Japan’s consumption tax system is critical to doing business there, especially for foreign companies looking to expand their operations here. As of 2024, the Japanese consumption tax applies to a wide range of goods and services, with a standard rate of 10% and a reduced rate of 8% for certain items like food and beverages. This tax serves as an indirect tax, meaning that businesses collect it from their customers and remit it to the government. With recent 2024 tax reforms, understanding the nuances of this system has become even more important for foreign companies operating in or targeting the Japanese market. This article provides a comprehensive guide on the tax rules, registration requirements, exemptions, and filing processes, aiming to help businesses navigate the complexities of Japan’s consumption tax regime effectively.

- What is the Japanese Consumption Tax and How Does it Work?

- Who Needs to Register for Consumption Tax in Japan?

- What are the Exemptions Available for Foreign Businesses?

- How do you handle tax payments and filing in Japan?

- Understanding Tax Credits and Deductions

- What are the Consequences of Non-Compliance?

- Navigating Japan’s Consumption Tax as a Foreign Business

- FAQs

- What is the standard consumption tax rate in Japan?

- When does a foreign business need to register for Japanese consumption tax?

- Are exports exempt from the Japanese consumption tax?

- What is the Qualified Invoice System in Japan?

- What happens if a business fails to register for consumption tax?

- Do foreign businesses need a tax agent in Japan?

- How can a foreign business claim input tax credits?

- What types of sales are exempt from consumption tax?

- When are consumption tax returns due in Japan?

- What is the penalty for late consumption tax payments?

What is the Japanese Consumption Tax and How Does it Work?

Japan’s consumption tax is a value-added tax (VAT) applied to most goods and services. Introduced in 1989, the tax functions as an indirect tax, where the responsibility of collecting and remitting the tax lies with businesses rather than individuals. The current rate of 10% applies broadly, with a reduced rate of 8% reserved for specific items such as food and non-alcoholic beverages. This dual-rate system ensures that essential goods remain more affordable for consumers.

Key features of the Japanese consumption tax include:

- Indirect taxation: Businesses act as intermediaries, collecting the tax from consumers.

- Two-tier rate system: A standard rate of 10% and a reduced rate of 8% for qualifying items.

- Cross-border applicability: Certain transactions involving foreign businesses may also fall under the scope of the tax.

- National and local components: The tax includes national and local levies combined into a single rate.

As Japan’s tax authorities emphasize compliance, both domestic and foreign businesses must stay updated on the regulations and obligations associated with the consumption tax.

What are the key features of the Japanese consumption tax?

The Japanese consumption tax system operates on several principles that distinguish it from other global tax regimes. These include:

Scope of Taxation: The tax applies to all goods and services sold in Japan unless explicitly exempt. This includes physical goods and intangible services, such as digital products provided by foreign businesses.

Taxable Base: The tax is levied on the total amount of taxable sales, including

the value of goods or services and associated fees. For businesses, determining theconsumption tax payable depends on their taxable sales during the fiscal year.

Tax Exemptions: Certain sales, such as exports and specific financial transactions, are exempt from consumption tax. This ensures that international trade and essential financial activities are not overly burdened.

Dual-Rate Structure: While the standard tax rate is 10%, the reduced rate of 8% applies to food, beverages, and subscription-based newspapers.

For foreign companies operating in Japan or selling goods and services to Japanese customers, understanding these features is crucial to maintaining compliance and avoiding penalties.

How is the consumption tax rate determined in Japan?

The government determines the Japanese consumption tax rate, which has both national and local components. The standard rate of 10% has been in place since October 2019, with a reduced rate of 8% applicable to specific goods, such as food, non-alcoholic beverages, and newspaper subscriptions that meet particular criteria.

Key factors influencing the tax rate include:

- Government policy: Adjustments to the tax rate are often driven by fiscal needs, including social security funding and public infrastructure investments.

- Economic conditions: When deciding on rate changes, the government evaluates economic stability and public affordability.

- Special exemptions and reductions: Items critical to daily life, such as food, enjoy a lower local consumption tax rate, ensuring affordability.

For foreign businesses, it’s essential to understand which rates apply to their products or services. For instance, digital service providers might be subject to the standard 10% rate, whereas businesses dealing with food distribution may benefit from the reduced rate of 8%. Awareness of these distinctions helps businesses accurately calculate and remit their consumption tax obligations.

What constitutes taxable sales under the Japanese consumption tax?

Under Japanese tax law, taxable sales are defined as any transaction involving providing goods or services within Japan. This includes domestic and foreign companies that sell products or offer services to customers in Japan. Transactions subject to consumption tax include:

Goods and tangible assets: Physical products sold or distributed in Japan, such as retail goods, are generally subject to the standard 10% rate.

Services: Intangible services, such as consulting, advertising, and digital goods (e.g., software, e-books), are also considered taxable transactions, even when provided by non-resident businesses.

Cross-border sales: For foreign businesses, any provision of services within Japan or distribution of goods in Japan falls under the scope of consumption tax. However, exports are generally exempt from consumption tax to encourage international trade.

Taxable thresholds: Businesses with taxable sales exceeding 10 million JPY during their base period (usually two fiscal years prior) must register and comply with tax filing obligations.

The distinction between taxable and exempt transactions is vital for businesses calculating their tax amount. Non-compliance or miscalculation can result in significant penalties, making it crucial to understand these guidelines in detail.

Who Needs to Register for Consumption Tax in Japan?

Consumption tax registration in Japan is crucial for businesses engaged in taxable transactions. Domestic and foreign companies must understand whether their operations meet the criteria for mandatory registration. The primary determinant is the registration threshold based on taxable sales during a defined base period.

For foreign companies, navigating the registration process involves understanding how the Japanese tax authorities define taxable sales and the implications of crossing the threshold. Businesses meeting the criteria must ensure compliance by registering with the Japanese tax office and adhering to tax payment and filing obligations.

What is the consumption tax registration threshold for foreign companies?

The registration threshold is critical for determining whether a business must register for a consumption tax in Japan. This threshold is based on the total taxable sales generated during the base period, typically the two fiscal years before the current tax year.

Critical details about the registration threshold include:

10 Million JPY Threshold:

Businesses with taxable sales exceeding 10 million JPY during their base period are required to register for consumption tax purposes. This includes both domestic enterprises and foreign companies conducting business in Japan.Foreign Business Applicability:

For foreign companies, taxable sales include transactions such as providing or distributing goods within Japan. Even non-resident companies may need to register if they exceed the threshold.Changes from the 2024 Tax Reform:

The 2024 tax reform introduces stricter registration guidelines, particularly for cross-border transactions—foreign businesses. Previously exempt due to lower sales may now be subject to registration under the updated rules.Special Cases:

Companies newly establishing operations in Japan, or those without a taxable sales history in Japan may still be required to register under certain circumstances, such as if they anticipate generating significant taxable sales in their first year of operation.

For foreign businesses, meeting the threshold obligates them to apply with the district director of the tax office. Failure to register, even when the threshold is exceeded, can lead to penalties and loss of potential tax credits.

How does the 2024 tax reform affect tax registration for foreign businesses?

The 2024 tax reform introduces essential changes to the registration process, particularly for foreign businesses. These updates aim to ensure compliance and create a level playing field between domestic and international enterprises. Key impacts of the reform include:

Broader Scope for Cross-Border Transactions:

As the reforms expand the definition of taxable transactions, more types of foreign service providers and non-resident companies will be required to register.Mandatory Registration for Digital Services:

Companies providing digital services to customers in Japan, such as e-books, streaming services, or software, are now explicitly required to register, even if they do not have a permanent establishment in Japan.Simplified Registration Procedures:

The reform includes updates to streamline the registration process for foreign businesses, making it easier for them to comply. However, companies without a physical presence in Japan still appoint a Japanese tax agent.Increased Monitoring by Tax Authorities:

The Japanese tax authorities have enhanced monitoring and enforcement measures to ensure that businesses, particularly those operating internationally, meet their obligations.

Foreign businesses planning to operate in Japan in 2024 and beyond should carefully review these changes. Registering promptly and complying with the new regulations will help them avoid penalties and ensure smooth business operations.

What steps are involved in the tax registration process?

For foreign businesses operating in Japan, the tax registration process is crucial in complying with the country’s consumption tax regulations. While the process can seem complex, understanding the steps involved can simplify compliance and ensure timely registration. Here’s a step-by-step guide to registering for Japanese consumption tax:

Determine Eligibility:

Before applying for registration, businesses must assess whether they exceed the 10 million JPY taxable sales threshold during the base period (the two fiscal years prior). If your business activities meet this threshold, registration is mandatory.Prepare Necessary Documents:

The following documentation is typically required when submitting your application:- Proof of taxable sales (e.g., invoices, contracts, or accounting records).

- Details about your business operations, such as the services or goods provided in Japan.

- Identification information, including company registration documents for foreign companies.

Submit the Registration Application:

Applications must be submitted to the district director of the tax office with jurisdiction over the area where the business operates. If the company does not have a physical presence in Japan, a Japanese tax agent must be appointed to apply on its behalf.Appoint a Japanese Tax Agent:

Foreign companies without a permanent establishment in Japan are required to appoint a tax agent. This agent acts as a liaison with the Japanese tax authorities, handling communications, filings, and payments on behalf of the foreign business.Receive Taxpayer Identification Number:

Upon approval, businesses receive a Consumption Taxpayer Identification Number (CTIN). This number is necessary for filing tax returns, making tax payments, and claiming tax credits.Maintain Compliance Records:

Registered businesses must keep detailed records of their taxable sales, tax payments, and related transactions. These records are essential for accurate reporting and substantiating claims for tax exemptions or credits.

Foreign businesses planning to register should start early, as the process can take time, especially when appointing a tax agent or gathering the required documents. Delays in registration may result in penalties or difficulties in claiming tax credits on prior transactions.

What are the Exemptions Available for Foreign Businesses?

The Japanese consumption tax system includes various exemptions aimed at reducing the tax burden on specific types of transactions. These exemptions are particularly relevant for foreign businesses, as they help minimize costs and simplify tax compliance. Understanding the categories of exempt transactions is essential for foreign companies to determine when they are not required to pay or collect consumption tax. By taking advantage of these exemptions, businesses can optimize their tax obligations while complying with Japanese regulations.

What types of sales are exempt from consumption tax?

Certain sales and transactions are exempt from Japanese consumption tax, providing relief for domestic and foreign businesses. The most common categories of exempt transactions include:

Exports of Goods:

Sales involving the export of goods outside Japan are generally exempt from consumption tax. This exemption ensures that Japan’s taxation system does not impose an additional burden on businesses engaged in international trade.- Example: A foreign company exporting electronics manufactured in Japan to overseas markets is not required to pay consumption tax on those sales.

International Transportation Services:

Services related to the international transportation of goods or passengers, such as shipping or air travel, are exempt. This exemption applies to both non-resident businesses and Japanese companies.- Example: A logistics company providing warehousing and transportation for goods exported from Japan.

Certain Financial Transactions:

Transactions such as loans, insurance policies, and specific financial instruments are exempt from consumption tax. This ensures that essential financial activities remain unaffected by indirect taxation.- Example: A foreign business investing in Japanese bonds does not incur consumption tax on these financial transactions.

Educational and Welfare Services:

Activities related to education, healthcare, and welfare services, particularly those provided by non-profit organizations, are also exempt.- Example: A non-resident organization offering online educational courses to Japanese students.

Land Transactions:

Land sale or lease (excluding specific uses) is exempt from consumption tax. This rule applies to both domestic and foreign businesses operating in Japan.- Example: A foreign company purchasing a plot of land to establish an office is not subject to consumption tax on the purchase.

These exemptions are designed to promote specific industries and facilitate international business operations. However, businesses must carefully document and include these transactions in their tax returns to claim exemption status.

How can foreign businesses qualify for tax exemptions?

Foreign businesses can take advantage of consumption tax exemptions in Japan by meeting specific criteria and following established procedures. Proper documentation and compliance with Japanese tax regulations are essential to qualify for these exemptions. Below are the key steps and requirements for foreign businesses to claim tax exemptions:

Identify Eligible Transactions:

Businesses must determine which sales or transactions qualify as exempt from consumption tax. This includes exports, international services, certain financial transactions, and other tax-exempt categories under Japanese tax law.Maintain Detailed Documentation:

Foreign businesses must provide evidence that their transactions fall under exempt categories to qualify for exemptions. Common documents include:- Invoices indicating that the goods were exported or the services were provided internationally.

- Contracts or agreements showing the nature of the transaction.

- Shipping documents, such as bills of lading, for exported goods.

- Proof of financial or other exempt activities, such as receipts or statements for loans or investments.

File Proper Tax Returns:

Even if a business qualifies for exemptions, it is still required to file regular tax returns with the Japanese tax office. The exempt sales must be reported in the relevant sections of the return to ensure transparency and compliance. This process helps the Japanese tax authorities verify exemption claims.Appoint a Tax Agent if Necessary:

pointing a Japanese tax agent is needed for Non-resident

Appointing a Japanese tax agent is required fApCompanies or those without a physical presence in Japan. The agent assists with filing exemption claims and ensuring compliance with Japanese tax laws.

Monitor Changes in Tax Law:

Japanese tax regulations, including exemption rules, may change over time. For example, the 2024 tax reform has introduced updates to specific processes, potentially affecting cross-border businesses. Staying informed and adapting to these changes is critical for continued compliance.Seek Guidance from Tax Professionals:

Foreign businesses unsure about their exemption eligibility or compliance requirements are encouraged to consult with tax experts in Japan. Professional assistance can help navigate the complexities of the Japanese tax system and avoid common mistakes.

Qualifying for tax exemptions reduces the tax burden and smooths business operations in Japan. However, foreign businesses must remain proactive in fulfilling their documentation and filing obligations to maintain compliance and avoid penalties.

What documentation is needed to claim exemptions?

Providing the correct documentation is critical for foreign businesses seeking to benefit from consumption tax exemptions in Japan. Japanese tax authorities require detailed and accurate records to verify that transactions meet the criteria for exemption. Below is an overview of the essential documents typically needed to claim exemptions:

Invoices and Receipts:

- Invoices must clearly outline the nature of the transaction, including whether it involves exported goods or tax-exempt services.

- Receipts or payment records should indicate that the transaction aligns with tax-exempt categories under Japanese law.

Contracts or Agreements:

- Signed contracts between the foreign business and its customers or clients are often required to confirm the details of the sale or service.

- These contracts must demonstrate that the goods or services are being provided in a way that qualifies for exemption (e.g., cross-border exports or international services).

Shipping Documentation (for exported goods):

- Exporters must provide shipping-related documents, such as bills of lading, freight invoices, and export declarations.

- These documents prove that goods have left Japan and are being delivered to international destinations.

Proof of Financial Transactions:

- For exemptions related to financial services, businesses may need to submit records of loan agreements, investment statements, or other financial documentation showing that the activity is exempt from taxation.

Customs Declarations:

- AA customs declaration stamped by the relevant authorities is an essential document for goods being exported for goods being exported. This declaration confirms that the transaction is classified as an export and is, therefore, exempt.

Taxpayer Identification and Registration:

- Businesses must provide their Consumption Taxpayer Identification Number (CTIN) to support their exemption claims.

- Proof of registration with the Japanese tax office may also be necessary for foreign companies.

Additional Supporting Evidence:

- Depending on the transaction, additional documentation, such as service reports, certificates of exemption, or letters of authorization, may be required.

- For example, businesses providing digital services may need to submit records of customer locations to confirm that the services qualify for exemption.

Best Practices for Document Preparation:

- Accuracy and Completeness: Ensure all submitted documents are complete. Error-freeing or incorrect information can delay exemption approvals.

- Organized Records: Maintain an organized system for storing tax-related documents to facilitate timely filing and compliance checks.

- Regular Audits: Periodically review documentation to ensure it aligns with the latest requirements from Japanese tax authorities, especially after updates like the 2024 tax reform.

By preparing and submitting the necessary documentation, foreign businesses can confidently claim tax exemptions and reduce their overall consumption tax obligations in Japan.

How do you handle tax payments and filing in Japan?

Once a foreign business is registered for a consumption tax in Japan, it must comply with regular filing and payment obligations. This process involves submitting accurate tax returns, calculating the consumption tax amount, and ensuring payments are made on time. Non-compliance can result in penalties and loss of eligibility for tax credits, making it critical for businesses to understand the filing and payment procedures in detail.

What is the process for filing a tax return as a foreign business?

Filing a tax return for consumption tax in Japan requires careful attention to detail. Foreign businesses, especially those without a permanent establishment in Japan, must adhere to specific guidelines to ensure compliance. Below is a step-by-step overview of the filing process:

Determine the Tax Period:

- The standard tax period for consumption tax is the same as the business’s fiscal year, which for most businesses is a 12-month period.

- Some companies may be required to file quarterly returns if their taxable sales exceed certain thresholds.

Calculate the Taxable Amount:

- Businesses must calculate their taxable sales for the tax period. This includes all goods and services subject to the 10% standard or 8% reduced rate.

- Businesses can deduct any consumption tax paid on purchases (input tax credits) from this total to arrive at the net tax amount owed.

Prepare the Tax Return:

- Prepare the return using the forms provided by the Japanese tax office. The forms require detailed reporting of taxable sales, exempt transactions, and tax credits claimed.

- Ensure that all required documentation (e.g., invoices, receipts, and shipping records) is prepared to support the figures reported in the return.

Appoint a Tax Agent (if applicable):

- Non-resident businesses or those without a presence in Japan must appoint a Japanese tax agent to handle the filing.

- The tax agent is responsible for submitting the return, communicating with the district director of the tax office, and ensuring compliance with Japanese tax laws.

Submit the Tax Return:

- Tax returns must be filed with the district director of the tax office by the due date, typically within two months after the end of the tax period.

- Businesses can submit their returns electronically or via mail, depending on their registration status.

Make Tax Payments:

- The consumption tax payment must be made when filing the return. Payments can be made through bank transfers, tax agents, or at designated government offices.

- Late payments may result in penalties, so businesses should ensure funds are available to cover their tax liabilities.

By following these steps, foreign businesses can fulfill their consumption tax filing obligations and avoid issues with the Japanese tax authorities. Accurate reporting and timely payments also help maintain eligibility for tax credits and ensure smooth business operations in Japan.

When are consumption tax payments due?

Timely payment of consumption tax is crucial to complying with Japanese tax regulations. The due date for tax payments is closely tied to the tax filing deadline, and foreign businesses must ensure they meet these deadlines to avoid penalties. Below is a breakdown of the payment timelines and requirements:

Standard Payment Deadline:

- Consumption tax payments are due within two months after the business’s tax period ends.

- For example, if a company’s fiscal year ends on March 31, the consumption tax payment must be made by May 31.

Quarterly or Monthly Payments for Large Businesses:

- Businesses with significant taxable sales (exceeding 100 million JPY in the base period) may be required to make quarterly or monthly prepayments instead of annual payments.

- These prepayments are calculated based on the previous year’s tax liability and adjusted at the end of the tax period.

Payment for New Businesses:

- Newly established businesses may also be required to pay consumption tax quarterly if their taxable sales exceed specific thresholds during the first fiscal year.

Methods of Payment:

- Businesses can pay their consumption tax through the following methods:

- Bank Transfer: Payments can be made via designated banks in Japan.

- Direct Debit: Businesses can arrange automatic deductions from their bank account.

- Tax Agent: Non-resident businesses must work with a Japanese tax agent who will facilitate the payment on their behalf.

- Over-the-Counter Payment: Tax payments can be made at local tax offices or government-authorized financial institutions.

- Businesses can pay their consumption tax through the following methods:

Late Payment Penalties:

- If a business fails to pay by the deadline, it may incur penalties, including:

- Late Payment Interest: A daily interest rate is applied to the unpaid amount.

- Additional Penalties: These are assessed if the payment is significantly delayed or underpaid.

- To avoid such penalties, businesses should ensure that payments are made on time and in the correct amount.

- If a business fails to pay by the deadline, it may incur penalties, including:

Tips for Ensuring Timely Payments:

- Set Up Reminders: Businesses should track their tax period and payment deadlines using calendars or automated tools to prevent missed payments.

- Work with a Tax Agent: Foreign businesses without a local presence should rely on a Japanese tax agent to handle filings and payments efficiently.

- Maintain Accurate Records: Keeping detailed records of taxable sales and tax payments simplifies calculating and remitting the correct amount.

By understanding the payment deadlines and ensuring compliance, foreign businesses can avoid unnecessary penalties and maintain smooth operations in Japan’s business environment.

What role does a tax agent play in tax payment?

For foreign businesses operating in Japan, especially those without a permanent establishment, appointing a Japanese tax agent is a legal requirement and an essential step to ensuring smooth tax compliance. A tax agent serves as a liaison between the business and the Japanese tax authorities, handling various aspects of the consumption tax process, including tax filing, payments, and communication. Here’s how a tax agent supports foreign businesses in managing their tax obligations:

Handling Tax Filings:

- The tax agent prepares and submits consumption tax returns on behalf of the business, ensuring all taxable sales, exemptions, and tax credits are accurately reported.

- This is particularly important for non-resident businesses, as tax agents are familiar with Japanese regulations and filing procedures.

Facilitating Tax Payments:

- Tax agents are authorized to make payments on behalf of the business. They ensure that payments are made on time and in the correct amount to avoid penalties.

- For businesses dealing in JPY, the tax agent can handle currency conversions and remittances efficiently.

Advising on Tax Regulations:

- A tax agent stays updated on changes to Japanese tax laws, including updates like the 2024 tax reform. They advise how these changes may affect the business’s obligations, such as registration or taxable sales thresholds.

- This ensures the business remains compliant and avoids unnecessary fines or penalties.

Managing Documentation:

- The tax agent organizes and maintains all relevant tax documents, including invoices, receipts, and shipping records, which are critical for filing returns and claiming exemptions or tax credits.

- In case of audits or queries from the Japanese tax authorities, the agent acts on behalf of the business to address any concerns.

Acting as a Local Representative:

- For foreign businesses without a physical presence in Japan, the tax agent serves as the official point of contact for the district director of the tax office. This includes receiving notifications, responding to inquiries, and submitting additional documentation when required.

- This representation simplifies the process for non-resident companies, allowing them to focus on their business operations.

Assisting with Refund Claims:

- If a business is eligible for a consumption tax refund, the tax agent helps prepare and submit the claim. This includes ensuring all supporting documents, such as proof of tax paid in Japan, are complete and accurate.

Why Appointing a Tax Agent is Crucial for Foreign Businesses

Appointing a qualified Japanese tax agent is essential for any foreign business in Japan. Without local expertise, navigating the complexities of Japan’s tax system can be overwhelming, leading to errors, missed deadlines, and penalties. By working with a tax agent, businesses can ensure compliance, manage their tax liabilities effectively, and focus on expanding their operations in Japan’s competitive market.

Understanding Tax Credits and Deductions

One of the most significant advantages of registering for a consumption tax in Japan is the ability to claim tax credits. These credits allow businesses to deduct the consumption tax paid on purchases (input tax) from the tax collected on sales (output tax), reducing their overall tax liability. Understanding the rules around tax credits and deductions is crucial for foreign businesses to optimize their financial operations and remain compliant with Japanese tax regulations.

What are the eligibility criteria for tax credits?

Businesses must meet specific eligibility criteria to claim tax credits under the Japanese consumption tax system. The Japanese tax authorities require careful documentation and adherence to the following conditions:

Taxable Sales Requirement:

- Tax credits are only available for businesses engaged in taxable transactions. This includes selling goods or providing services subject to the standard 10% rate or the 8% reduced rate.

- Transactions exempt from consumption tax (e.g., exports or certain financial services) do not generate tax credits.

Proper Registration:

- The business must be appropriately registered as a taxable entity with the Japanese tax authorities. Foreign businesses must have completed the tax registration process and obtained a Consumption Taxpayer Identification Number (CTIN).

Valid Tax Invoices:

- To claim input tax credits, businesses must retain valid tax invoices issued by their suppliers. These invoices should clearly state the consumption tax amount paid, the supplier’s details, and the transaction specifics.

- With the introduction of Japan’s Qualified Invoice System in 2023, businesses must ensure that the invoices meet the new format requirements.

Timely Filing of Tax Returns:

- Businesses must submit accurate tax returns within the designated deadlines. Claims for tax credits must be included in the return and supported by the required documentation. Late or incomplete filings may result in the denial of credit claims.

Taxable Purchase Requirements:

- The purchases for which tax credits are claimed must be directly related to the business’s taxable activities. For example:

- Eligible: Purchases of raw materials or goods for resale.

- Ineligible: Personal expenses or purchases related to exempt transactions.

- The purchases for which tax credits are claimed must be directly related to the business’s taxable activities. For example:

Base Period Review:

- Eligibility for tax credits may also depend on the business’s base period. Companies with taxable sales below 10 million JPY in the base period may be categorized as exempt entities and ineligible to claim credits.

Benefits of Claiming Tax Credits:

- Reduced Tax Liability: Tax credits lower the consumption tax owed, helping businesses save on operating costs.

- Increased Cash Flow: By deducting input taxes, businesses can improve cash flow and allocate resources more effectively.

- Compliance Assurance: Properly claiming tax credits ensures businesses comply with Japanese tax laws, reducing the risk of audits or penalties.

How can foreign businesses utilize tax credits effectively?

Foreign businesses operating in Japan can significantly benefit from tax credits, but maximizing their impact requires a strategic approach. Proper planning, compliance, and record-keeping are essential to ensure businesses can claim the maximum consumption tax deductions while avoiding potential errors. Here are key strategies to help foreign enterprises to utilize tax credits effectively:

Keep Comprehensive and Organized Records:

- Maintained detailed records of all taxable purchases and ensured they were supported by valid tax invoices issued under Japan’s Qualified Invoice System.

- Store documents such as contracts, receipts, and shipping records systematically, as these may be requested during audits or for verification by the Japanese tax authorities.

Ensure Invoice Compliance:

- From October 2023 onwards, Japan implemented the Qualified Invoice System, which requires businesses to issue and retain invoices in a specific format to claim input tax credits.

- Ensure suppliers provide compliant invoices, including the amount of consumption tax paid, their taxpayer identification number, and descriptions of the transactions.

Separate Taxable and Exempt Purchases:

- Clearly distinguish between taxable purchases (eligible for credits) and exempt transactions, such as exports or financial services, which do not qualify for tax credits.

- Use accounting software or systems that can accurately track and allocate these expenses.

Plan for Major Purchases:

- Foreign businesses planning to make significant investments, such as purchasing equipment or renting office space, can time these purchases to align with their tax periods. This ensures that input taxes from these transactions are included in the corresponding tax return.

Leverage Tax Agents:

- Partnering with a Japanese tax agent can simplify the process of claiming credits. Agents can help ensure accurate filing, prepare tax returns, and verify that all credit claims comply with local regulations.

Review Cross-Border Transactions:

- Confirm that any consumption tax paid in Japan qualifies for credits for businesses engaging in cross-border transactions.

- For example, services purchased from local suppliers to support export activities may still generate input tax credits, even though exports are exempt from taxation.

Conduct Periodic Reviews:

- Audit credit claims and taxable sales records regularly to ensure that calculations are accurate and in accordance with Japanese tax laws. This can help businesses avoid errors that can lead to denied claims or penalties during audits.

Benefits of Effective Utilization:

By effectively managing and claiming tax credits, foreign businesses can:

- Reduce their overall tax liability, thereby improving profitability.

- Improve cash flow by reclaiming taxes paid on purchases.

- Strengthen compliance and reduce the risk of penalties or audits.

Proper utilization of tax credits enhances financial efficiency and smoother operations within the Japanese market.

What is the impact of the base period on tax credits?

The base period is a critical concept in Japan’s consumption tax system, as it determines whether a business is eligible to claim tax credits and influences how tax obligations are calculated. Understanding how the base period affects tax credit eligibility and compliance is essential for foreign businesses to avoid miscalculations or penalties. Below, we break down the impact of the base period on tax credits:

1. Definition of the Base Period:

- The base period typically refers to the two fiscal years before the current tax period.

- For example, if the current fiscal year is 2024, the base period covers the fiscal years 2022 and 2023.

- The taxable sales during this period determine whether the business qualifies as a taxable entity and can claim input tax credits.

2. Taxable Sales Threshold:

- Businesses must exceed the 10 million JPY taxable sales threshold during the base period to qualify for tax credits.

- Businesses falling below this threshold are classified as exempt entities and are not required to collect or pay consumption tax. However, exempt entities are also ineligible to claim tax credits on purchases made during the tax period.

- For foreign businesses, smaller-scale operations may face limitations on reclaiming consumption tax paid in Japan.

3. Impact on Newly Established Businesses:

- For new businesses without a base period (e.g., companies entering Japan for the first time), eligibility for tax credits depends on their expected taxable sales in the first fiscal year.

- Businesses anticipating taxable sales exceeding 10 million JPY may be required to register for consumption tax and can begin claiming input tax credits immediately.

- Conversely, businesses expecting more minor taxable sales may be classified as exempt, limiting their ability to recover consumption tax on initial investments.

4. Carrying Forward Unused Tax Credits:

- Businesses with high input taxes relative to output taxes during the base period may generate unused tax credits.

- These credits can typically be carried forward to subsequent tax periods, reducing the overall tax burden over time.

- However, careful tracking and accurate filing are necessary to ensure the smooth application of unused credits.

5. Base Period Reviews by Tax Authorities:

- The Japanese tax authorities regularly review base period sales data to verify eligibility for tax credits.

- If discrepancies are found between reported taxable sales and actual transactions during the base period, businesses may face penalties or audits, making accurate record-keeping essential.

Practical Example:

- A foreign business had taxable sales of 12 million JPY during its base period. This qualifies it as a taxable entity, allowing it to claim input tax credits for purchases such as office supplies or services used in Japan.

- Another business with taxable sales of 8 million JPY during the base period is classified as exempt. It cannot claim these credits, even if it paid consumption tax on eligible purchases.

Key Takeaways:

- The base period determines whether a business is taxable or exempt and directly impacts the ability to claim tax credits.

- Exceeding the 10 million JPY threshold allows businesses to claim tax credits, which can significantly reduce their consumption tax obligations.

- Foreign businesses should carefully monitor their base period sales and maintain accurate records to ensure compliance and maximize tax efficiency.

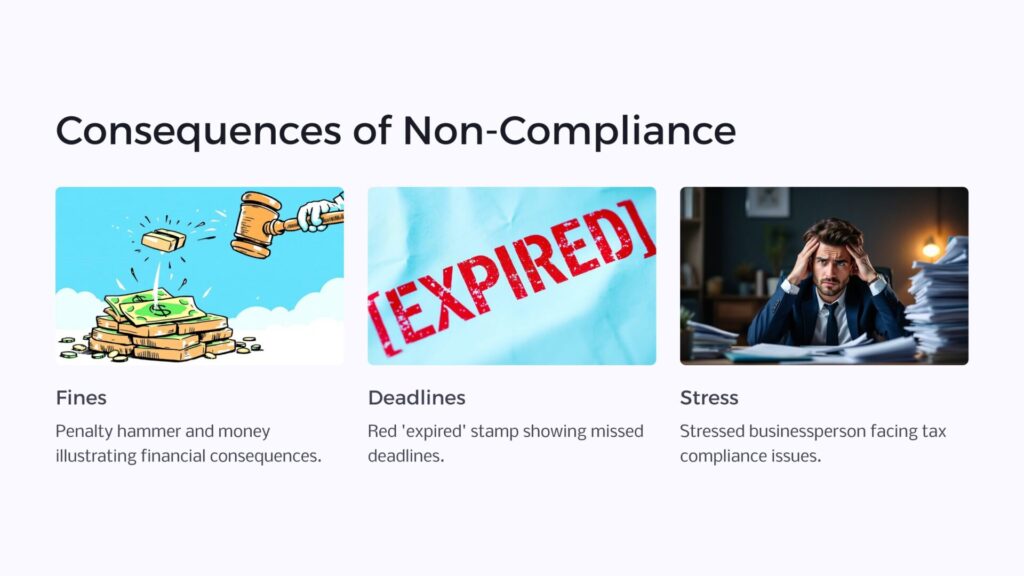

What are the Consequences of Non-Compliance?

Failing to comply with Japan’s consumption tax regulations can seriously affect foreign businesses. Whether it’s a failure to register, file returns, or pay taxes on time, non-compliance can result in financial penalties, loss of business credibility, and even legal repercussions. Understanding these risks is critical for businesses to remain compliant and maintain a positive standing with the Japanese tax authorities.

What penalties can foreign businesses face for failing to register?

Foreign businesses that fail to register for consumption tax when required risk significant penalties and complications. Below are the main penalties that may be imposed:

Failure to Register Penalty:

- Businesses exceeding the 10 million JPY taxable sales threshold but failing to register as taxable entities may face fines.

- The penalty often includes backdated consumption tax payments on all taxable sales made during non-compliance and additional interest.

Loss of Tax Credit Eligibility:

- Businesses that fail to register lose the right to claim input tax credits. This means they cannot deduct the consumption tax on purchases, leading to higher overall costs.

- For example, a non-registered foreign business cannot recover consumption tax on office rental payments, supply purchases, or other business expenses in Japan.

Late Registration Interest:

- If registration is delayed but later completed, businesses may still be required to pay interest on the unpaid consumption tax. The longer the delay, the higher the financial burden.

Audits and Investigations:

- Failure to register can trigger audits by the Japanese tax authorities, leading to scrutinscrutinizingsiness’s transactions and operations.

- Such investigations may uncover additional areas of non-compliance, resulting in compounded penalties.

Reputational Damage:

- Non-compliance can harm the business’s reputation with customers, partners, and Japanese regulatory bodies. It can also negatively impact opportunities for growth and collaboration within the Japanese market.

Legal Consequences:

- In severe cases, repeated or deliberate non-compliance may result in legal actions, such as injunctions, asset freezes, or restrictions on conducting business in Japan.

Key Steps to Avoid Registration Penalties:

Monitor Taxable Sales Regularly:

Foreign businesses should track their taxable sales to ensure they register promptly after approaching the 10 million JPY threshold.Appoint a Tax Agent:

Non-resident businesses can reduce the risk of errors by having a qualified Japanese tax agent handle registrations and filings.Act Early:

If a business realizes it has exceeded the taxable sales threshold but has not registered, it should act quickly to file the necessary registration documents and minimize penalties.

Proactive compliance is essential for foreign businesses to avoid these penalties and maintain smooth operations in Japan. By registering for consumption tax when required and adhering to filing deadlines, companies can minimize financial risks and focus on growth opportunities.

How do the Japanese tax authorities enforce compliance?

The Japanese tax authorities, led by the National Tax Agency (NTA), employ various methods to ensure compliance with the country’s consumption tax regulations. These enforcement measures encourage proper tax registration, accurate filings, and timely payments while identifying and addressing non-compliance among businesses, including foreign companies. Below are the primary ways in which Japanese tax authorities enforce compliance:

1. Audit and Inspection Programs:

- The NTA conducts regular tax audits to verify the accuracy of tax returns and ensure that businesses follow them.

- Audits may focus on specific industries or businesses identified as high-risk, including foreign companies engaged in cross-border transactions.

- During an audit, the authorities may request detailed records, such as invoices, contracts, and payment receipts, to confirm that all taxable sales have been accurately reported.

2. Data Analysis and Monitoring:

- The NTA uses sophisticated data analysis tools to monitor business activities and identify discrepancies in tax filings.

- For instance, mismatches between reported taxable sales and actual revenue figures flagged by third-party data (e.g., shipping records or bank transactions) can trigger further investigation.

3. Cross-Border Cooperation:

- Japan collaborates with international tax authorities to monitor cross-border transactions, especially in the digital economy.

- Foreign businesses providing digital services to Japanese customers, for example, are subject to increased scrutiny to ensure compliance with the 2024 tax reform and recent updates to tax rules for non-resident businesses.

4. Penalties and Fines:

- To discourage non-compliance, the Japanese tax authorities impose financial penalties on businesses that fail to:

- Register for consumption tax.

- File tax returns accurately and on time.

- Pay taxes owed by the due date.

- Additional penalties, such as late payment interest or fines for fraudulent reporting, may also apply.

5. Use of Tax Agents:

- Foreign businesses without a permanent establishment in Japan must appoint a Japanese tax agent. Tax agents ensure proper communication with the NTA and help companies navigate compliance requirements.

- The authorities may closely monitor the activities of businesses that have not appointed a tax agent, as these businesses are more likely to be non-compliant.

6. Mandatory Registration for High-Risk Categories:

- Certain business types, such as those involved in digital services or cross-border goods distribution, are flagged as high risk for non-compliance. These businesses are often subject to mandatory registration requirements and increased monitoring by tax authorities.

7. Public Awareness Campaigns:

- To promote compliance, the NTA conducts educational campaigns to inform businesses about their responsibilities under the consumption tax system.

- These campaigns emphasize the importance of proper registration, filing, and payment while guiding the fulfillment of tax obligations.

Practical Example:

- A non-resident digital service provider fails to register for consumption tax despite exceeding the 10 million JPY taxable sales threshold. The NTA identifies this through cross-border transaction data and initiates an audit. The company must register retroactively, pay the tax owed with penalties, and appoint a Japanese tax agent for future compliance.

Key Takeaways:

- The Japanese tax authorities use a combination of audits, data monitoring, and cross-border cooperation to enforce compliance.

- Proactively maintaining accurate records, appointing a tax agent, and meeting all filing and payment deadlines can help businesses avoid penalties and enforcement actions.

- By staying informed about Japan’s tax regulations, foreign businesses can operate confidently and efficiently within the Japanese market.

What are the common mistakes to avoid regarding consumption tax?

Navigating Japan’s consumption tax system can be challenging for foreign businesses, especially those new to the market. Many common mistakes can lead to financial penalties, loss of tax credits, and increased scrutiny from the Japanese tax authorities. By understanding these pitfalls, businesses can proactively ensure compliance and avoid costly errors. Below are the most common mistakes and how to avoid them:

1. Failing to Register for Consumption Tax:

- One of the most frequent errors is neglecting to register as a taxable entity after exceeding the 10 million JPY taxable sales threshold.

- How to Avoid: Regularly monitor your taxable sales during the base period and ensure you register promptly if the threshold is met. Engage a tax agent to assist with registration if needed.

2. Inaccurate Tax Returns:

- Tax return errors, such as incorrect reporting of taxable sales or missing deductions, can trigger audits and penalties.

- How to Avoid: Double-check all calculations and ensure that all taxable and exempt sales are accurately reported. Use accounting software or work with a professional to prepare returns.

3. Not Claiming Input Tax Credits:

- Some businesses overlook the opportunity to claim input tax credits for consumption tax paid on purchases, resulting in higher tax liabilities.

- How to Avoid: Keep valid tax invoices and ensure they meet the requirements of Japan’s Qualified Invoice System. Deduct eligible input taxes on time in your tax returns.

4. Misunderstanding Exemptions:

- Foreign businesses sometimes misclassify transactions as exempt without meeting the proper conditions, such as export documentation for goods shipped outside Japan.

- How to Avoid: Understand the specific requirements for exemptions and maintain thorough documentation, including shipping records and contracts.

5. Missing Filing Deadlines:

- Late filing of tax returns can result in penalties and additional interest on unpaid taxes.

- How to Avoid: Track filing deadlines, typically within two months after the end of the fiscal year, and set reminders to avoid delays.

6. Neglecting Cross-Border Obligations:

- Non-resident businesses providing digital services or selling goods to Japanese customers may fail to recognize their obligation to register and pay consumption tax.

- How to Avoid: Familiarize yourself with Japanese tax rules for cross-border transactions, especially in light of the 2024 tax reform. Consult a tax agent for assistance with compliance.

7. Improper Documentation:

- Incomplete or missing records, such as invoices, contracts, or receipts, can result in denied tax credits or exemptions during audits.

- How to Avoid: Maintain detailed and organized records for all transactions. Ensure invoices comply with the Qualified Invoice System and include the required details.

8. Not Appointing a Tax Agent:

- Foreign businesses without a permanent establishment in Japan must appoint a Japanese tax agent, yet many fail to do so, leading to compliance issues.

- How to Avoid: Work with a trusted tax agent who can handle filings, payments, and communication with the Japanese tax authorities on your behalf.

Practical Example:

- A foreign company selling digital services to Japanese customers failed to register for consumption tax, assuming it did not apply to their transactions. After an audit by the National Tax Agency (NTA), the company was required to pay backdated taxes, penalties, and interest. The company could have avoided these penalties by consulting with a tax agent and registering proactively.

Key Takeaways:

- Avoiding common mistakes such as failing to register, missing deadlines, or misunderstanding exemptions is critical for maintaining compliance with Japan’s consumption tax system.

- Proactive measures, such as appointing a tax agent, keeping thorough records, and staying informed about tax reforms, can help foreign businesses navigate the system efficiently and minimize risks.

Navigating Japan’s Consumption Tax as a Foreign Business

Understanding and complying with Japan’s consumption tax system is essential for foreign businesses seeking to establish or expand their presence there. With its dual-rate structure, strict registration thresholds, and complex filing requirements, the Japanese consumption tax presents challenges and opportunities for international companies.

To operate smoothly and avoid penalties, businesses must prioritize the following:

- Timely Registration: Monitor your taxable sales and ensure you register as soon as you meet the 10 million JPY threshold. Delayed registration can result in financial penalties and loss of tax credits.

- Accurate Filing and Payments: Prepare your tax returns meticulously, ensure timely payments, and leverage input tax credits to minimize tax liability.

- Appointing a Tax Agent: For businesses without a permanent establishment in Japan, appointing a qualified Japanese tax agent is critical for meeting legal requirements and maintaining compliance.

- Staying Updated on Tax Reforms: With the 2024 tax reform, foreign businesses must pay close attention to updated rules for cross-border transactions and new registration requirements.

By proactively managing their consumption tax obligations and seeking guidance from experts when necessary, foreign businesses can fully take advantage of Japan’s robust market while avoiding regulatory pitfalls. Compliance ensures smoother operations, enhances a company’s reputation, and builds trust with customers and partners in Japan.

Consulting with a professional tax advisor is highly recommended if you have any questions about Japan’s consumption tax or require assistance with tax registration, filing, or compliance. Their expertise can help you navigate the complexities of Japan’s tax system and focus on growing your business.

FAQs

What is the standard consumption tax rate in Japan?

Answer: Japan’s standard consumption tax rate is 10%, while a reduced rate of 8% applies to certain items such as food and non-alcoholic beverages.

When does a foreign business need to register for Japanese consumption tax?

Answer: A foreign business must register for consumption tax if its taxable sales exceed 10 million JPY during the base period (the two fiscal years prior to the current year).

Are exports exempt from the Japanese consumption tax?

Answer: Yes, exports of goods are generally exempt from consumption tax. To claim this exemption, businesses must provide valid documentation, such as shipping records and customs declarations.

What is the Qualified Invoice System in Japan?

Answer: Introduced in 2023, the Qualified Invoice System requires businesses to issue invoices in a specific format to claim input tax credits. These invoices must include the supplier’s taxpayer ID, tax amount, and detailed transaction information.

What happens if a business fails to register for consumption tax?

Answer: Businesses that fail to register when required may face penalties, including backdated tax payments with interest and fines. They may also lose eligibility to claim input tax credits.

Do foreign businesses need a tax agent in Japan?

Answer: Foreign businesses without a permanent establishment in Japan must appoint a Japanese tax agent. This agent handles tax filings, payments, and communication with the Japanese tax authorities.

How can a foreign business claim input tax credits?

Answer: To claim input tax credits, businesses must ensure they are appropriately registered, retain qualified invoices, and report the credits in their tax returns. Credits can only be claimed for purchases directly related to taxable business activities.

What types of sales are exempt from consumption tax?

Answer: Common exempt transactions include exports, international transportation services, certain financial services, and land transactions. Documentation is required to verify exemption status.

When are consumption tax returns due in Japan?

Answer: Tax returns are generally due within two months after the end of the fiscal year. For businesses filing quarterly or monthly, deadlines vary accordingly.

What is the penalty for late consumption tax payments?

Answer: Late payments are subject to interest charges and potential additional penalties. The longer the delay, the higher the financial impact on the business.