Consumption tax refunds, such as those facilitated by VAT BACK services, offer significant financial relief to businesses but also come under scrutiny by tax authorities. In this article, I’ll explore the refund system, its risks, and why following correct procedures is essential. I draw insights from the recent press conference by the newly appointed Tokyo Commissioner, Kazuhiko Hoshiya.

VAT BACK Easy to Claim, But Targeted by Authorities: Why Consumption Tax Refunds Require Caution

The consumption tax refund system, often supported by VAT BACK services for businesses dealing with cross-border transactions, allows companies to reclaim the difference between the tax they pay on purchases and the tax they collect on sales. This is especially common for export businesses, where the tax on overseas sales is zero, often resulting in refunds. However, this process also targets businesses for audits and investigations, as tax authorities are looking for system abuse.

In a recent press conference, the new Tokyo Commissioner, Kazuhiko Hoshiya, emphasized the tax authorities’ strict approach toward fraudulent refunds. He referred to tax evasion through fraudulent refunds as “a highly malicious act that seeks to defraud the public treasury,” stating that the Bureau will continue to investigate suspicious transactions thoroughly in cooperation with related agencies.

New Commissioner’s Approach: Stricter Oversight on Fraudulent Refunds | VAT BACK

Kazuhiko Hoshiya, who assumed his position as Tokyo Commissioner in July 2024, expressed his vision to continually update the Bureau’s operations and policies to stay ahead of fraudulent activities. Hoshiya, a University of Tokyo’s Faculty of Law graduate, highlighted the importance of fair taxation and underscored that the Bureau will take firm action to prevent tax avoidance and fraudulent refund claims.

This heightened scrutiny applies to all businesses seeking consumption tax refunds, including those using VAT BACK services for international transactions. As fraudulent refund claims become a growing concern, companies must be aware that tax authorities are more vigilant than ever.

Why Expert Guidance and Documentation Are Key to Successful Refunds

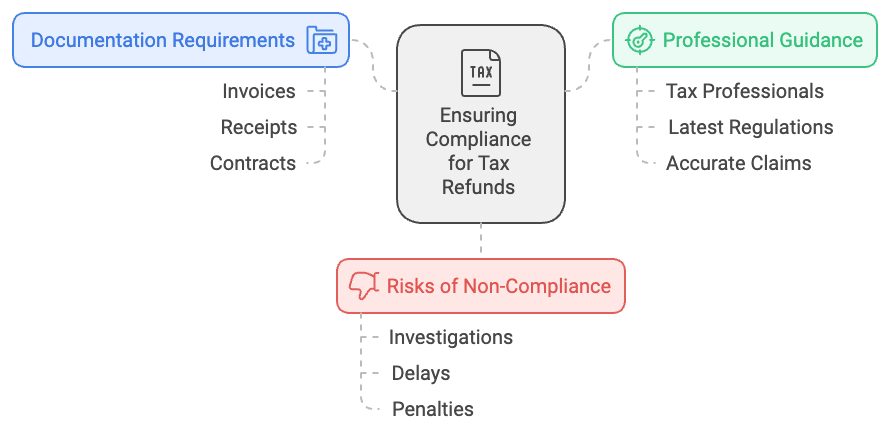

Given the increasing focus on preventing fraudulent tax refunds, businesses must diligently maintain proper documentation and engage professionals, including VAT BACK experts, to ensure compliance. Without appropriate records—such as invoices, receipts, and contracts—a refund claim can quickly be flagged for investigation, leading to delays or even penalties.

It’s highly recommended to involve tax professionals who are well-versed in the latest regulations. They can help ensure your claims are accurate, legitimate, and compliant, reducing the risk of attracting unwanted attention from the tax authorities.

Conclusion: Stay Compliant and Avoid Penalties

While the consumption tax refund system, including services like VAT BACK, is designed to benefit businesses, especially those involved in export activities, it can also put them at risk of audits if not appropriately managed. As highlighted in the Tokyo Commissioner’s recent press conference, fraudulent claims are under strict scrutiny, and businesses must ensure they follow the correct procedures.

By maintaining accurate documentation and seeking professional advice, you can maximize the benefits of the consumption tax refund system without falling foul of the authorities.

Keyword

VAT BACK