If you are considering relocating or moving abroad, it is vital to ensure you are aware of all tax-related procedures before you leave Japan. In particular, tax obligations in Japan do not entirely disappear even if you move abroad.

Even if you become a non-resident, you will still have tax obligations if you have assets or income in Japan. In addition, if you have just left Japan, you may still have tax obligations, especially for resident tax.

For this reason, it is necessary to set up a “Tax Agent”(Nozei Kanrinin[納税管理人]) to facilitate tax payment during your stay abroad.

What is a Tax Agent?

A tax agent is a person who handles tax-related procedures in Japan on your behalf while you are abroad. Documents and notices from the tax office are sent to that person and can be handled as needed. If you do not set up a tax agent, essential tax documents may not be received, and deadlines may be missed. It may result in delinquent taxes and penalties.

Role of the Tax Agent

- Correspondence with the tax office (receipt of documents)

- Procedures for payment of taxes

- Responding to questions and confirmations from the tax office

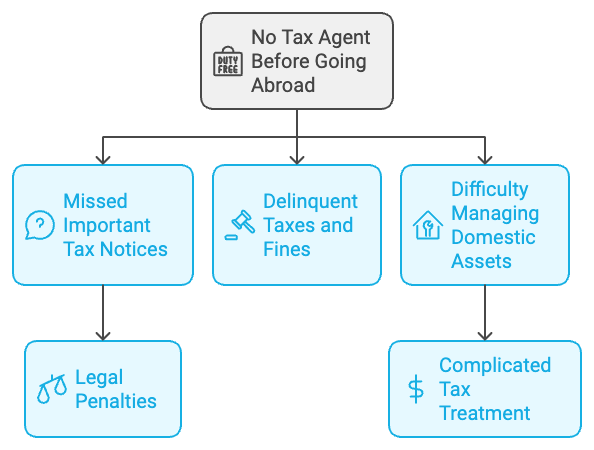

What happens if I don’t set up a tax agent?

If you go abroad without setting up a tax agent, the following problems may arise.

- Missing Important Notices: Notices and documents related to tax payments are sent to your absent Japanese address. If you fail to check these, you may miss a communication from the tax office, and the deadline will pass without your knowledge.

- Delinquent Taxes and Fines: Failure to pay taxes or file a tax return may result in delinquent taxes and fines, which are legal penalties for failure to file a tax return.

- Difficulty in managing domestic assets: If you have real estate or other assets in Japan, you are more likely to run into trouble if tax treatment does not run smoothly.

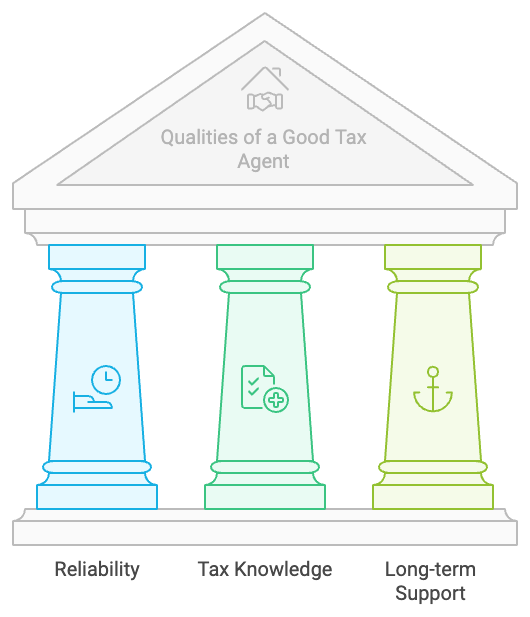

How to Choose a Tax Agent

A tax agent is usually a trusted family member, friend, or professional (e.g., a Public Certified Tax Accountant). In making the selection, it is essential to consider the following.

- Reliability: It is essential to choose someone you can trust because they will be responsible for tax matters on your behalf.

- Tax Knowledge: Understanding tax procedures is desirable. A tax accountant can be expected to provide expert advice and reliable support.

- Long-term support: If you plan to stay abroad for an extended period, it is important to ensure your tax agent is available.

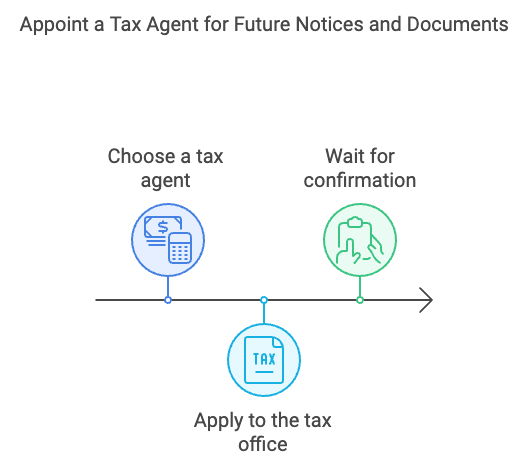

Steps to Set up a Tax Agent

The specific steps to set up a tax manager require filing paperwork with the tax office. The following steps should be followed.

- Determine potential tax agent: Choose someone you trust and an expert.

- Apply to the tax office: Fill out the prescribed forms and provide details such as the address and contact information of the tax administrator. If you choose to work with me, I can submit this application on your behalf.

- Confirmation Procedure: Once the tax office is registered as the tax administrator, future notices and documents will be sent to that person.

Practical advice for expatriates

Finally, I advise those moving or staying abroad for an extended period to ensure you know all tax-related procedures before leaving the country.

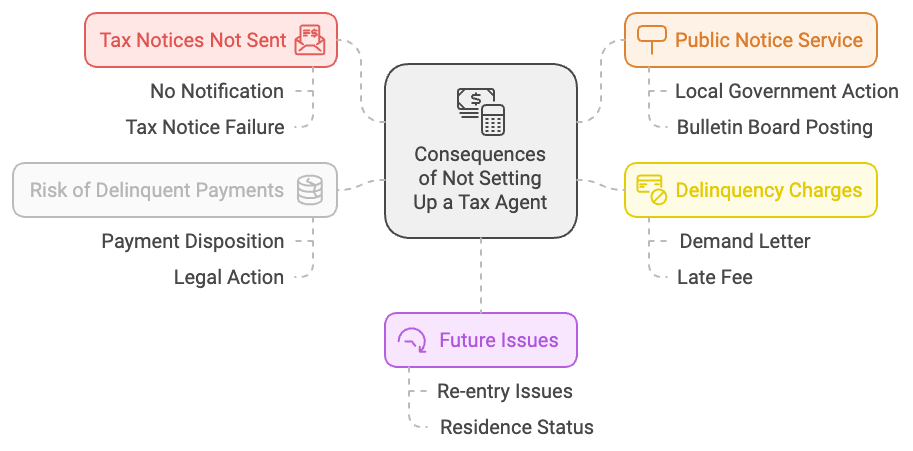

I don’t recommend ignoring setting up a tax agent because it has the following serious adverse effects.

- Tax notices will not be sent.

If a taxpayer moves abroad without notifying the tax agent, the tax notice cannot be sent. - Implementation of Service of Public Notice

If a tax notice cannot be sent, the local government may perform “service by public notice.” This system states that a document is deemed to have been served by being publicly posted on the bulletin board of the city hall for a certain period of time. - Accrual of delinquency charges

If payment is not made by the due date after service of public notice, a demand letter will be issued, and a late fee may be added. - Risk of delinquent payments

If a taxpayer continues to fail to make payments, he/she may be subject to a disposition for delinquency. - Future Issues

Non-payment or delinquency of taxes may affect future re-entry into Japan or renewal of residence status.

Therefore, it is essential to take appropriate measures to ensure that a tax administrator is set up when moving abroad or that the total amount is paid before leaving the country. It will avoid future problems and provide a smooth international move or stay.

Setting up a tax manager is essential to prevent problems. Providing tax advice is one way to do this, so consult with a specialist before leaving Japan and be prepared to live abroad with peace of mind.

Keyword

Tax Agent