The Qualified Invoice System [invoice Seido] started in October 2023.

There has been a lot of fuss in various places, but to reduce the impact of the invoice system, there is a transitional measure that allows an 8% deduction on the purchase side, even though the invoice number is not registered.

Another issue I see as a challenge is the response on the receiving side.

Even if the issuing side understands the system, it will not mesh well if the invoiced party does not understand the transitional measures.

In this issue, I will summarize how to understand and respond to this transitional measure on the billing side and how to respond to this issue on the receiving side.

Will I be unable to bill for sales tax as of October 1, 2023?

On a delivery basis

First, whether or not an invoice is required will change based on the job’s completion date.

The invoice system will apply when goods are delivered or services are rendered on or after October 1, 2023.

If goods are delivered, or services are rendered by September 30, 2023, invoices issued in October can still be issued similarly.

Delivery after October 1, 2023

Tax-exempt businesses(Menzei Jigyousya), i.e., those who do not have an invoice number, can issue invoices with 8% consumption tax(Shouhizei) on them after October 2023.

The number one reason to register for the invoice system is that it will no longer be possible to charge Shouhizei. Until now, a seller could issue an invoice with Shouhizei on it even if it was not obligated to pay consumption tax (even if it was not a consumption-taxable business).

In the press, Invoice Seido has been reported as a way to exclude tax-exempt businesses(Menzei Jigyousha) from the market. However, it is still possible to charge Shouhizei without registering Invoice Seido, i.e., without an invoice number.

By the way, an invoice number(Invoice Bangou) is a “T+13 digit number. For corporations, it is an ID with a T in front of the corporate number.

We have seen cases where sole proprietors confuse this invoice number with the number on their My Number card. The number on your My Number card is essential personal information, so do not disclose it by mistake.

You can Add an Equivalent amount of Shouhizei

What does charging Shouhizei mean on your invoices even if you do not have an invoice number?

Specifically, when you invoice for 100,000 yen, excluding tax, you can invoice 108,000 yen.

Transitional measure period

It is possible to charge an additional amount equivalent to the 8% consumption tax because a transitional measure period has been established. Transitional measures minimize the impact of changes in Shouhizei.

Considering the social impact of the change, the transition to the consumption tax system has been designed to be as smooth as possible. Specifically, the system will allow purchasers to deduct 8% or 5% of Shouhizei on invoices without invoice numbers for the following periods.

| Period | Ratio |

|---|---|

| from October 1, 2023 to September 30, 2026 | 80% of the amount equivalent to purchase |

| from October 1, 2026 to September 30, 2029 | 50% of the amount equivalent to purchase |

As a result, the billing party can charge an additional 8% equivalent Shouhizei[消費税] for the most recent period.

Consideration of journal entries

As a tax-exempt business(Menzei Jigyousha), assuming that the amount equivalent to the consumption tax is accounted for, including the tax, the same treatment will be applied in the future.

| Date | Debit | Credit | Description | ||

| Oct 31 | Receivables | 108,000円 | Sales | 108,000円 | Advertising agency service fee |

Understanding of business partners

When applying this method, it is essential to make sure that your business partners understand the application. There are two points to be understood.

- Invoice Seido does not apply to goods delivered or services rendered in September 2023, even if the invoice is issued on or after Oct 1, 2023.

- Even if goods are provided or services are rendered after October 1, 2023, an 8% consumption tax deduction(Shiire Zeigaku Koujo) is possible for the time being

Since Invoice Seido is a new system, there are many cases where people do not know how to deal with it, regardless of whether they are Japanese or not. Even accounting staff may deal with it by checking with redundancy or contacting their tax advisors.

There is a possibility that some people may be turned away at the door, so please explain adequately and make sure they understand.

Please refer to this Japanese blog or my YouTube page for further understanding if necessary.

I want your transactions to be mutually pleasant. I have tried to create this to eliminate as many obstacles to that understanding as possible. Of course, “billing” is essential, but I believe that the root of this is to facilitate human relations more than the documents. I would be happy if it is helpful so we can act in a mutually agreeable manner even when there are systemic changes such as the one we have seen.

Restrictions on discounting under the Act against Delay in Payment of Subcontract Proceeds, Etc. to Subcontractors

If a supplier says, “You are Menzei Jigyousha, so please just put JPY100,000 yen” for an invoice of JPY110,000 if, including Shouhizei, it violates the Subcontract Law.

The Fair Trade Commission has issued that notice.

Since there is a transitional measure for tax credits on purchases, even if there is a request for a price reduction, the maximum decreased total should be JPY108,000.

The main subcontracting entrepreneur cannot ask for more reduction.

Strict legal classification of invoices

After October 2023, taxable businesses'(Kazei Jigyousha) invoices are called “Invoice” in Japanese.

In contrast, tax-exempt businesses(Menzei Jigyousha) will use the conventional invoicing method, called a “rete-classified invoice(Kubun Kisai Seikyusho).

Each differs in the following ways.

| Item | Simple Invoice | the rate-classified Invoice | The Qualified Invoice |

|---|---|---|---|

| Issuer’s name or title | ◯ | ◯ | ◯ |

| Transaction Date | ◯ | ◯ | ◯ |

| Transaction Details | ◯ | ◯ | ◯ |

| Transaction Amount | ◯ | ◯ | ◯ |

| Receiver’s name or title | ◯ | ◯ | ◯ |

| Statement that the item is subject to the reduced tax rate | ◯* | ◯ | |

| The total amount of consideration (including tax) divided by each tax rate. | ◯* | ◯ | |

| Invoice Bangou of a qualified invoicing company | ◯ | ||

| Tax rate Comparison of invoices | ◯ |

If there is no description of *, the recipient can add it to the invoice and store it by himself/herself.

If you cannot issue an invoice with Invoice Bangou, you’ll issue the rate-classified invoice with some remarks. So, what are the remarks?

The following items will be explained.

Putting Remarks on the rate-categorized invoice

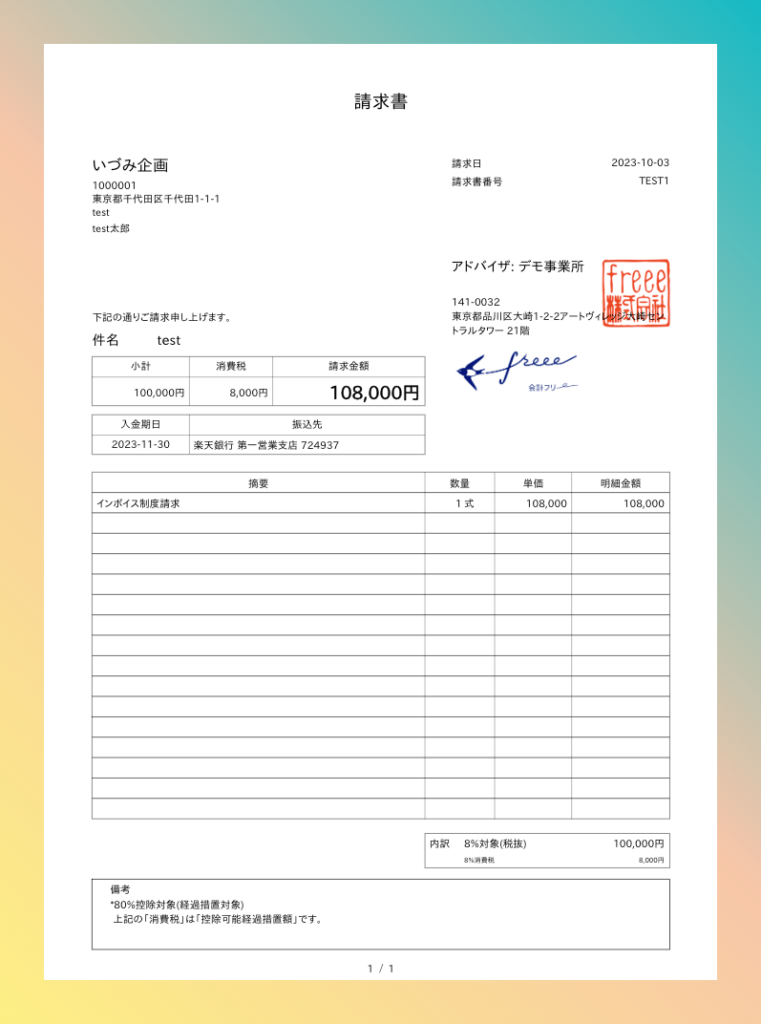

The following is an example of an invoice.

In addition to the information on the rate-classified invoice, you can write the note described in the “Policy” section below.

It is good enough for the recipient to know they can use transitional measurement and prove this in a tax audit. This is not the only correct answer.

In addition, strictly speaking, it would be necessary to state “the total amount of consideration (including tax) broken down by tax rate.

However, since you are a tax-exempt business, this section will not exist. The interpretation generates another type of invoice.

“Policy”

The first and simplest method is to charge only the total amount.

Since tax-exempt businesses cannot charge consumption tax, the column “Consumption tax”(Shouhizei[消費税]) should be excluded.

You should put

E.G., “Transitional measures applied, 80% deductible,” etc.

A second method is to state “that the item is subject to the reduced tax rate” and “the total amount of consideration (including tax) separately for each tax rate.

The notification stipulates that this should be added to the invoice for a separate listing.

However, the consumption tax is placed on the invoice even though, in principle, the consumption tax should not be placed on the invoice.

Some people may feel uncomfortable, so please use the first method.

To bill without Shouhizei Item

The following is the content as per the first method above.

Description

Note: Transitional measures applied, 80% deductible

If you want to show Shouhizei[消費税] item

If you wish to provide a separate item for calculation, you may use the following words.

- “80% Deductible (subject to transitional measures).”

- Consumption Tax Correction Amount,”

- “Deductible Transitional Measure Amount,”

- If you use “Deductible Transitional Measure Amount,” it will look like this.

Description

Note: Transitional measures applied, 80% deductible

Deductible transitional measure amount

In the case of FREEE

I tried, but when I created the invoice with freee, I could not delete Shouhizei item, so I made an adjustment in the remarks.

Shouhizei External Calculation

The following is described in the remarks column.

Description

Note: 80% deductible (subject to transitional measures)

The “consumption tax” above is the “deductible transitional amount.

Shouhizei Internal Calculation

The concept of how to describe is the same in the case of internal taxation.

Description

Note: 80% deductible (subject to transitional measures)

The “consumption tax” above is the “deductible transitional amount.

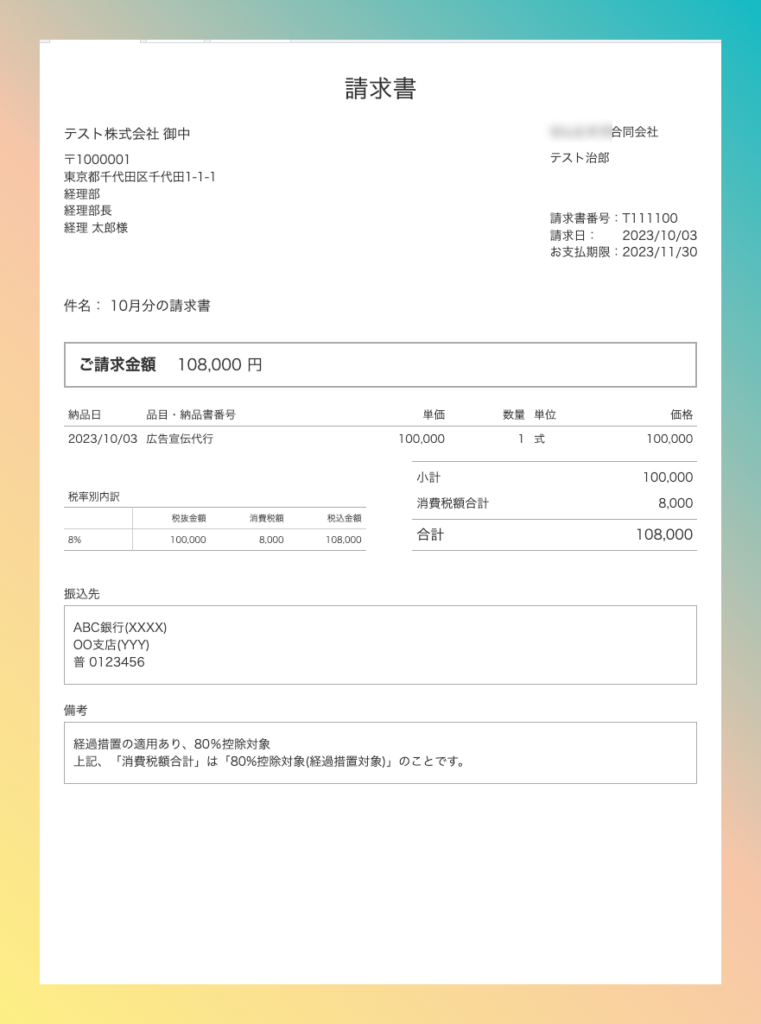

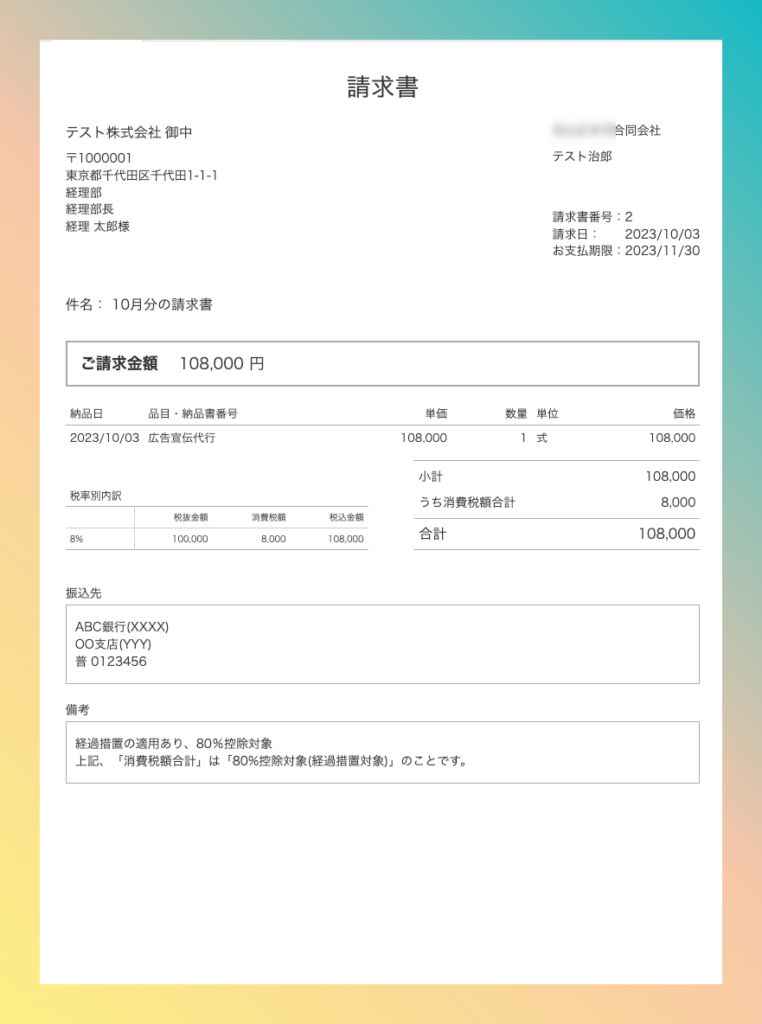

Moneyforward

Shouhizei[消費税] External Calculation

Description

Note: Transitional measures applied, 80% deductible

Above, “Total consumption tax” is “80% deductible (transitional measure amount)

Shouhizei[消費税] Internal Calculation

Description

Note: Transitional measures applied, 80% deductible

Above, “Total consumption tax” is “80% deductible (transitional measure amount)

Misoca

Shouhizei External Calculation/Shouhizei Internal Calculation

Please put remarks as per the mentioned examples.

Description

Note: Transitional measures applied, 80% deductible

Above, “Consumption tax (8%)” is “80% deductible (transitional measure amount)”.

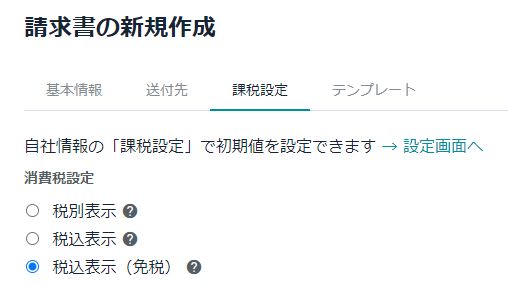

Tax included

Misoca allows you to display tax-inclusive for tax-exempt(Menzei Jigyousha).

In the “Create New Invoice” section, select “Taxation Settings”.

Please select “Tax inclusive (tax exempt)”.

If you do not want to display Shouhizei, you use this way.

Then, process the invoice according to “To bill without Shouhizei Item“.

You can make an invoice without Shouhizei.

Description

Note: Transitional measures applied, 80% deductible

Let’s negotiate the price in the long run.

It may be challenging to do so immediately, but the above transitional measures will eventually disappear.

From a long-term perspective, it will be necessary to change the price itself.

Please understand that the transitional measures period is the time to adjust the body price. I’m pleased to support you with Business Tax Advisory or Pay-As-You-Go Consulting.

English Invoice Kindle Book Announcement

We are belatedly preparing a Kindle book about invoicing in English.

I intend to finish writing it by the end of this month (October 2023), so if you find this helpful information, I would appreciate it if you could plop it down.