What Is a Work-Prohibited Visa? Why Is Employment Restricted?

A work-prohibited visa is a status of residence that does not permit work in Japan. This includes tourist visas and temporary visitor visas. These visas prohibit work activities in Japan.

In Japan, residence status is granted based on the type of activity a foreigner will engage in. This allows for proper management of the foreign national’s residency and clarifies the scope of their activities in Japan. This management ensures foreign nationals do not work illegally in Japan. Why is it necessary to take measures to prevent illegal employment?

Employment Protection in Japan and Working Prohibited Visa

The purpose of setting work restrictions is to protect Japan’s labor market and ensure employment opportunities for Japanese nationals. If foreigners are allowed to work without restrictions, more companies will hire foreigners at lower wages, increasing competition with Japanese workers and possibly worsening working conditions.

Also, for non-Japanese who have already entered the country through proper procedures, illegal employment deprives them of work opportunities.

Labor Market Stability

The acceptance of large numbers of foreign workers, especially in simple labor, may affect the domestic labor market. Therefore, Japan promotes the acceptance of highly skilled personnel with specialized skills and restricts simple labor.

For these reasons, Japan has established work restrictions for foreigners, and the law strictly enforces illegal employment. When employing a foreigner, companies must confirm the appropriate residence status and be careful not to be accused of facilitating illegal employment.

What visas allow you to work?

Several types of visas enable non-Japanese to work in Japan. Below are the main types of work visas.

Main types of work visas

- Technical/Humanities/International Services: This visa is for technicians or office workers and requires that your education and work experience be related to your job description.

- Specified Technical Skills: These visas are for working in specific industrial fields where there is a shortage of workers. There are two types of visas: “Specified Technical Skills 1” and “Specified Technical Skills 2.”

- Specified Technical Skill No. 1

- Fields covered: Specified Skills 1 is recognized in 12 specified industrial fields, including nursing care, construction, and manufacturing.

- Requirements: You must pass a specific skills evaluation test and the Japanese Language Proficiency Test (equivalent to JLPT N4). It is also possible to obtain this certification if you have completed Technical Internship No. 2.

- Period of stay: The maximum stay is five years, renewable for one year, six months, or every four months. However, bringing family members is not permitted.

- Specified Technical Skills II

- Fields of work: Specified Technical Skills II are available in 11 fields, excluding nursing care, and are intended for foreign nationals engaged in work requiring advanced skills.

- Requirements: Foreigners are required to have more advanced technical skills and work experience, which they can acquire by passing an examination.

- Period of stay: There is no upper limit to the period of stay and no limit to the number of renewals. Spouses and children are allowed to accompany the foreigner, making long-term employment possible.

- Specified Technical Skill No. 1

- Technical internship visa: This visa is for working as a trainee to acquire skills.

- Nursing care: This visa is for working in the nursing care field.

- Intra-company transfer: This visa is required to transfer from a foreign company to a Japanese-affiliated company.

- Management: This visa is required to establish a company in Japan and work in a management or managerial position.

- Entertainer: This visa is for performers, actors, singers, athletes, etc.

- Professor: This visa is for teaching at a university or other institution of higher education.

In addition to these, there are work visas for specific occupations such as “legal and accounting services,” “medical care,” “research,” and “education.” If you have a status of residence such as “Permanent Resident” or “Spouse or Child of Japanese National,” you can work regardless of the type of occupation.

What are the problems with working on a work-prohibited visa?

There are several severe problems with working on a work-prohibited visa. The main issues are described below.

Legal Risks

Illegal Work: Working with a work-prohibited visa is considered “illegal work,” violating Japan’s Immigration Law. Illegal work is defined as work in Japan by a foreigner who is not qualified.

Facilitating Illegal Work: Not only the foreign national who works illegally but also the company or individual who employs the foreign national may be charged with “facilitating illegal work. This crime applies to using a foreigner not qualified to work or facilitating illegal employment.

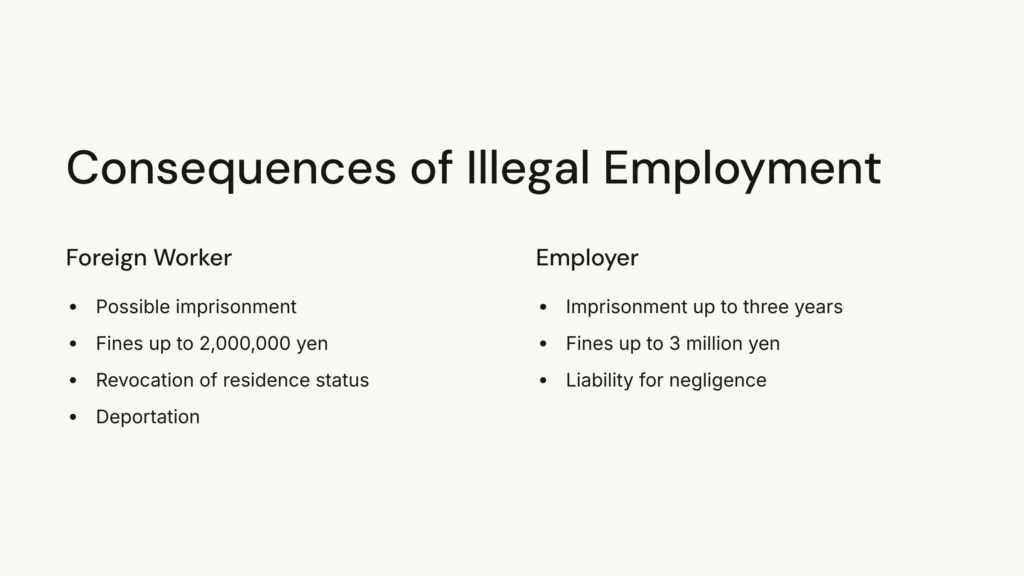

Penalties and Penalties

Penalties for foreign nationals: Foreign nationals who work illegally may be imprisoned for up to one year or fined up to 2,000,000 yen. In addition, the alien’s residence status may be revoked, or he/she may be deported.

Penalties for companies: Companies and employers found guilty of encouraging illegal employment may be imprisoned for up to three years or fined up to 3 million yen. This includes cases of unintentional negligence.

Other Impacts

- Impact on future residence status: If a foreigner is found working illegally, obtaining a residence status to work legally in Japan may be challenging.

These risks and penalties indicate that Japanese law strictly enforces illegal employment. Therefore, when hiring a foreign national, it is essential to ensure that he/she has the appropriate residence status and that his/her activities are within the scope of that status.

Does it generate income tax? Examined from a legal perspective

This section explains explicitly how to work on a work-prohibited visa and whether or not income tax is incurred.

Legal position

In Japan, income tax is imposed on income generated, regardless of whether the income is legal or not, by the Income Tax Law. Therefore, income earned on a work visa may be subject to income tax. This is based on the principle that if you work in Japan and earn a salary, you are subject to the same taxes as a Japanese national, even if you are a foreigner.

Distinction between residents and non-residents

The scope of income taxation depends on whether the foreign national is a “resident” or a “non-resident.” Residents are taxed on income earned in Japan and abroad(it depends on whether you’re a permanent or non-permanent resident), while non-residents are taxed only on income earned in Japan.

Could it be tax evasion? Tax Office Responses and Risks

Failure to pay income tax may be tax evasion if you work on a work-prohibited visa. Below is an explanation of the risks of tax evasion and how the tax office handles it.

Risk of Tax Evasion

Criminal Penalties: If tax evasion is discovered, a penalty of up to 10 years in prison or a fine of up to 10 million yen, or both, may be imposed. This applies to intentional fraud or failure to file a tax return.

Additional tax: If an underreporting or no-reporting of income is discovered, an additional tax for underreporting or no-reporting is imposed. These taxes are usually in addition to the taxes that should have been paid, and in the case of a heavy additional tax, the rate is exceptionally high.

Delinquent Taxes: Delinquent taxes are imposed on unpaid tax amounts that are past due. This increases over time and adds to the financial burden.

Tax Office Response

Tax Investigations: The tax office may conduct periodic audits to detect fraud and undeclared tax evasion. If the investigation results in suspicion of tax evasion, the case may be moved to a more severe “criminal investigation.” This investigation may involve coercive means (search and seizure).

Prosecution and prosecution: If a criminal investigation confirms tax evasion, charges will be filed with the public prosecutor, and the case will be treated as criminal.

Summary

Thus, failure to properly pay taxes on income earned under a work-prohibited visa risks heavy financial penalties. Complying with the law and working with the appropriate visa status is essential.