Tax Reform in 2021 in JTC Certificate

Content and Reason for Revision

The 2021 Tax Reform to the Consumption Tax Law tightened the document preservation requirements for export duty exemption for goods worth 200,000 yen or less. This revision’s background includes measures to prevent fraud and more reliably prove the fact of exports.

Revision details

The required documents for the certificate for export tax exemption differ depending on whether the postal items’ value is more than JPY200,000.

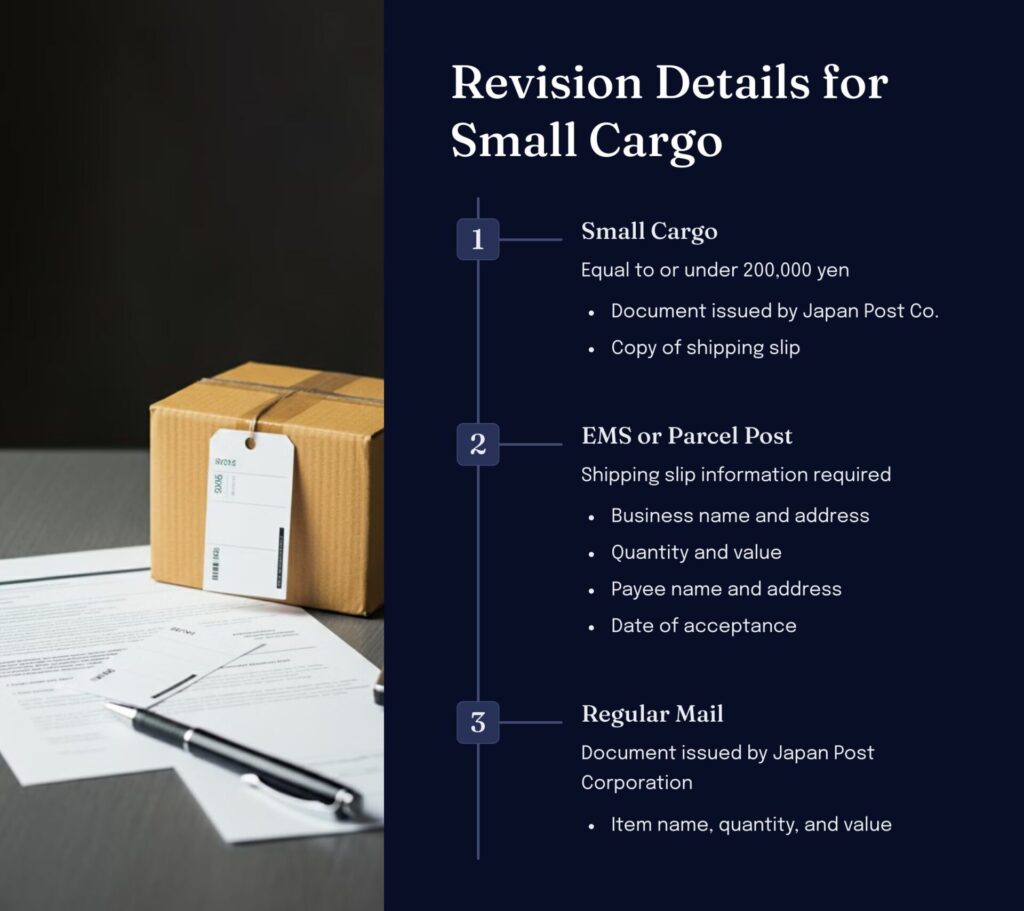

Small postal items equal to or under 200,000 yen

- For EMS or parcel post:

- A document issued by Japan Post Co. to certify acceptance of mail.

- A copy of the shipping slip or other documents (the following information must be included):

- The name and address of the business that exported the product.

- Quantity and value by name and description.

- The name and address of the payee.

- Date of acceptance by Japan Post Co.

- For regular mail:

- A document issued by Japan Post Corporation evidencing acceptance of the mail (with the item’s name and the quantity and value of each item appended).

Postal Items exceeding 200,000 yen

- Customs procedures are required, and an “Export License” must be preserved. Customs clearance procedures are not performed automatically when using a post office and must be entrusted separately at the post office counter.

Thus, since the required proof documents differ depending on the value of the cargo, it is essential to prepare the appropriate documents and proceed with the procedures to obtain export tax exemption.

What is Postal Items

Postal Items are those shipments handled by the Postal Service, such as Japan Post Office. So, if you use FedEx or DHL, they will issue export license documents, which can prove exports.

What are the price criteria?

The price standard is on a FOB basis.

The FOB price is considered the standard because it is required to be stated on the export license. Customs clearance fees are included, but overseas transportation fees are not.

Therefore, it is considered to be the base price of the unit.

Problems before the revision

Before the revision, the requirements are either of the following.

- To contain exporting data on the “ledger book.”

- To preserve certificates to prove the recipient’s received goods

Thus, there were cases of fraudulent applications for export tax exemption due to false ledger book entries. It is a relatively easy and arbitrary process to record in the books and document from the recipient.

For example, in the case of ledgers, it is easy to state that the goods are exports because the record are made by the person.

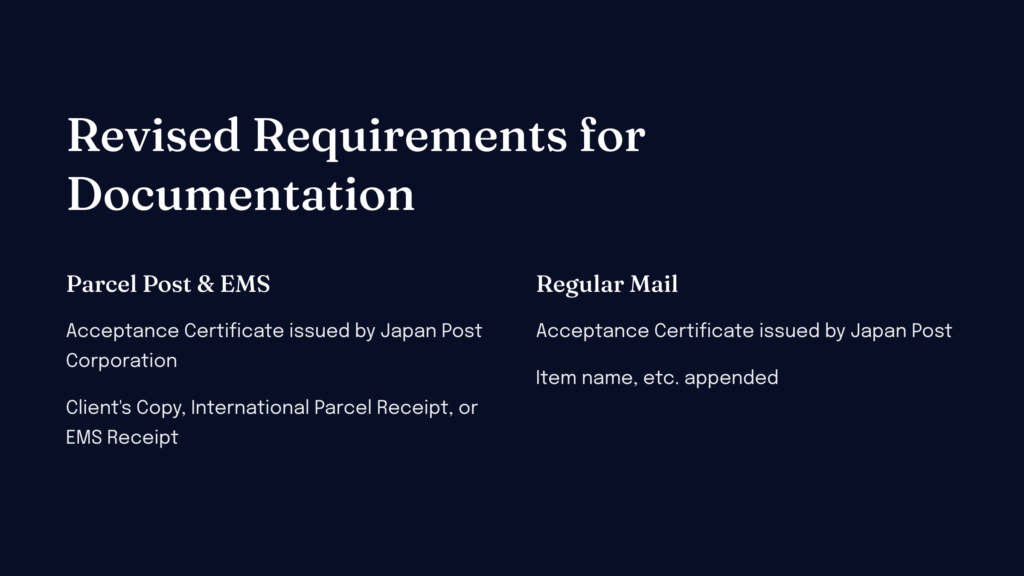

Revised Requirements

In the case of parcel post and EMS, in addition to the “Acceptance Certificate issued by Japan Post Corporation,” the “Client’s Copy,” “International Parcel Receipt,” or “EMS Receipt” must be preserved.

This amendment is a preventive measure against cases where the amount is less than 200,000 yen and is only entered on the books to make it appear as if it was exported.

Undervalue Issues

Undervalue is the fraudulent practice of declaring a lower price than the actual transaction price at the time of importation to reduce customs duties and consumption taxes. This method is sometimes used to reduce the importer’s tax burden, but it is against the law and is subject to heavy penalties if discovered.

Although not directly related to the Consumption Tax Law, it is possible to speculate that the amendment may be made in connection with the Customs Law and other laws.

Can FedEx or DHL Prove Export?

Yes, even if you use FedEx or DHL, you can still provide proof of an export license. You can prove the items for exports using the export certificates they issue. If you keep these documents in good order and record them in your books, you can receive an export tax exemption for Japanese consumption tax.

Be aware of the requirements for export duty exemption | EMS JCT Refund

The requirements for tax exemption are strict.

If it does not follow the established practice, the purchase tax credit will not be allowed. The investigation will also be rigorously checked. Please be careful.

Keywords

EMS JCT Refund