Information Through the Online Workplace Pension Information Service

You can receive the following social insurance information online. This service began in 2023.

If you use a virtual office, you can reduce the amount of paper you receive. Be sure to sign up. It will help reduce costs for the government, but it should also lead to cost savings for recipients.

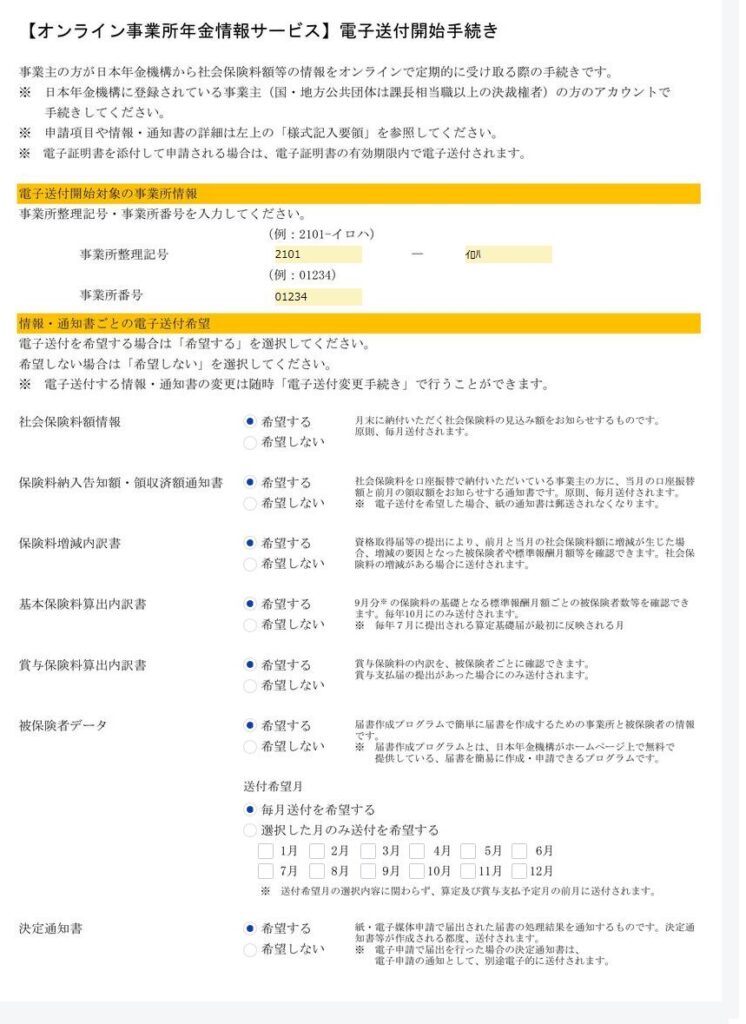

You can receive the following items. If it’s just information, online is sufficient.

- Social Insurance Premium Amount Information

- Premium Adjustment Statement

- Basic Insurance Premium Calculation Breakdown Statement

- Bonus Insurance Premium Calculation Breakdown Statement

- Insured Person Data

- Decision Notices

- Notice of Premium Payment Amount and Amount Received

Things that can be understood concretely

Let’s take a look at the specific details.

Social Insurance Premium Amount Information

- Estimated monthly social insurance premiums

- Delivery Notification (sent monthly)

Premium Adjustment Statement

- Monthly Premium Adjustment Form (for months with premium increases/decreases only)

Basic Insurance Premium Calculation Breakdown Statement

- Number of insured persons by standard monthly remuneration level for September premiums (annually in October)

Bonus Insurance Premium Calculation Breakdown Statement

- Notice of Bonus Insurance Premiums per Insured Person (Month in Which Bonus Payment Report Was Submitted)

Insured Person Data

- Data such as the insured person’s name and date of birth (used when creating CSV files for electronic applications via the notification form creation program)

Decision Notices

- Notification of Decision for Notifications Submitted by Means Other Than Electronic Application

Notice of Premium Payment Amount and Amount Received

- Notice of Direct Debit Amount (Monthly mailings will be discontinued)

How to Apply

The application process is as follows.

It’s not that difficult.

Let’s go over it.

Flow Overview

- Obtain a g-Biz ID

- Create a G-Biz ID for the (a) Director(s).

- Log in to your e-Gov My Page

- Log in to your e-Gov My Page using the account you created.

- Application for Use

- By submitting your application to start, you can receive electronic data on a regular basis.

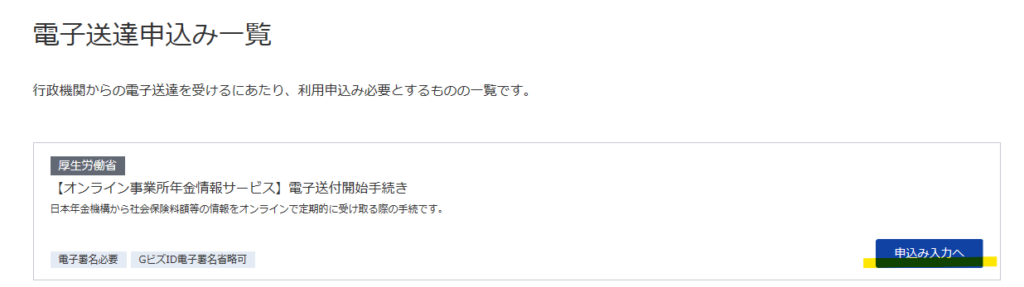

You can apply from this URL.

When you need something for your business, make sure to distinguish it from anything created for personal use clearly.

Important Notes When Applying for Electronic Delivery

Points to note when making it.

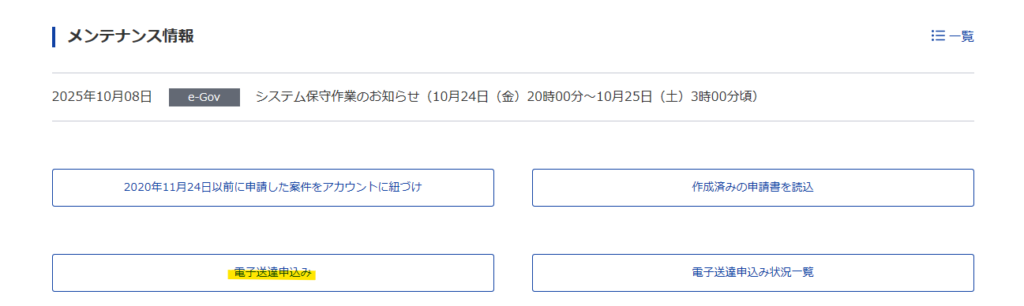

After logging in to e-GOV, apply for electronic delivery at the “電子送達申し込み” button.

When entering the business establishment code(事業所整理記号) on the user page, use “41 + your assigned number”. This must be entered as a 4-digit number. As this may vary by region, please verify the code.

Katakana must be entered in full-width characters.

Finally, let’s submit it at the “提出” button.

Be sure to print out your application details (PDF). After submission, you will find a “Download Application Copy(申請書控えダウンロード)” option on the screen.

Let’s make good use of it.