English-Speaking Tax Advisor for Individuals & Small Businesses in Japan

Aki Japan Tax Consultant Office

Specialized in Income and Corporate Tax for English-speaking clients such like sole proprietors, small businesses, and foreign professionals in Japan.

English-Speaking Tax Advisor

Aki Japan Tax Consultant Office

Cross-Border & Japanese Tax Support

for Individuals and Small Businesses.

Our Services

We primarily support sole proprietors and small to medium-sized businesses with tax compliance and advisory matters, with particular focus on international cases and English-speaking clients.

Spot Tax Advisory Session (Online / In-Person)

- A focused session designed to organize tax issues and confirm direction.

- Starting from JPY 27,500 (50 minutes)

- Available nationwide and overseas via Zoom; in-person meetings also available

- Tax consultations available in English

※This service is intended for issue clarification and directional guidance. It does not include the preparation of formal written opinions.

Tax Filing Support

- Support for overseas investments, foreign tax credits, non-resident matters, and more

- Support Plan: from JPY 88,000

- Comprehensive Plan: from JPY 187,000 (example pricing)

- We recommend beginning with a single-session consultation (online or in-person) to clarify issues and confirm direction.

Ongoing Tax Advisory Engagement

- For clients who wish to have periodic consultations every 2 or 4 months

- Clients seeking one consultation per year are encouraged to use the single-session option

- Engagement is offered after confirming compatibility and direction through an initial consultation

Other Services

- International inheritance, tax audit support, financing assistance, tax representative services

- Support for freee and Xero implementation

- We recommend starting with a single-session consultation (online or in-person) to organize your situation

Our Services

We primarily provide tax return support for sole proprietors and small to medium-sized businesses, with particular experience in international matters and English-speaking clients.

Spot Tax Advisory Session (Online / In-Person)

- 50 minutes – JPY 27,500 (standard session)

- Available nationwide and overseas via Zoom; in-person meetings also available

- Tax consultations available in English

Tax Filing

- Overseas investments, foreign tax credits, non-resident matters, and more

- Support Plan: from JPY 88,000

- Comprehensive Plan: from JPY 187,000 (example pricing)

- We recommend starting with a Spot Tax Advisory Session (online or in-person) to clarify direction before proceeding

Ongoing Tax Advisory Engagement

- For clients who prefer periodic consultations every 2–4 months

- If you require only one consultation per year, please use the Spot Session option

- Engagement is offered after confirming compatibility and direction through an initial consultation

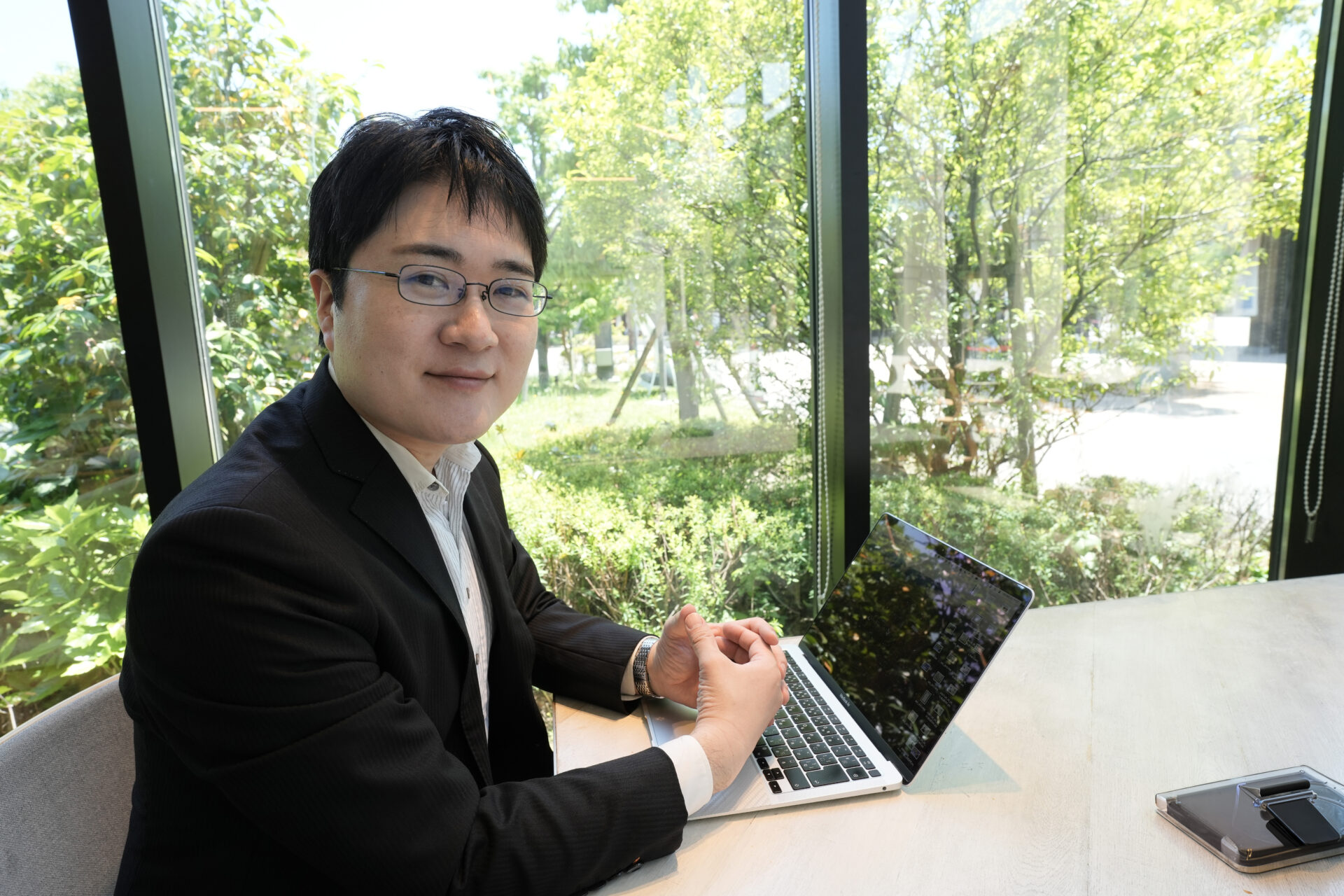

Aki Kojima

Certified Public Tax Accountant(Japan), MBA

All services are handled directly by the principal.

Your contact person will not change during the engagement.

The principal personally manages and responds to all matters.

Consultations available nationwide and internationally via online meetings (Japanese / English).

International Matters

EDirect Principal Handling

Cloud Accounting

Blog

We share insights to deepen your understanding of Japanese tax matters, along with updates on the latest tax law changes.

Management Visa and Executive Compensation | The Surprisingly Tricky Pitfalls of Setting Executive Compensation

Management Visa and Receipt of Compensation You need to be cautious when receiving...

Will Unpayment Affect? Social Insurance Premiums and Visa Renewals in 2027.

There has been a recent trend toward stricter visa renewal requirements.As early as...

Individual Business Tax Paid by Self-Employed

In addition to income tax and resident tax, the self-employed need to pay individual...

Customer Testimonials

Here are some testimonials from our clients. Discover how my services have positively impacted their businesses and lives.

My experience was outstanding from start to finish. The booking process was smooth and well-organized, with timely reminders, and the meeting itself was both professional and welcoming.

Kojima-san reviewed key areas including my resident status, various tax exposures, and the process for handling business expenses. His explanations were clear and thorough, and I felt an immediate sense of trust in his guidance—trust that was later reinforced by my own research.

By the end of our meeting, I felt genuinely relieved and confident in the path forward. I would highly recommend his services.

I really didn’t know anything, so I’m truly grateful for all the explanations and advice you gave me. I hadn’t been able to handle invoices or taxes very well, so it was a huge help to get your consultation and have you explain these complex topics to me.

FAQ

Here are some of the frequently asked questions.

Q. How is tax consultation provided?

Consultations are available online or in person, depending on your preference.

In-person meetings are typically held at a rental office in Umeda, Osaka.

If you prefer another location within Osaka City, I can arrange a suitable meeting space nearby.

Q. Is it possible to consult in English?

Yes. Consultations are available in both English and Japanese.

Many of our clients are foreign residents and international business owners.

Q. When may this service not be suitable?

This service may not be appropriate for:

-

Those expecting immediate responses via LINE or chat

-

Those wishing to outsource all bookkeeping tasks

-

Those primarily seeking the lowest-cost option (free consultations are not offered)

Q. When is a Spot Tax Advisory Session appropriate?

-

A Spot Tax Advisory Session is suitable if you:

-

Need clarification on overseas income or foreign tax credit issues

-

Want to confirm your tax status as a non-permanent or permanent resident

-

Seek guidance on RSUs, foreign employment income, or cross-border compensation

-

Require a professional opinion before filing or entering into a retainer agreement

-

Would like a second opinion on international tax matters

This session focuses on organizing your issues and providing strategic direction.

Final filing decisions and formal written tax opinions are handled separately. -

Book a session

Please use the button below to book your Spot Tax Advisory Session.