Here is a summary of tax-saving measures for self-employed individuals from the viewpoints of the tax accountant for self-employed. Please review these measures to confirm your potential tax savings.

- Apply the Special Deduction for Blue Returns | The tax accountant self-employed

- Distribution for Office Rent, Communications, and Utilities.

- Vehicles Cost Distribution

- Less than 300,000 yen Fixed assets

- Increase expenses with short-term prepaid expenses

- You can add the Taxes to your costs

- Using Safety Mutual Aid

Small Business Mutual Aid- Income Tax Deduction

- Furusato Nozei Credit

- Mortgage deduction or interest on loans expensed

- Expense the cost of a consultation with an expert

- Expensing Entertainment Expenses

- Expenses for seminars and books

- Carry forward income losses

- Spouse Deduction | tax accountant self-employed

Apply the Special Deduction for Blue Returns | The tax accountant self-employed

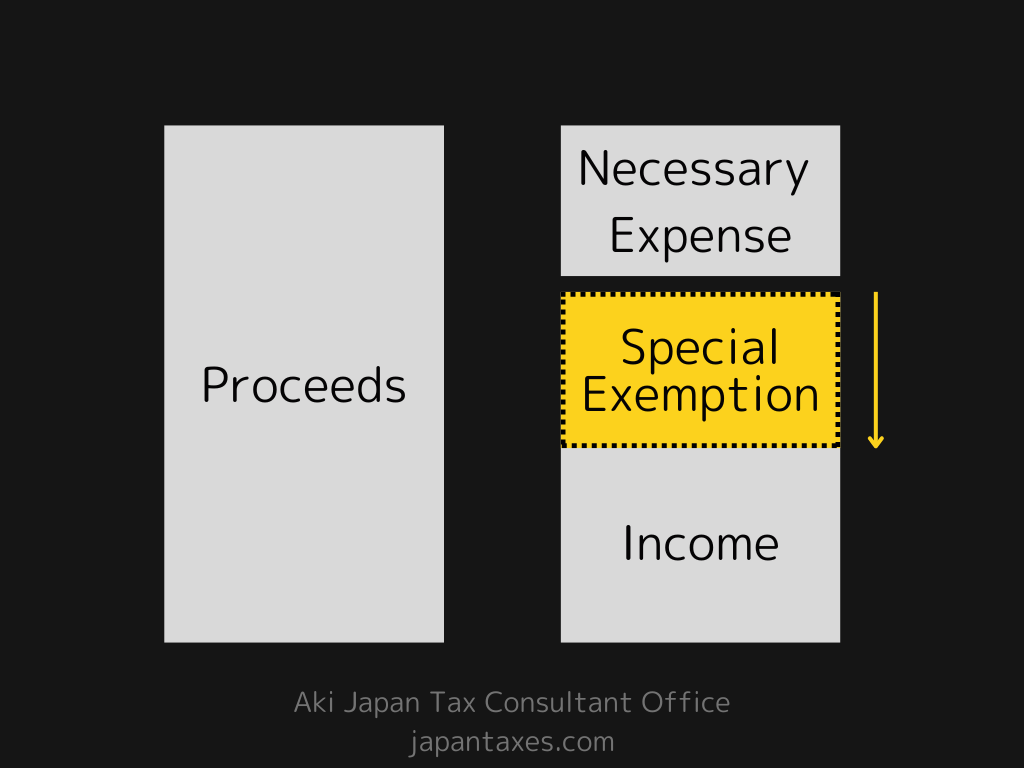

The special exemption for blue returns is a system that allows sole proprietors or self-employed who file income tax returns as blue returns to deduct a certain amount from their taxable income. If you apply for this exemption, your taxable income will be lowered, reducing income tax. This means you can minimize resident tax and national health insurance.

If you apply for the special exemption for blue returns, you can reduce your taxable income. The maximum amount of the special exemption is JPY650,000. Still, the amount that can be applied varies from 650,000 yen, 550,000 yen, and 100,000 yen, depending on the bookkeeping and filing methods: sending electronically through e-Tax and sending it by mail.

https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/2072.htm

Conditions to apply for the special exemption for blue returns

Conditions for JPY650,000 exemption

- Having business income or business scale real estate income

- Double-entry bookkeeping for recording transactions related to the sales of the 1 above.

- File an income tax return with the financial statements for blue returns (balance sheet and profit and loss statement) created based on the 2 above.

- File tax returns on time.

- Has not chosen the special exception for calculating income on a cash basis

- Filing tax returns via eTax or preparing and storing journal entries and general ledgers is considered “high-quality electric bookkeeping,” as defined by the Electronic Bookkeeping Act.

Distribution for Office Rent, Communications, and Utilities.

Many sole proprietors use a room in their home as a workspace or the first floor as a store for personal and business use. In such cases, you can record a certain amount as business expenses. You must distribute a certain cost for business activities.

There are no clear rules on how to distribute. However, it is generally based on the used area, the number of work hours, the number of days, and the number of hours used. There is no “must be this way” or “this is the right way” standard for a distribution.

It is important to provide a reasonable explanation when the tax office asks.

Vehicles Cost Distribution

If you use your car only for business purposes, you may include the cost of the car in your expenses. Business use” includes, for example, the following cases

- Use your car to attend a business meeting or a client’s office.

- Commuting to work

On the other hand, a car used only for private purposes cannot be posted as an expense. This technique can be used when the car is used for business.

Or you may consider whether you can distribute the vehicle costs for your business.

Less than 300,000 yen Fixed assets

Sole proprietors filing a blue tax return(Aoiro Shinkoku[青色申告]) can add your cost of assets, such as depreciable assets less than 300,000 yen per unit (or per set) at once in the year.

Those who file a white tax return(Shiroiro Shinkoku[白色申告]) without blue tax return approval can put an asset of less than 100,000 yen at once.

You can easily imagine you buy a computer, a desk/chair, a multifunction copying machine, a smartphone, and so on. You can use it for these items.

Increase expenses with short-term prepaid expenses

In principle, you must record prepaid expenses on your debit side and change your cost separately for a period. However, the “Special Exception for Short-Term Prepaid Expenses” allows you to add prepaid unrealized expenditures to your cost.

For example, consider a case where a year’s worth of premiums (July 2024 to June 2025) is paid in July 2024.

In principle, you can expense only the premiums for the six months from July to December on the tax return for January to December 2024, and the premiums from January 2025 to June 2025 should be recorded as assets as prepaid expenses.

If you can meet the condition, you can expense the entire amount of premiums paid in July 2024. The tax office’s notification is as follows.

Basic Income Tax Notification 37-30-2 Short-term prepaid expenses

Prepaid expenses (which means expenses paid for the continuous provision of services based on a certain contract, which corresponds to services that have not yet been provided as of December 31 of the year. The same shall apply hereinafter in this paragraph) However, if the person has paid the number of prepaid expenses for services to be provided within one year from the date of such payment. The person has continuously included the amount equivalent to the amount of such payment in the necessary expenses for the year that includes the date of such payment; such amount shall be allowed.

You can add the Taxes to your costs

Business tax and property tax can be included in your business cost. Automobile tax, real estate acquisition tax, stamp tax, and consumption tax are also treated as your business costs. However, income tax, inheritance tax, resident tax, and traffic fines cannot be included in taxes and dues as expenses.

A sole proprietor who owns a home and conducts business from that home may include property tax only for a reasonable percentage of the gross floor area, such as the percentage of the area used for the business to the gross floor area.

Using Safety Mutual Aid

The Management Safety Mutual Aid (SME Bankruptcy Prevention Mutual Aid Program) prevents SMEs from experiencing a chain reaction of bankruptcies or financial difficulties in the event of a business partner’s bankruptcy.

Unsecured and unguaranteed, the scheme allows you to borrow up to 10 times the premiums (up to 80 million yen) and include the premiums in your business costs. In addition, prepaid premiums paid in advance for one year or less may be included in your business cost.

Please note that as a sole proprietor, you can add the cost to your business income but not others, such as real estate income.

Small Business Mutual Aid

The mutual aid system is a retirement benefit system for business owners prepared by the government. It allows small business owners to set aside funds in advance to stabilize their livelihood and rebuild their businesses in preparation for retirement or business closure.

You can put all the premiums paid at your costs when calculating your income.

The mutual aid system is open to business owners who fall into one of the following categories

Who can use it?

- Sole proprietors or company executives with 20 or fewer full-time employees in the construction, manufacturing, transportation, real estate, agriculture, and service (limited to lodging and entertainment) industries.

- Sole proprietors or company officers with 5 or fewer full-time employees if they operate a commercial (wholesale/retail) or service (excluding lodging and entertainment) business.

- An officer of a business association with 20 or fewer members engaged in business or an officer of a cooperative association with 20 or fewer full-time employees.

- Officers of an agricultural cooperative corporation with 20 or fewer full-time employees who are mainly engaged in agriculture management.

- A member of a professional corporation such as a lawyer corporation or a certified tax accountant corporation that always employs 5 or fewer employees.

- Joint proprietors (up to two per proprietor) manage a business operated by a sole proprietor who falls under 1 or 2 above.

Income Tax Deduction

You can deduct certain costs from your income when calculating your income tax. Some overlap with those already introduced, but here is a list.

| Deductions | Contents | Quota |

|---|---|---|

| Miscellaneous Losses Deduction | Applies to damage caused by disaster, theft, or embezzlement. | Whichever of the following is greater (Losses) – (Gross income, etc.) x 10% (Amount of disaster-related expenditures out of the net loss)-50,000 yen |

| Medical Expenses Deduction | Applies when medical expenses above a certain amount are paid. *Spouses and other relatives who share the same livelihood are also included. | (Medical expenses paid – amount covered by insurance or other means)-100,000 yen *If your income for the year is less than 2,000,000 yen, the amount of your income x 5%. |

| Social Insurance Premium Deduction | This applies when social insurance premiums such as health and national pension premiums are paid. *Spouses and other relatives who share the same livelihood are also included. | Total premiums paid |

| Small Business Mutual Aid Deduction | Applies when premiums are paid for small-scale enterprise mutual aid | Total premiums paid |

| Life Insurance premium Deduction | Applies to life insurance, long-term care medical insurance, and individual annuities for which premiums have been paid. | Amount calculated by a certain method (Maximum 120,000 yen) |

| Earthquake insurance premiums Deduction | Applies to earthquake insurance premiums paid | Amount calculated by a certain method (Maximum 50,000 yen) |

| Donation Deduction | Applies to donations made to Home town as Furusato Nozei and certified non-profit organizations, etc. | – Total amount of donated – expenditures and Income x 40% Whichever is less – 2,000 yen |

| Disabled Person Deduction | Applies to taxpayers, deductible spouses, and dependents who are disabled. | Per person, – Persons with disabilities: 270,000 yen – Special disabled 400,000 yen – 750,000 yen for special disabled persons living together |

| Widow(er) Deduction | Applies to widows who do not qualify as “single parents” as of December 31 of that year. The widow(er) exemption will be replaced by the single-parent exemption beginning with the 2020 tax year. | 270,000 yen |

| Single Parent Deduction | Applicable when the taxpayer is a single parent. *The single-parent deduction is effective from the 2020 income tax year. | 350,000 yen |

| Working Student Deduction | Applicable if you are working while going to school. However, total income must be less than 750,000 yen. | 270,000 yen |

| Spouse Deduction | Applicable when the spouse’s total income is 480,000 yen or less (In the case of salary only, salary income is less than 1,030,000 yen) | – Spouse eligible for the general exemption: up to 380,000 yen – Spouses eligible for senior citizen’s exemption can receive up to 480,000 yen (Spouse eligible for the exemption whose age is 70 years old and over) |

| Spouse Special Deduction | Applicable when the taxpayer’s total income is 10 million yen or less, and the spouse’s total income is between 480,000 yen and 1,330,000 yen. | Applies to dependent children, parents, etc., 16 years or older. |

| Dependent deduction | Applies to dependent children, parents, etc., 16 years of age or older. | Up to 480,000 yen, depending on the amount of income |

| Basic Deduction | Applies to all | Up to 480,000 yen depending on the amount of income |

Furusato Nozei Credit

Furusato Nozei credit is a donation credit that allows you to deduct the donation amount from your tax income from your favorite municipalities.

In exchange for the donation, you can receive a credit for the resident tax of the municipality where you live and a credit for your income tax from the tax office.

By receiving credits, the actual cost will be 2,000 yen.

On top of that, you can receive returned goods such as food and home appliances.

As a result, you can receive the returned goods almost free of charge.

Mortgage deduction or interest on loans expensed

The housing loan deduction, correctly called the “special deduction for housing loans, etc.,” is a system under which 0.7% of the outstanding balance of the annual housing loan can be deducted from income tax for up to 13 years when a house is newly built, acquired, expanded, or reconstructed with a housing loan. If the deduction is not fully deducted from income tax, it will be deducted from the following year’s inhabitant tax.

As a home acquisition promotion policy, it helps to save tax. If you acquire a house, you must use this system.

On the other hand, mere borrowing can be divided into two types of cases: one is for private use to cover temporary living expenses, and the other is to finance capital investment or open a business for business use. This interest portion can be expensed.

Assuming that the mortgage deduction is not applied because of the duplicate deduction issue, the office portion can be expensed in the case of a home and office.

Expense the cost of a consultation with an expert

Tax attorney fees are eligible expenses as long as they are incurred from work related to the business. Expenses for services rendered by a tax accountant, such as daily bookkeeping, tax returns, and financial statement preparation, may also be recorded as expenses.

When treating tax accountant fees as expenses, the contract form and payment method are not affected. Whether it is an advisory contract for monthly consulting fees or a spot contract for temporary tax return filing services, as long as it is related to your business, it can be recorded as an expense.

There is often a withholding tax, so remember to withhold it. Please note that consulting fees cannot be subtracted from the inheritance in inheritance-related matters.

Expensing Entertainment Expenses

Entertainment expense is an account item for expenses incurred in entertaining people related to their business. For example, expenses incurred when entertaining customers, clients, suppliers, etc., are treated as entertainment expenses. Gifts are also generally treated as entertainment expenses if given to people related to the business. When you invite your clients to dinner or give them seasonal gifts, the expenses can be recorded as entertainment.

Note that expenses for dinner parties with people unrelated to the business (which, in principle, are not considered expenses) and personal gifts of mid-year and year-end gifts are not included. It should be noted that entertainment expenses are close to welfare expenses and advertising expenses.

Expenses for seminars and books

Books purchased can be recorded as expenses as long as they are related to the business. Generally, journal entries should be made for such items as “Newspaper book expenses,” “Training expenses,” and “Miscellaneous expenses. However, when creating journal entries for miscellaneous expenses, the book purchases should be limited to infrequent occasions and in small amounts.

Seminars can be included in expenses in the same way. These are training expenses. Do not include anything unrelated to the business.

Be sure to explain the relevance properly. For example, consider the cost of manga. A cartoonist may include the cost of manga in his expenses, assuming he can explain that he purchased the manga as a resource for writing his manga.

By this logic, if a sole proprietor purchases manga for his inspiration, it should be an expense. However, this needs to be explained properly.

For example, a tax inspector says

What is the difference between the comics you buy for expenses and those you buy as a hobby, and do you keep track of which comics you buy separately?

Can you separate them when asked like this? This is what we mean by being able to explain.

Carry forward income losses

One advantage of filing a blue tax return is the loss carried forward system. This system allows you to balance a deficit for up to three years and deduct it from income in the following year or later.

It is necessary to report losses when filing a tax return to carry forward losses. In addition, if you choose a white tax return, you cannot file the losses. In the case of a blue tax return and you have “business income”, “real estate income”, “forestry income”, or “transfer income”, you can report and carry forward the losses.

Spouse Deduction | tax accountant self-employed

A taxpayer with a spouse is eligible for a deduction under the Income Tax Law. It’s called This is called the spouse deduction.

For sole proprietors, it must be properly separated from the special deduction for blue full-time employees.

Conditions for the Spouse

A spouse eligible for the deduction needs to meet all of the following four requirements as of December 31 of the current year.

Please note that the spouse deduction is not available for taxpayers whose total income exceeds 10 million yen for the tax year 2008 and thereafter.

(1) Spouse according to the provisions of the Civil Code (this does not apply to persons in common-law relationships).

(2) Sharing living expenses

(3) Annual total income must be less than 480,000 yen (less than 380,000 yen before 2019). (An employee’s salary income must be less than 1,030,000 yen.)

(4) The applicant must not have received any salary throughout the year as a full-time employee in a blue-filer or a white-filer business.

Keywords

tax accountant self-employed