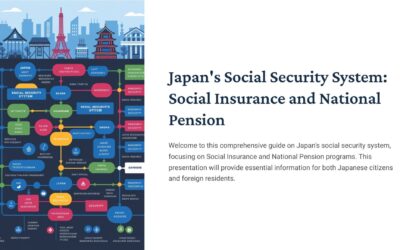

Introduction: The Dual Mechanism of Social Security

For those living and working in Japan, understanding the intricacies of taxes and social insurance contributions is crucial. These two mechanisms, while distinct in their principles, collectively ensure that everyone is adequately covered, providing a safety net against unforeseen financial hardships.

Social Insurance: Preparing for Potential Risks

At its core, social insurance is a collective preparation against risks that could lead to financial challenges, such as unexpected job loss or health issues. The benefits one can expect to receive from this system are typically proportional to the amount they’ve contributed over time.

Income Tax: A Reflection of Earning Capacity

On the other hand, taxes in Japan are determined based on one’s ability to pay. Essentially, the higher your income, the more tax you’re expected to pay. Unlike social insurance, where contributions are tied to potential future benefits, taxes are strictly based on your current income.

Breaking Down Employment Insurance, Health Insurance, and Pension Contributions

When examining your paycheck, you’ll notice deductions labeled as employment insurance, health insurance, and pension contributions. These are your contributions to the social insurance system. To provide a clearer picture:

– For general employment insurance, employees contribute 0.6% of their income, while employers contribute 0.95%.

– Health insurance and welfare pension insurance rates vary based on age. For those under 40, the rate stands at 10.22%. However, for individuals aged 40 and above, the rate increases to 11.86%. It’s worth noting that these figures are specific to Osaka prefecture. Importantly, employers shoulder half of these costs, lightening the load on employees.

Conclusion: Embracing Shared Responsibility and Mutual Support

Living and working in Japan extends beyond merely paying income tax. It’s about actively participating in social insurance schemes designed to offer support during challenging times. While the system might seem intricate at first glance, understanding its nuances is a fundamental aspect of life in Japan, emphasizing shared responsibility and mutual aid.

Thank you for joining us on this exploration of Japan’s tax and social insurance landscape. Stay informed and stay prepared!