:

- Accountants ensure you meet all legal requirements, including income tax, corporate tax, and consumption tax regulations.

- International Tax Guidance:

- For ex-pats and foreign companies, tax consultants provide advice on managing cross-border tax obligations and avoiding double taxation.

Tax consulting services are precious for foreign companies entering the Osaka market, as they simplify compliance with Japan’s strict tax laws.

Accounting Services for Foreign Companies in Japan

Foreign companies operating in Osaka face unique challenges regarding accounting and tax compliance. Specialized accounting firms offer services such as:

Bookkeeping and Financial Reporting:

- Ensure accurate record-keeping in line with Japanese accounting standards.

- Provide detailed financial reports for internal and external stakeholders.

Corporate Tax Filing:

- Assist with preparing and filing corporate tax returns, including deductions and credits applicable to foreign-owned businesses.

Payroll Management:

- Handle salary calculations, social insurance contributions, and employee withholding tax obligations.

Start-Up Support:

- Guide new foreign businesses through registering in Japan, setting up accounting systems, and fulfilling initial tax obligations.

By leveraging these services, foreign businesses can focus on growth and operations while leaving the complexities of Japanese accounting to local experts.

Year-End Tax Advisory Services

Year-end tax advisory is a critical service for individuals and businesses in Osaka. Accountants assist with:

- Year-End Adjustments for Employees:

- Ensure salaried employees benefit from accurate adjustments, incorporating deductions such as insurance premiums and dependents.

- Filing Independent Returns:

- For individuals with additional income or businesses outside of standard payroll systems, accountants prepare and submit year-end tax returns.

- Tax Optimization Strategies:

- Identify opportunities to reduce tax liabilities through deductions, exemptions, and credits available under Japanese tax law.

Year-end tax advisory services ensure that ex-pats and Osaka companies close the fiscal year with complete compliance and minimal tax liabilities.

How to Ensure Tax Compliance in Japan?

Tax compliance is a critical responsibility for both individuals and businesses in Japan. The country’s tax laws are comprehensive and strictly enforced, making understanding and meeting your obligations essential. For expats and companies operating in Osaka, ensuring compliance involves staying informed about regulations, working closely with tax professionals, and adopting effective tax planning strategies. Below, we explore the critical aspects of tax compliance in Japan.

Understanding Tax Regulations and Obligations

Japan’s tax system includes various taxes at the national and local levels. Staying compliant requires understanding these obligations and meeting deadlines. Key points include:

National Taxes:

- Income Tax: Individuals must file returns for income earned in Japan (and globally, if applicable).

- Corporate Tax: Companies operating in Japan must report their profits and pay corporate taxes.

Local Taxes:

- Prefectural and Municipal Taxes: Depending on location, Osaka businesses and residents are subject to additional taxes.

Consumption Tax:

- Businesses must register and collect consumption tax if their taxable sales exceed 10 million yen annually.

Failing to comply with these regulations can result in penalties, audits, or even legal action. A tax accountant in Osaka can help you navigate these obligations with confidence.

The Role of Tax Authorities in Japan

Japan’s tax authorities, including the National Tax Agency (NTA) and local tax offices, actively ensure compliance. Their responsibilities include:

Audits and Inspections:

- The NTA regularly conducts audits to verify the accuracy of tax filings and identify non-compliance.

- Osaka’s local tax offices handle inspections for prefectural and municipal taxes.

Guidance and Enforcement:

- Tax authorities provide guidelines to help taxpayers understand their obligations.

- Strict penalties are imposed for late filings, underreporting, or evasion.

Support Services:

- Local tax offices in Osaka offer consultations for individuals and businesses, often in Japanese.

Working with a tax accountant ensures that your filings are accurate and complete, reducing the risk of audits and penalties.

Strategies for Effective Tax Planning

Effective tax planning is essential for minimizing liabilities while complying with Japanese regulations. Strategies include:

Proactive Financial Management:

- Keep detailed records of income, expenses, and deductions throughout the year.

- Ensure all transactions are documented and categorized accurately.

Utilize Available Deductions and Credits:

- Claim deductions for social insurance, medical expenses, and dependents to reduce taxable income.

- Businesses can take advantage of depreciation and operating expense deductions.

Stay Ahead of Deadlines:

- Be aware of filing deadlines for income, corporate, and consumption taxes.

- Early preparation helps avoid last-minute errors and penalties.

Work with a Tax Accountant:

- Tax professionals in Osaka can provide tailored advice based on your financial situation.

- They also ensure that your tax strategy aligns with Japan’s legal requirements.

By implementing these strategies, individuals and businesses can manage their taxes efficiently and focus on long-term financial growth.

Conclusion

Managing taxes in Japan can be complex, especially for ex-pats and foreign businesses navigating unfamiliar regulations. However, with the proper support, tax compliance can become a seamless process. A professional tax accountant in Osaka is vital in helping individuals and businesses meet their obligations while maximizing financial efficiency. From income tax and corporate tax to consumption tax compliance, these experts offer invaluable guidance tailored to your needs.

Whether you’re an expat looking to simplify year-end tax filing or a foreign company managing cross-border operations, partnering with a knowledgeable tax accountant ensures that your financial matters are handled accurately and efficiently. In Osaka, a city known for its vibrant business environment, having a trusted tax advisor is not just a convenience—it’s a necessity.

Take the first step towards stress-free tax management by consulting with a local tax professional in Osaka. Their expertise will provide clarity, compliance, and confidence in navigating Japan’s tax landscape.

FAQs

What services does a tax accountant in Osaka provide?

Answer:

A tax accountant in Osaka offers various services, including tax filing, international tax consulting, corporate tax management, year-end adjustments, and accounting services tailored for expats and foreign businesses.

Do tax accountants in Osaka provide services in English?

Answer:

Yes, many tax accountants in Osaka cater to international clients and provide services in English, ensuring clear communication and support for ex-pats and foreign companies.

What are the common tax challenges for expats in Japan?

Answer:

Expats often face challenges such as determining residency status, understanding income tax obligations, managing withholding taxes, and completing year-end tax filings accurately.

How can a tax accountant help foreign businesses in Osaka?

Answer:

Tax accountants assist foreign businesses with corporate tax compliance, consumption tax filing, payroll management, and ensuring adherence to Japanese tax regulations.

When is the tax filing deadline in Japan?

Answer:

The deadline for individual income tax filing in Japan is typically March 15th, while corporate tax deadlines depend on the company’s fiscal year-end. A tax accountant can help you track and meet these deadlines.