How to Enroll and Pay for Social Insurance and National Pension in Japan

Japan’s social security system includes various insurance programs to support residents during illness, injury, retirement, and other life events. Two of the most critical systems are Social Insurance(社会保険[Shakai Hoken]) and the National Pension(国民年金[Kokumin Nenkin]). Understanding how to enroll and pay for these programs is crucial for both Japanese citizens and foreign residents living in Japan. This guide will explain the procedures, eligibility, payment methods, and exemptions related to these systems, ensuring you stay compliant and maximize the available benefits.

- Understanding Japan’s Social Insurance and Pension Systems

- Who Needs to Enroll in Social Insurance and Pension Plans?

- Free Enrollment for Dependent Spouses under Employees’ Pension Insurance

- How to Enroll in Social Insurance and National Pension

- How to Pay Social Insurance and National Pension Premiums

- Exemptions and Payment Reductions(免除と減額制度)

- Lump-Sum Withdrawal for Foreign Residents

- Key Benefits of Social Insurance and Pension Systems

- Conclusion

- FAQs

- Can I pay both Social Insurance and National Pension at once?

- How do freelancers manage their insurance payments in Japan?

- What if I leave Japan before retirement?

- 4. What happens if I miss a National Pension payment?

- 5. Can dependent spouses get pension coverage without paying premiums?

- 6. Are National Pension premiums tax-deductible?

- 7. What is the difference between Social Insurance and National Health Insurance?

- 8. How can I check if my employer is properly paying my Social Insurance premiums?

- 9. Can I get a discount on National Pension payments?

- FAQs (よくある質問)

- 1. Can I pay both Social Insurance and National Pension at once?

- 2. How do freelancers manage their insurance payments in Japan?

- 3. What if I leave Japan before retirement?

- 4. What happens if I miss a National Pension payment?

- 5. Can dependent spouses get pension coverage without paying premiums?

- 6. Are National Pension premiums tax-deductible?

- 7. What is the difference between Social Insurance and National Health Insurance?

- 8. How can I check if my employer is properly paying my Social Insurance premiums?

- 9. Can I get a discount on National Pension payments?

- 10. What should I do if I can’t afford my National Health Insurance premiums?

Understanding Japan’s Social Insurance and Pension Systems

Japan has a well-structured social security system that supports residents throughout their lives. Social Insurance and the National Pension System are two significant components of this system. Understanding how these systems work is essential for effectively managing your healthcare and retirement plans.

What is Social Insurance(社会保険[Shakai Hoken]) in Japan?

Social Insurance is a mandatory program for full-time employees in Japan and is designed to provide financial protection in case of illness, injury, disability, and retirement. It covers several types of insurance:

- Health Insurance (健康保険[Kenkou Hoken]): Covers medical expenses, hospitalization, and maternity care.

- Employees’ Pension Insurance (厚生年金保険[Kousei Nenkin Hoken]): Provides retirement, disability, and survivor benefits.

- Employment Insurance (雇用保険[Koyou Hoken]): Offers unemployment benefits and job training support.

- Workers’ Accident Compensation Insurance (労災保険[Rousai Hoken]): Covers work-related injuries and occupational diseases.

- Long-Term Care Insurance (介護保険[Kaigo Hoken]): Provides support for elderly care services starting from age 40.

Social Insurance Premium Rates and Payment Calculation (社会保険の料率と計算方法)

The premiums for Social Insurance are calculated based on the employee’s monthly salary and bonus amounts. Both the employee and employer share the cost.

| Insurance Type | Employee Share | Employer Share | Total Rate |

|---|---|---|---|

| Health Insurance (健康保険) | ~4.95% | ~4.95% | ~9.9% |

| Employees’ Pension (厚生年金保険) | ~9.15% | ~9.15% | ~18.3% |

| Employment Insurance (雇用保険) | ~0.3% | ~0.6% | ~0.9% |

| Long-Term Care Insurance (介護保険) | ~0.9% | ~0.9% | ~1.8% |

📝 Example Calculation:

- Monthly Salary: ¥300,000

- Health Insurance: ¥300,000 × 4.95% = ¥14,850 (Employee’s share)

- Employees’ Pension: ¥300,000 × 9.15% = ¥27,450 (Employee’s share)

🔔 Note:

- The exact rate may vary by region and industry.

- The company also pays the same amount.

What is the National Health Insurance (国民健康保険[Kokumin Kenkou Hoken])?

The National Health Insurance (NHI) is managed by local governments and is intended for individuals not covered by Employees’ Health Insurance. This typically includes:

- Self-employed individuals and freelancers

- Part-time and contract workers

- Students and retirees

It primarily covers medical expenses for illness, injuries, and hospitalization.

What is Employees’ Health Insurance (健康保険)?

Employees’ Health Insurance is mandatory for full-time employees and is jointly funded by the employer and the employee. It offers broader medical coverage than the National Health Insurance, including:

- Medical treatments, hospitalization, and prescriptions

- Sickness and Injury Allowance (傷病手当金[Shoubyou Teatekin]) for income compensation during medical leave

- Maternity Allowance (出産手当金[Shussan Teatekin]) for maternity leave compensation

Key Differences Between Employees’ Health Insurance and National Health Insurance

| Aspect | National Pension (国民年金) | Employees’ Pension Insurance (厚生年金保険) |

| Eligibility | All residents aged 20–59 not in employment | Full-time company employees |

| Premium Payment | Flat-rate monthly contributions | Salary-based contributions shared by employer and employee |

| Benefit Amount | Basic pension benefits | Higher pension due to earnings-based calculation |

| Management | Managed by Japan Pension Service | Managed by employers and Japan Pension Service |

What is the National Pension System in Japan?

The National Pension System (国民年金 [Kokumin Nenkin]) is Japan’s universal pension program designed to provide basic financial security for all residents aged 20 to 59, regardless of nationality. It ensures income support in the event of retirement, disability, or death.

There are three categories of insured individuals under the National Pension system:

- Category I Insured Persons: Self-employed individuals, freelancers, students, and unemployed persons.

- Category II Insured Persons: Full-time employees enrolled in Employees’ Pension Insurance (厚生年金保険).

- Category III Insured Persons: Dependent spouses of Category II insured persons.

National Pension Premiums and Payment Calculation (国民年金の掛け金と計算方法)

The National Pension premium is a fixed monthly amount that all Category I insured persons must pay. This amount is determined annually by the government.

| Year | Monthly Premium (標準保険料) |

|---|---|

| 2023 | ¥16,520 |

| 2024 | ¥16,980 (Expected) |

💡 Key Points:

- The premium is the same for everyone, regardless of income.

- Payments are made monthly, but there are options for advance payments with discounts.

- Category II and Category III insured persons are automatically enrolled through their employer or spouse, and premiums are handled accordingly.

Example Calculation (支払い例)

If you are a self-employed individual or freelancer:

- Monthly Payment: ¥16,520

- Annual Total: ¥16,520 × 12 = ¥198,240

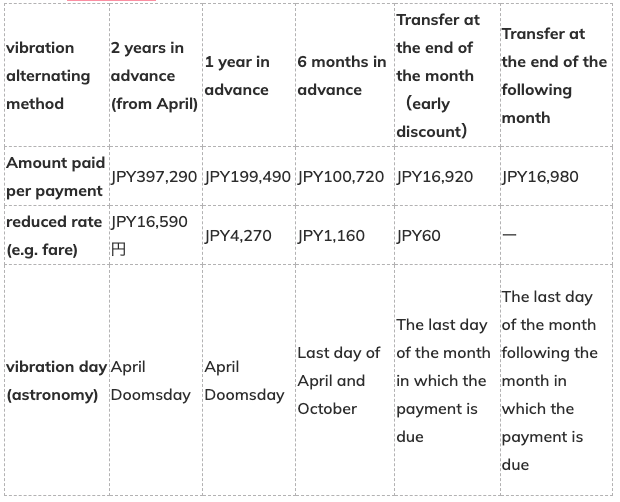

🔔 Advance Payment Discounts:

- 6 months in advance: ¥97,900 (discounted)

- 1 year in advance: ¥194,370 (discounted)

🔔 Note: Discounts are available for advance payments (6 months, 1 year in advance).

Key Differences Between National Pension and Employees’ Pension Insurance (厚生年金保険)

| Aspect | National Pension (国民年金) | Employees’ Pension Insurance (厚生年金保険) |

|---|---|---|

| Eligibility | All residents aged 20–59 not in employment | Full-time company employees |

| Premium Payment | Fixed monthly rate (¥16,520 in 2023) | Salary-based contributions shared by employer and employee |

| Benefit Amount | Basic pension benefits only | Higher pension due to earnings-based calculation |

| Management | Managed by Japan Pension Service | Managed by employers and Japan Pension Service |

Who Needs to Enroll in Social Insurance and Pension Plans?

In Japan, enrollment in Social Insurance and the National Pension System is mandatory for residents based on their employment status and residency. Understanding who is required to join these systems ensures compliance with Japanese laws and allows individuals to access essential benefits.

Obligation for Social Insurance (社会保険の加入義務)

Social Insurance (社会保険 [Shakai Hoken]) is required for most full-time employees working in Japan. This system covers various insurances, including health insurance and pension insurance.

Who Must Join the National Pension?

- Full-time employees working at companies with more than 5 employees.

- Part-time or contract workers working over 30 hours per week (or more than 3/4 of full-time hours).

- Company directors may be eligible depending on the company structure.

- Non-Japanese employees working full-time are also required to join.

Foreign Residents’ Enrollment Requirements

- Freelancers and self-employed individuals.

- Part-time workers working fewer than 20 hours per week.

- Students working limited hours.

💡 Note: Freelancers and self-employed individuals must enroll in the National Health Insurance (国民健康保険) and National Pension (国民年金).

Who Must Join the National Pension? (国民年金の加入義務)

The National Pension (国民年金 [Kokumin Nenkin]) system is a universal pension system that applies to all residents of Japan aged 20 to 59.

Categories of Insured Persons:

Category I Insured Persons (第1号被保険者):

- Self-employed individuals, freelancers, and students.

- Unemployed individuals.

- Foreign residents who are not full-time employees.

Category II Insured Persons (第2号被保険者):

- Full-time company employees and public servants.

- Enrolled automatically in Employees’ Pension Insurance (厚生年金保険).

Category III Insured Persons (第3号被保険者):

- Dependent spouses of Category II insured persons.

- Aged 20–59 and not employed.

- Covered under National Pension without paying premiums (funded by the spouse’s employer contributions).

Foreign Residents’ Enrollment Requirements (外国人居住者の加入義務)

Foreign residents living in Japan are generally required to enroll in either Social Insurance or the National Pension, depending on their employment status.

Foreigners Who Must Enroll:

- Full-time foreign employees working in Japan → Social Insurance (Health Insurance + Employees’ Pension Insurance).

- Foreign students, freelancers, or part-time workers → National Health Insurance and National Pension.

- Spouses of full-time employees may qualify for Category III Insured Person if dependent.

Exceptions:

- Foreign workers from countries that have a social security agreement with Japan may be exempt if they are paying into their home country’s pension system.

- Countries include Germany, France, Australia, South Korea, and others.

- Short-term stays (less than 3 months) typically do not require enrollment.

🔔 Important:

Even foreign residents are entitled to the same benefits and obligations as Japanese citizens once enrolled.

Example Cases:

John, a Full-Time Employee at a Japanese Company:

- Social Insurance (Health Insurance + Employees’ Pension Insurance) → Mandatory

Emily, a Freelancer in Tokyo:

- National Health Insurance + National Pension → Mandatory

Carlos, a Dependent Spouse of a Company Employee:

- Category III Insured Person → Automatic Enrollment in National Pension (No premium required)

Free Enrollment for Dependent Spouses under Employees’ Pension Insurance

In Japan, spouses of full-time employees may be eligible for free enrollment in the National Pension System through the Category III Insured Person (第3号被保険者) system. This provides important pension coverage without requiring the dependent spouse to pay premiums.

What is the Category III Insured Person(3号被保険者) in Employees’ Pension Insurance?

The Category III Insured Person is designed for dependent spouses of full-time employees who are enrolled in Employees’ Pension Insurance (厚生年金保険). This system ensures that non-working spouses can build pension eligibility without making direct payments.

Eligibility Criteria:

- Must be aged 20 to 59.

- The spouse must be a full-time employee enrolled in Employees’ Pension Insurance.

- The dependent spouse must earn less than ¥1.3 million per year (approximately ¥108,333 per month).

- Must be registered as a dependent through the working spouse’s employer.

💡 Note: If the spouse’s income exceeds the threshold, they must enroll in the National Pension as a Category I Insured Person and pay premiums directly.

How Dependent Spouses of Company Employees Qualify for Free Enrollment

The enrollment process for dependent spouses is typically handled by the working spouse’s employer. Here’s how the process works:

Employer Notification:

- The working spouse informs their company that their spouse is financially dependent.

- Required documents include proof of income and identification.

Employer Submits Paperwork:

- The company submits the dependent information to the Japan Pension Service(日本年金機構).

Automatic Enrollment:

- Once approved, the dependent spouse is automatically enrolled in the National Pension (Category III).

- No premium payments are required, as contributions are covered by the system.

Health Insurance Coverage:

- The dependent spouse may also be added to the working spouse’s Health Insurance without additional cost.

🔔 Important:

If the spouse starts working and their income exceeds the ¥1.3 million limit, they must switch to Category I and pay their own National Pension premiums.

How Dependent Spouses Can Be Covered under Social Insurance

In addition to National Pension, dependent spouses can also be covered under their spouse’s Social Insurance, which includes:

- Health Insurance (健康保険): Covers medical expenses for the dependent spouse.

- Long-Term Care Insurance (介護保険): Automatically applies if the spouse is aged 40–64.

Eligibility for Health Insurance as a Dependent:

- The spouse must earn less than ¥1.3 million per year.

- Must not be engaged in full-time employment.

- Must be registered by the working spouse’s employer.

💡 Example:

- Anna is married to Ken, who works full-time at a company enrolled in Employees’ Pension Insurance.

- Anna earns JPY1 million per year from part-time work.

- Ken registers Anna as a dependent.

- Anna is now enrolled in the National Pension (Category III) and covered under Ken’s Social Insurance, without paying premiums.

How to Enroll in Social Insurance and National Pension

Enrolling in Japan’s Social Insurance and National Pension System is essential for accessing healthcare and securing future pension benefits. The enrollment process depends on your employment status and residency.

Enrollment Process for Social Insurance

Social Insurance (社会保険) is mandatory for full-time employees working in Japan. The enrollment process is generally handled by the employer.

Step-by-Step Enrollment Process:

Employment Begins:

- Once you start working full-time, your employer is responsible for enrolling you.

Submission of Required Documents:

- The employer submits necessary forms to the Japan Pension Service and Health Insurance Association.

- Documents include:

- My Number (Individual Number Card or Notification Card)

- Residence Card (在留カード) for foreign nationals

- Employment contract

Automatic Enrollment:

- After submission, you are automatically enrolled in:

- Health Insurance (健康保険)

- Employees’ Pension Insurance (厚生年金保険)

- After submission, you are automatically enrolled in:

Receive Insurance Cards:

- Your Health Insurance Card(健康保険証) and Pension Handbook (年金手帳) will be issued and sent to you.

- Health insurance cards will be shifted to a system based on the my number card (myna insurance card), and new current health insurance cards will no longer be issued from December 2, 2024.

💡 Note: Part-time workers working over 30 hours per week may also be eligible.

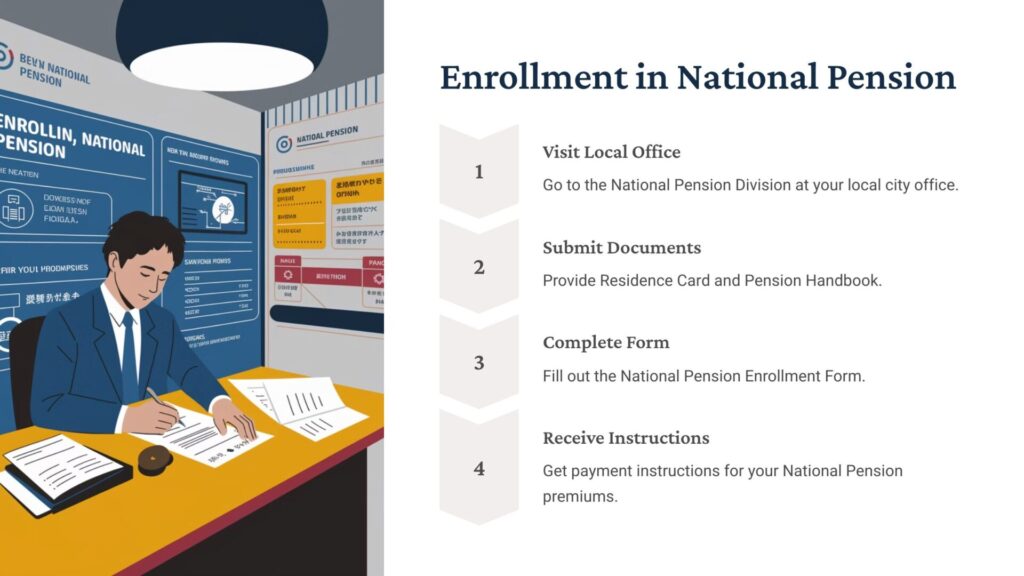

How to Enroll in the National Pension

Individuals not covered by Social Insurance (such as self-employed persons, freelancers, students, and part-time workers) must enroll in the National Pension (国民年金).

Step-by-Step Enrollment Process:

Visit Your Local City Office (市区町村役場):

- Go to the National Pension Division (年金係) at your local city, ward, or town office.

Submit Required Documents:

- Residence Card (在留カード) or My Number Card

- Pension Handbook (if already issued)

Complete the Enrollment Form:

- Fill out the National Pension Enrollment Form (国民年金加入申出書).

Receive Payment Instructions:

- You will receive information about premium payments and how to make them.

Start Making Payments:

- Begin paying the monthly premium (currently ¥16,520 for 2023).

💡 Note: Foreign residents staying in Japan for more than 3 months are required to enroll.

Required Documents and Where to Apply

For Social Insurance (会社員向け):

- Handled by the Employer

- Required Documents:

- My Number Card or Notification Card

- Residence Card (在留カード)

- Employment Contract

For National Pension (自営業・フリーランス向け):

- Apply at: Local City/Ward Office (市区町村役場)

- Required Documents:

- My Number Card or Notification Card

- Residence Card (在留カード)

- National Pension Handbook (if applicable)

For Dependent Spouses (扶養配偶者):

- Handled by the Spouse’s Employer

- Required Documents:

- Income Verification (must be under ¥1.3 million/year)

- Dependent Registration Form

Important Notes

- Students can apply for the Special Payment System for Students (学生納付特例制度) to defer payments.

- Low-income individuals may qualify for payment exemptions or reductions.

- Changes in employment status require updating your insurance enrollment.

How to Pay Social Insurance and National Pension Premiums

Paying your Social Insurance and National Pension premiums on time is essential to maintain continuous access to healthcare services and secure future pension benefits in Japan. Below are the detailed payment methods for both systems.

Payment Methods for Social Insurance (社会保険)

For full-time employees, Social Insurance premiums are automatically deducted from the employee’s salary each month. This includes both Health Insurance and Employees’ Pension Insurance.

How Payment Works:

Automatic Salary Deduction (給与天引き):

- Your employer deducts the required premium amount directly from your monthly salary.

- The premium covers:

- Health Insurance (健康保険)

- Employees’ Pension Insurance (厚生年金保険)

- Long-Term Care Insurance (介護保険) (for those aged 40–64)

- Employment Insurance (雇用保険)

Employer Contribution:

- The employer pays an equal or higher portion of the premium.

- Example: For Health Insurance, the cost is typically split 50/50 between the employee and employer.

No Action Needed:

- Employees do not need to take any additional steps as the company handles all payments.

- A breakdown of the deductions is shown on the employee’s monthly payslip.

Payment Methods for the National Health Insurance(国民健康保険)

The National Health Insurance (NHI) system is designed for individuals not covered by Social Insurance, such as self-employed individuals, freelancers, part-time workers, and retirees. Unlike Social Insurance, NHI premiums must be paid directly by the insured person.

📌 Payment Options:

Bank Transfer (口座振替) – Automatic Withdrawal

- Set up an automatic bank transfer for monthly payments.

- Often comes with a small discount in some municipalities.

- Requires submission of a Bank Transfer Request Form at the city office or bank.

Payment Slip (納付書) – Convenience Stores, Banks, Post Offices

- Use the payment slip sent by your local government.

- Pay at:

- Convenience stores (7-Eleven, Lawson, FamilyMart)

- Banks

- Post offices

Credit Card Payment (クレジットカード払い)

- Available in some municipalities.

- Requires online registration through the local government’s website.

Lump-Sum Payment (一括納付)

- Pay 6 months or 1 year in advance for a discount.

- Check with your city office for discount rates.

📌 Example of NHI Premium Calculation (保険料の計算例):

| Household Income | Household Size | Annual Premium | Monthly Payment |

|---|---|---|---|

| ¥2,500,000 | 1 Person | ¥180,000 | ¥15,000 |

| ¥4,000,000 | 3 Persons | ¥465,000 | ¥38,750 |

🔔 Note: Premium amounts vary by municipality. Always check with your local city office.

📌 Late Payments (未納の場合):

- Short-Term Insurance Card (短期保険証): Issued if premiums are unpaid. Valid for 3–6 months.

- Qualification Certificate (資格証明書): Requires full upfront payment for medical care.

- Asset Seizure (財産差押え): In severe cases, unpaid premiums can lead to bank account seizures.

💡 Tip: If you cannot pay, apply for a reduction or exemption at your city office.

How NHI Premiums Are Calculated (保険料の計算方法)

The premium for National Health Insurance varies depending on:

- Previous year’s income

- Household size

- Age of household members

- Municipality rules (since it is managed by local governments)

💡 Components of NHI Premium:

- Income-based portion (所得割): Based on total household income.

- Per capita portion (均等割): Fixed amount per insured household member.

- Household portion (平等割): Fixed amount per household.

- Asset-based portion (資産割): (In some municipalities) based on property ownership.

🔔 Note: Premium amounts vary by municipality, so it’s important to check with your local city office.

Example of NHI Premium Calculation (保険料の計算例)

Let’s assume a family of three (two parents and one child) living in Tokyo, with a total annual household income of ¥4,000,000.

| Premium Component | Calculation | Amount (概算) |

|---|---|---|

| Income-based portion (所得割) | ¥4,000,000 × 8% | ¥320,000 |

| Per capita basis (均等割) | ¥35,000 × 3 people | ¥105,000 |

| Household basis (平等割) | Flat rate | ¥40,000 |

| Total Annual Premium (合計) | ¥320,000 + ¥105,000 + ¥40,000 | ¥465,000 |

| Monthly Payment (月額保険料) | ¥465,000 ÷ 12 | ¥38,750 |

💡 Note:

- This is a sample calculation. Actual premium rates vary by municipality.

- Municipalities may offer income-based discounts for low-income households.

Payment Methods for the National Pension

For self-employed, freelancers, and those not enrolled in Social Insurance, the National Pension premium must be paid directly.

Monthly Premium (2023): ¥16,520

Payment Options:

Bank Transfer (口座振替):

- Set up an automatic withdrawal from your bank account.

- Offers a discount for monthly payments.

Payment Slip (納付書) at Convenience Stores:

- Use the payment slip sent by the Japan Pension Service to pay at convenience stores like 7-Eleven, Lawson, or FamilyMart.

Credit Card Payment:

- Apply to pay premiums via credit card.

- Requires prior registration with the Japan Pension Service.

Online Payment:

- Pay through the Japan Pension Service website using online banking or electronic money.

Advance Payment (前納):

- Pay premiums 6 months, 1 year, or 2 years in advance for a discount.

- Example Discounts:

- 6 months advance: ¥97,900

- 1 year advance: ¥194,370

What Happens If You Miss a Payment?

Failing to pay Social Insurance or National Pension premiums on time can have serious consequences.

For Social Insurance:

- Basically, the payment is deducted from wages, so delays in payment are unlikely to occur.

- Coverage continues as long as you are employed, but unpaid premiums can lead to issues with future benefits.

- Employers are responsible for ensuring timely payment.

For National Pension:

- Unpaid premiums can affect your pension eligibility and reduce your future pension amount.

- You may lose eligibility for Disability Basic Pension (障害基礎年金) and Survivors Basic Pension (遺族基礎年金).

Options If You Can’t Pay:

Payment Exemptions (免除):

- Apply for full or partial exemption due to financial hardship.

Payment Deferral (猶予):

- Young people under 50 or low-income earners can defer payments.

Retroactive Payment (追納):

- Pay missed premiums later to maintain pension eligibility.

🔔 Important:

Ignoring overdue payments may lead to legal action or asset seizure. It’s important to consult with your local pension office if you face payment difficulties.

Exemptions and Payment Reductions(免除と減額制度)

For individuals facing financial difficulties, Japan offers several systems to reduce or exempt the payment of National Pension and National Health Insurance premiums. These systems ensure that all residents can maintain basic social security coverage, even during challenging financial times.

Who Qualifies for a Payment Exemption?

For National Pension (国民年金):

Individuals may qualify for a full or partial exemption from National Pension premiums if they meet any of the following conditions:

- Low-income households

- Unemployment or sudden income loss

- Experiencing a disaster or natural calamity

- Students (via the Special Payment System for Students)

Types of Exemptions:

| Exemption Type (免除の種類) | Amount You Must Pay | Pension Eligibility |

|---|---|---|

| Full Exemption (全額免除) | ¥0 | 1/2 of pension credits |

| 3/4 Exemption (3/4免除) | ¥4,130 (2023) | 5/8 of pension credits |

| Half Exemption (半額免除) | ¥8,260 (2023) | 3/4 of pension credits |

| 1/4 Exemption (1/4免除) | ¥12,390 (2023) | 7/8 of pension credits |

🔔 Note: Even if you receive an exemption, a portion of the period still counts toward your pension eligibility.

For National Health Insurance (国民健康保険):

Local governments provide premium reductions or exemptions for individuals who:

- Belong to a low-income household

- Recently experienced a disaster or unemployment

- Are receiving welfare benefits (生活保護)

💡 Discounts may include:

- Reduction in the income-based portion (所得割)

- Exemption of the per capita portion (均等割)

🔔 Important:

Exemptions and reductions vary by municipality, so it’s necessary to consult your local city office for details.

How to Apply for Payment Reductions

For National Pension (国民年金):

- Visit the Local Pension Office (年金事務所) or your city office (市区町村役場).

- Prepare necessary documents:

- Income Certificate (所得証明書)

- Identification (My Number Card or Residence Card)

- Pension Handbook (年金手帳)

- Submit the application form (免除申請書).

- Wait for approval notification (takes about 1–2 months).

For National Health Insurance (国民健康保険):

- Visit your local city office.

- Provide proof of income or proof of unemployment.

- Complete the exemption application form (減免申請書).

- Receive a decision on the exemption or reduction.

💡 Tip:

Applications must be renewed annually, and approval is based on previous year’s income.

Impact of Exemptions on Future Benefits (免除が将来の年金額に与える影響)

- Periods covered by exemptions partially count toward pension eligibility.

- Full exemptions provide reduced pension credits but still protect against total disqualification.

- Retroactive payments (追納) can be made for exempted periods to restore full pension credits.

Lump-Sum Withdrawal for Foreign Residents

Foreign residents who have contributed to Japan’s National Pension (国民年金) or Employees’ Pension Insurance (厚生年金保険) but plan to leave Japan permanently may be eligible for a Lump-Sum Withdrawal Payment (脱退一時金). This system allows you to receive a partial refund of the pension premiums you have paid.

What is the Lump-Sum Withdrawal(脱退一時金)?

The Lump-Sum Withdrawal Payment is a one-time refund of pension contributions made by foreign nationals who are leaving Japan and will no longer be covered by Japan’s pension system.

🔔 Important Notes:

- This payment is available only once.

- Once claimed, you lose all rights to receive any future Japanese pension benefits (such as Old-Age Pension, Disability Pension, or Survivor’s Pension).

Eligibility for Lump-Sum Withdrawal (脱退一時金の受給資格)

To qualify for the Lump-Sum Withdrawal Payment, you must meet all of the following conditions:

- Not a Japanese citizen.

- Contributed to either:

- National Pension (国民年金)

- Employees’ Pension Insurance (厚生年金保険)

- Paid premiums for at least 6 months.

- No longer have a residence in Japan (i.e., have left Japan permanently).

- Apply within 2 years of leaving Japan.

💡 Note: You are no longer eligible if you obtain permanent residency or Japanese citizenship.

Payment Amounts for Lump-Sum Withdrawal (脱退一時金の金額)

The refund amount depends on the total period of contributions. Below is an example of contributions to the National Pension (国民年金).

National Pension Refund Amount (2023):

| Contribution Period | Refund Amount |

|---|---|

| 6 to 11 months | ¥49,230 |

| 12 to 17 months | ¥98,460 |

| 18 to 23 months | ¥147,690 |

| 24 to 29 months | ¥196,920 |

| 30 to 35 months | ¥246,150 |

| 36 months or more | ¥295,380 (Max) |

Employees’ Pension Insurance Refund Amount (厚生年金保険):

For Employees’ Pension Insurance, the amount is based on the average monthly salary and standard remuneration. The refund calculation is more complex and varies by case. For exact figures, consult the Japan Pension Service.

💡 Note: A 20.42% income tax is deducted from the Lump-Sum Withdrawal Payment. However, you can apply for a tax refund by filing a Tax Representative (納税管理人) in Japan.

How Can Foreigners Apply for a Lump-Sum Payment?

Step-by-Step Application Process:

Prepare the Required Documents:

- Lump-Sum Withdrawal Application Form (脱退一時金請求書) → Download from the Japan Pension Service website.

- Pension Handbook (年金手帳) or Pension Number Notification (基礎年金番号通知書).

- Copy of your passport (showing the page with your date of departure from Japan).

- Copy of your bank account details (for international remittance).

- My Number (if applicable).

Submit the Application:

- Send the completed form and documents to:

Japan Pension Service

Lump-Sum Withdrawal Payment Office

〒168-8505

Tokyo, Suginami-ku, Kamiogi 3-5-24 - Applications must be submitted within 2 years of leaving Japan.

- Send the completed form and documents to:

Receive the Payment:

- The payment will be transferred to your designated overseas bank account in Japanese yen (JPY) if approved.

- Processing takes about 3–6 months.

💡 Tip: Appoint a Tax Representative (納税管理人) in Japan to claim a tax refund on the 20.42% withheld tax.

Essential Points to Consider (注意点)

- Once you claim the lump sum Withdrawal, your pension record in Japan is cleared.

- You will lose all future rights to Japanese pension benefits.

- If you return to Japan for long-term work, you must re-enroll in the pension system, and previous contributions cannot be restored.

- Some countries with a Social Security Agreement with Japan allow for pension periods to be combined. Check if this applies to your country.

Example Scenario

Case:

- Anna, a foreigner, worked in Japan for 3 years and was paid into the national pension.

- After returning to her home country, she applies for the Lump-Sum Withdrawal Payment.

Calculation:

- Anna’s refund is ¥295,380.

- 20.42% tax is deducted: ¥295,380 × 0.2042 = ¥60,311.

- Final amount received: ¥235,069.

🔔 Note: Anna can appoint a Tax Representative to reclaim part of the withheld tax.

Key Benefits of Social Insurance and Pension Systems

Japan’s Social Insurance and National Pension systems provide a comprehensive safety net designed to protect individuals from financial hardships caused by illness, injury, unemployment, disability, and retirement. Understanding these benefits is essential for making the most of Japan’s social security system.

Medical and Welfare Benefits of Social Insurance (社会保険の医療・福祉給付)

Social Insurance (社会保険) offers extensive health and welfare benefits, ensuring financial security during unexpected life events.

1. Health Insurance Benefits (健康保険の給付金)

Medical Expense Coverage (療養の給付):

- Covers 70% of medical costs for doctor visits, hospitalization, surgeries, and prescription medications.

- Patients pay only 30% of the total medical bill.

High-Cost Medical Expense Benefit (高額療養費):

- Caps out-of-pocket medical expenses. Costs exceeding the limit are reimbursed.

- Example: The excess may be refunded if hospitalization fees exceed ¥100,000.

Sickness and Injury Allowance (傷病手当金):

- Provides income support if you cannot work due to illness or injury.

- Pays two-thirds of your average daily wage for up to 1.5 years.

Maternity Allowance (出産手当金):

- Covers income during maternity leave.

- Paid for 42 days before and 56 days after childbirth.

2. Employees’ Pension Insurance Benefits (厚生年金保険の給付)

Old-Age Pension (老齢厚生年金):

- It provides a higher pension amount than the national pension due to salary-based contributions.

- Combines with the Basic Pension (老齢基礎年金) for more significant retirement income.

Disability Pension (障害厚生年金):

- Provides financial support if you become disabled due to illness or injury.

- Higher benefits than the National Pension due to earnings-based contributions.

Survivors’ Pension (遺族厚生年金):

- Provides financial support to spouses and children if the insured person dies.

Retirement and Disability Benefits from the National Pension (国民年金の老齢・障害給付)

The National Pension (国民年金) system guarantees a basic level of income for all residents in Japan during retirement or in case of disability.

1. Old-Age Basic Pension (老齢基礎年金):

- Available from the age of 65.

- Requires at least 10 years of contributions.

- Full payment amount (2023): ¥66,250/month (~¥795,000 annually).

- Payments can be delayed or claimed early (adjusted amount).

2. Disability Basic Pension (障害基礎年金):

- Provides financial support for individuals who become disabled due to illness or injury.

- Grade 1 Disability: ¥993,750/year

- Grade 2 Disability: ¥795,000/year

3. Survivors Basic Pension (遺族基礎年金):

- Supports the family of a deceased insured person.

- For spouses with children under 18 or disabled children.

- Payment example: ¥795,000/year + ¥228,700 per child.

Income Tax Exemption for Social Insurance and National Pension Contributions (保険料の所得控除)

Social Insurance and National Pension contributions are tax-deductible, reducing your taxable income and overall tax burden.

Social Insurance Premiums (社会保険料):

- Fully deductible from taxable income.

- Includes Health, Pension, Employment, and Long-Term Care Insurance.

National Pension Premiums (国民年金保険料):

- Also, it is fully deductible.

- Prepaid contributions are deductible for the year they were paid.

💡 Tip: You will receive a Social Insurance Premium Deduction Certificate (社会保険料控除証明書), which you must submit during year-end tax adjustments (年末調整) or final tax return (確定申告).

Conclusion

Understanding and properly managing your Social Insurance (社会保険) and National Pension (国民年金) in Japan is essential for securing your healthcare, financial stability, and future retirement benefits. These systems are designed to support Japanese citizens and foreign residents through various stages of life, including illness, injury, unemployment, retirement, and disability.

Key Takeaways for Managing Your Social Insurance and Pension in Japan

Enrollment is Mandatory:

- Full-time employees are automatically enrolled in Social Insurance by their employers.

- Self-employed individuals, freelancers, and part-time workers must enroll in the National Pension and National Health Insurance.

Understand Your Premiums:

- Social Insurance premiums are salary-based and shared by both the employee and employer.

- National Pension has a fixed premium, while National Health Insurance premiums vary by income and household size.

Payment Methods:

- Social Insurance is automatically deducted from your salary.

- National Pension and NHI premiums must be paid directly through bank transfer, convenience stores, or online payment systems.

Utilize Exemptions and Reductions:

- If you face financial hardship, apply for premium exemptions or reductions to maintain coverage.

Lump-Sum Withdrawal for Foreign Residents:

- Foreign residents leaving Japan permanently can apply for a Lump-Sum Withdrawal Payment to recover pension contributions partially.

Tax Benefits:

- Social Insurance and National Pension contributions are tax-deductible, reducing your taxable income.

Dependents Can Be Covered:

- Dependent spouses can receive pension benefits without paying premiums through the Category III system under Employees’ Pension Insurance.

FAQs

Can I pay both Social Insurance and National Pension at once?

Answer:

No, you cannot pay both at once because they are separate systems.

- Social Insurance premiums are automatically deducted from your monthly salary by your employer.

- National Pension premiums must be paid directly by individuals (freelancers, self-employed, part-time workers) via bank transfer, payment slips, or convenience stores.

How do freelancers manage their insurance payments in Japan?

Answer:

Freelancers and self-employed individuals must enroll in:

- National Pension (国民年金) for retirement benefits.

- National Health Insurance (国民健康保険) for healthcare coverage.

Premium payments can be made through:

- Bank transfer (口座振替)

- Convenience stores (コンビニ支払い)

- Credit card payment (クレジットカード払い) (in some municipalities)

- Advance payments for discounts

💡 Tip: If you have low income, you may qualify for exemptions or reductions.

What if I leave Japan before retirement?

Answer:

Foreign residents who leave Japan permanently can apply for a Lump-Sum Withdrawal Payment (脱退一時金) if they:

- Contributed to National Pension or Employees’ Pension Insurance for at least 6 months.

- Apply within 2 years of leaving Japan.

- Are not Japanese citizens or permanent residents.

🔔 Important:

Once claimed, you will lose all rights to future Japanese pension benefits.

4. What happens if I miss a National Pension payment?

Answer:

Missing payments can lead to:

- Loss of eligibility for Disability Basic Pension (障害基礎年金) and Survivors Basic Pension (遺族基礎年金).

- Reduced future pension benefits.

💡 Solutions:

- Apply for a payment exemption or reduction.

- Use the payment deferral system (猶予制度).

- Retroactively pay missed premiums to recover pension credits.

5. Can dependent spouses get pension coverage without paying premiums?

Answer:

Yes. If you are a dependent spouse of a full-time employee enrolled in Employees’ Pension Insurance (厚生年金保険), you qualify as a Category III Insured Person (第3号被保険者).

Conditions:

- Aged 20–59.

- Annual income below ¥1.3 million.

- Registered as a dependent by your spouse’s employer.

💡 Note: You will receive pension credits without making any payments.

6. Are National Pension premiums tax-deductible?

Answer:

Yes. Both Social Insurance premiums and National Pension premiums are fully tax-deductible.

- You will receive a Social Insurance Premium Deduction Certificate (社会保険料控除証明書), which you can use during year-end tax adjustment (年末調整) or final tax return (確定申告).

7. What is the difference between Social Insurance and National Health Insurance?

Answer:

| Aspect | Social Insurance (社会保険) | National Health Insurance (国民健康保険) |

|---|---|---|

| Eligibility | Full-time employees in companies with 5+ employees | Self-employed, freelancers, part-time workers |

| Enrollment | Employer handles enrollment | Must self-enroll at the local city office |

| Premium Calculation | Based on salary (shared with employer) | Based on household income and household size |

| Coverage | Health care, pension, unemployment, accident coverage | Mainly health care coverage |

8. How can I check if my employer is properly paying my Social Insurance premiums?

Answer:

- Check your monthly payslip (給与明細) to confirm Social Insurance deductions.

- Log in to the Japan Pension Service website to verify your pension payment record.

- Ask your employer for confirmation if you suspect unpaid contributions.

💡 Tip: Non-payment by employers can lead to the loss of future benefits, so regular checks are important.

9. Can I get a discount on National Pension payments?

Answer:

Yes. You can receive a discount by making advance payments (前納).

Discount options:

- 6-month advance: ~¥1,160 discount

- 1-year advance: ~¥4,270 discount

- 2-year advance: ~¥16,590 discount (via bank transfer only)

💡 Tip: Advance payments are also tax-deductible.