Recently, Nerima Ward, Tokyo, Japan, faced a reassessment, resulting in approximately 37 million yen in additional taxes. Various opinions have surfaced regarding the burden on public officials, with some expressing concerns about the heavy load while others deem it unavoidable.

Before conducting street interviews to gather public opinion, more detailed reporting would be beneficial to better consider these viewpoints. So, let’s look at the details to understand Japan’s withholding income tax rule.

Overview

The recent tax reassessment by Nerima Ward on Oct 4th, 2023, reported they failed to pay withholding income tax, and the public officials should make compensation of JPY 37 million back tax.

It has led to significant implications, sparking discussions about the burden on public officials and the need for accurate reporting to understand the situation more comprehensively.

Public Opinion

Public opinions regarding the tax reassessment in Nerima Ward have highlighted concerns about the individual burden and potential repercussions on staffing within government offices.

It would be tough to ask an individual for 37 million yen in compensation, wouldn’t it?

What is the structure of withholding income tax, and what is the appropriateness of the public employee’s burden? I don’t think it is so that individuals have to pay for everyone. It’s a pity. I hope you review it and make sure it doesn’t happen again.

The structure of withholding income tax and the appropriateness of burdening public servants? Making them bear so much burden will add to the manpower shortage in the government offices. You are making the employees bear the burden, but if there is a profit, are you giving it back to the public servants?

What is the structure of withholding income tax, and what is the appropriateness of the burden on public servants?

It may be pitiful, but it can’t be helped to bear the burden. 3 years would have been enough time to realize it, right?

These viewpoints illuminate the various perspectives within the community, highlighting the diversity of thoughts and experiences. This rich tapestry of opinions provides insights into individuals’ different needs and priorities, which is essential for fostering a harmonious and inclusive environment.

Necessity of Accurate Understanding

In contrast, the press reported a news story about a principal and a teacher who had to pay 950,000 yen to release water at a swimming pool in Kanagawa Prefecture. However, the contrast seems strange.

There must be many cases of failure to pay withholding income tax that are not widely reported. I have heard of cases where companies have been charged for late payment of taxes.

In addition, as the city of Sendai is investigating, there are cases of over-collection and under-collection of withholding tax.

Responsibility of Public Officials

The question of the responsibilities of public officials should be worth considering.

If too much responsibility is placed on the public officials, their activities may atrophy.

On the other hand, if they are not held accountable for their actions, this could lead to irresponsible results.

Legally, this case is one in which the following laws require compensation.

If the accounting manager or an official assisting the accounting manager in his/her duties, an official receiving an advance of funds, an official having custody of possessed movables, or an official using articles, intentionally or through gross negligence (in the case of cash, intentionally or through negligence), loses or damages cash, securities, articles (including movables belonging to a fund) or possessed movables pertaining to his/her custody, or articles pertaining to his/her use, he/she shall compensate for damages caused thereby.

Article 243-2 of the Local Autonomy Law

The pool case differs from the failure to pay the withholding tax mentioned earlier. This is because compensation cannot be sought unless the negligence is grossly negligent. However, for those dealing with cash, the content is that compensation is sought, even if it is mere negligence.

Let’s consider the difference between mere negligence and gross negligence when hitting someone. Negligence is hitting someone while speeding, while gross negligence is speeding and hitting someone.

Assessment of Negligence

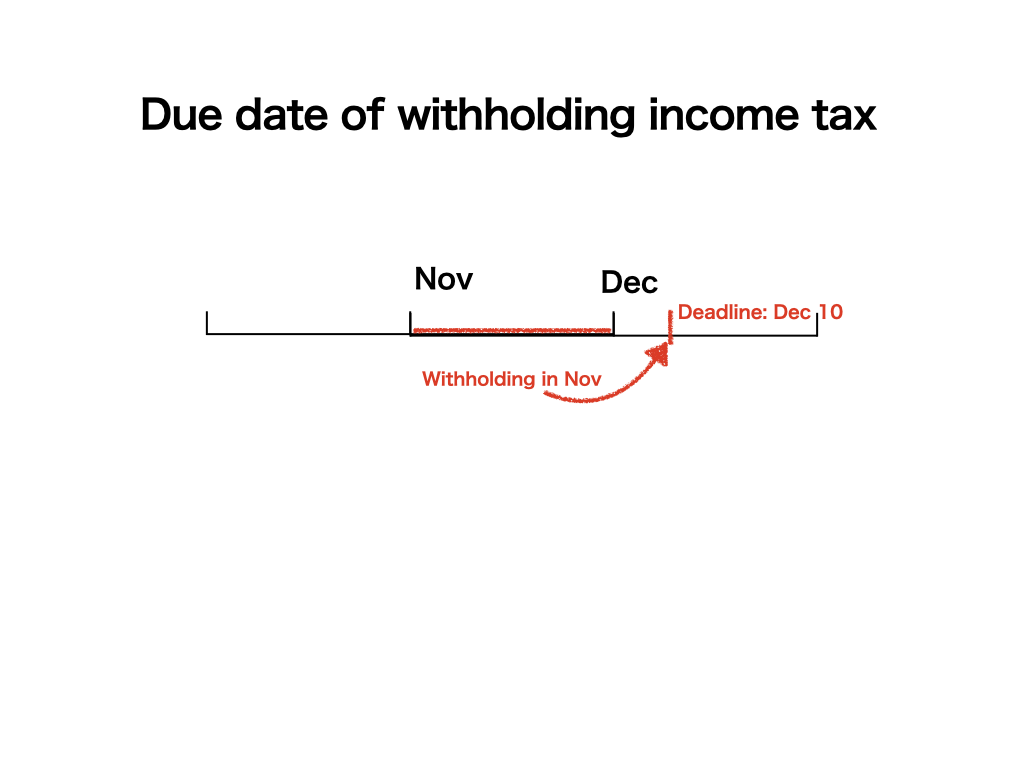

Deadline for payment of withholding income tax

Let us consider whether this case is negligence or minor negligence (lack of duty of care to the extent normally required).

First, withholding income tax is a system whereby a portion of the salary is deposited when the salary is paid, and the tax is paid to the tax office.

The person who deposited the money, in this case, Nerima Ward, is obligated to pay the tax.

If you paid your salary in November, you have until the 10th of the month to pay the withholding income tax on December 10.

Exploring the nature of negligence in the delayed payment of withholding income tax will provide insights into the root causes and potential areas for improvement.

What happens if you delay?

If you are late, you will be assessed additional taxes for the amount you are late. You will have to pay 5% of the amount you did not pay (additional tax for non-payment) and the amount you did not pay multiplied by the delinquency rate (delinquent tax, which was 2.4-2.5% at the time of this addendum).

However, regarding the 5% addition, you can miss the first one. Strictly speaking, you can miss it once if you have not paid it within the past year.

In the case of Nerima Ward, the additional charge for non-payment in 2021 is 0%, and only the overdue tax rate is charged.

Because of the nonpayment of the 2021 tax payment 2022 tax payment was not missed because of the nonpayment of the 2022 tax payment, the 2023 tax payment was not missed.

This part will affect the next year’s amount.

The amount of non-payment for the year 2022 is approximately 16 million yen.

Combined with the amount for 2023, the total is approximately 35 million yen.

This is a large portion of the total amount, resulting in the excessive amount shown in this report.

Causes of Delay

Nerima Ward has reported the following causes.

Cause

Nerima Ward Press Release, October 4, 2023, p. 2.

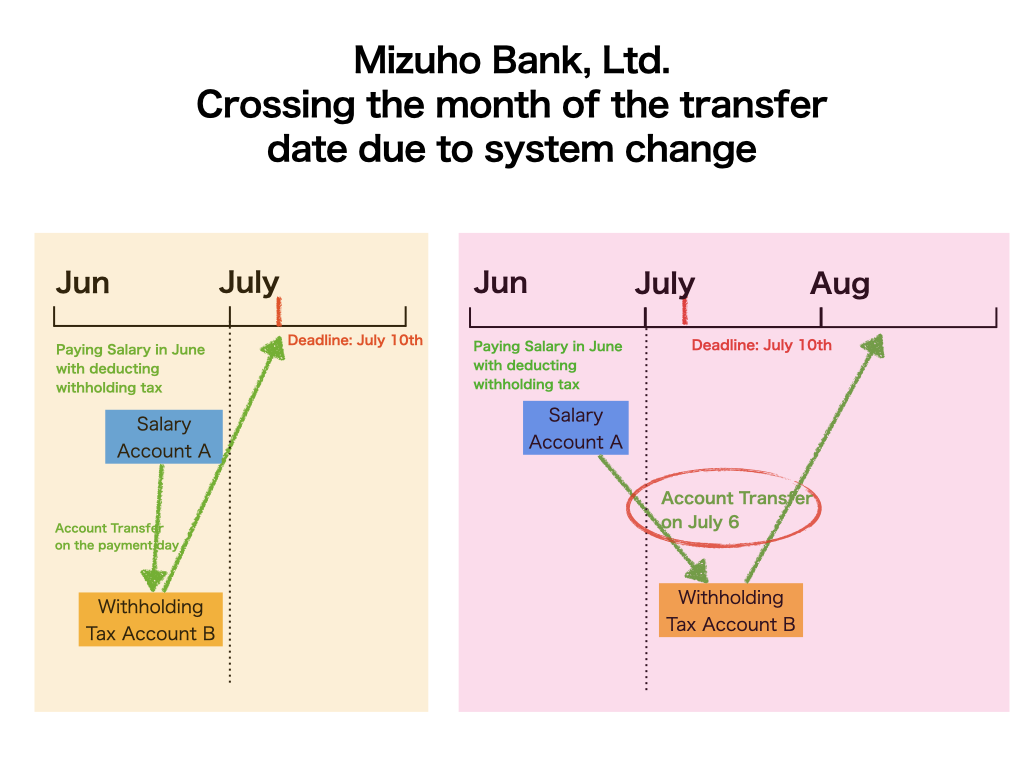

(1) Around November 2020, due to a review of the operations of the designated financial institution (Mizuho Bank, Ltd.), the withholding tax income date was changed from June 30 to July 6.

(1) Around November 2020, due to a review of the operations of a designated financial institution (Mizuho Bank), the withholding tax income date was changed from June 30 to around July 6. At this time, due to a lack of understanding of the law, the person in charge mistakenly believed that the due date was the 10th of the month (August 10) following the date on which withholding tax payments could be processed for accounting purposes (July 6), instead of the 10th of the month (July 10) following the month of salary payment (the original due date), and performed the paperwork.

(2) In the course of the approval process, the company realized that the amount payable on July 10 did not include the withholding tax related to the year-end allowance paid on June 30.

(2) In the process of the decision concerning the processing, the company failed to notice that the amount payable on July 10 did not include the source income tax related to the year-end and diligent allowance paid on June 30.

After reading this, I did not understand it well, so I contacted Nerima Ward to confirm because Mizuho Bank has changed the transfer of funds from 2020.

Previously, the withholding tax portion was looked back from payroll transfer account A to withholding payment account B when the June payment was made.

Since it is dated June in account B, I know that the withholding tax will be processed in the following month, July.

However, after the system was changed, the withholding tax amount came into account B on July 6.

If the person in charge processes the withholding tax based on the understanding that it will come in July, the payment will be made in August.

As a result, there is a one-month delay.

This is the reason for the misconception in (1) above.

Opportunities to Consider Future Measurement

This case is summarized not to blame the withholding tax omission but to convey the horror of the additional taxation.

It is more or less likely to be found in Nerima Ward and in other cities, towns, and villages.

Companies may also be cited for withholding tax omission.

This is because it is easy to know whether or not you are late in paying withholding tax, and if you forget to pay it, you are likely to be charged for it. There are even disputes over the fact that “we are not obligated to pay withholding tax.

So, what should we do to prevent this?

On the municipal side

This time, the employees will cover the additional taxes through insurance. Nerima Ward encourages its employees to join the compensation insurance for civil servants, and although membership is voluntary, 80% of the management staff has taken it out.

Other municipalities should also be proactive in joining the insurance, as it also covers things like withholding tax leakage. Those in departments that handle cash should especially join actively.

Even if you are compensated for 100 million yen, the cost is 6,240 yen. It is not that large an amount.

If there was an insurance policy that compensated even general business companies, there would be people who would want to buy it. In this sense, government employees can properly hedge their risks.

Proposed Measures

I have seen the proposal by Mr. Riki Sato, a member of the Nerima Ward Assembly as follows.

- In consultation with Mizuho Bank, the withholding income tax processing will be handled in the same manner as before 2020, and the withholding income tax income date will be returned to June 30.

- The manual on withholding tax will be updated to clearly indicate the laws and regulations on which the withholding tax is based and points to be noted in the practical treatment of withholding tax.

- Share the annual schedule for tax payment administration within the department in charge and prepare a check sheet to systematically grasp and manage the progress to avoid omissions and delays.

- Hold a briefing session at the beginning of each fiscal year for staff engaged in withholding tax administration within the Agency to ensure that they are thoroughly familiar with the laws and regulations that govern withholding tax and the administrative workflow.

First, regarding the first appeal to Mizuho Bank, I feel it will increase management’s frustration, who will think that only municipalities should be given special treatment. I have experience being asked by the bank to change our process for other matters, and it would be difficult to respond individually to modify the system.

2 and 3 are the easiest ways to take action. These are the main areas that need to be scrutinized. Simply implementing a separate inter-departmental reporting flow for withholding from salaries without basing it solely on the amount of bank deposits should be sufficient to deal with this issue.

Also, even if payment is delayed, confirming this with the documents reported to the tax office in January should be possible.

Conclusion and Recommendations

The “additional tax for nonpayment” is a tax that must be paid with caution because it occurs as follows

- The “additional tax for nonpayment” of late payment occurs when late

- If the tax is paid at the tax office’s suggestion, 10% is imposed; if the tax is paid voluntarily, 5% is imposed.

- However, the tax is exempted in the following cases

- When the amount of the additional tax for nonpayment is less than JPY5,000

- There has been no delay in the payment of withholding income tax for the past year from the month before the due date, and the payment was made by the day one month after the due date. There has been no previous delinquency.

Regarding Nerima Ward’s employees bearing the burden of additional tax collection, I believe the burden on public employees is not as great as some people have commented. However, public employees involved in tax payments should purchase public employee liability insurance.

Those involved in the general corporate sector should also be aware of this. With a correct understanding of the situation, make steady payments without delay on the payment due date!

If you need a consultation, please use our services.