The rules for including entertainment expenses in deductible expenses will be updated effective April 2024 in Japan. Many business owners are concerned about this provision. As a tax accountant, I am examining where the system should be used and its impact. I want to share my views on interpreting the new provisions and how to use them.

Description and Impact of Amendments

What has changed?

The criteria for determining entertainment expenses will be changed from 5,000 yen to 10,000 yen. The change will apply from April 1, 2024, to March 31, 2027.

Cabinet decision “Outline of Tax Reform for the Year 6 of the Reward” Reward and December 22, 2024 (finalized on May 11, 2024)。Revision details

(4) The following measures will be taken regarding the system of non-deductibility of entertainment expenses, etc.: The deadline for application will be extended by three years.

- Amount of particular food and beverage expenses excluded from the scope of non-deductible entertainment expenses, etc. The standard will be raised to 10,000 yen or less per person (current: 5,000 yen or less).

- Extension of the period of application of the special provisions for inclusion in deductible expenses for food and beverages for business entertainment and the special provisions for inclusion in deductible expenses for small and medium-sized corporations. The term of application will be extended for three years.

(Note) The revision in (1) above shall apply to food and beverage expenses paid on and after April 1, 2024.

Entertainment expenses were strictly considered for tax determination purposes. This discouraged people from spending on their luxuries to reduce taxes. Nowadays, there may be a viewpoint that one is spending money for society to turn the economy around. However, entertainment expenses were and continue to be strictly taxed at that time.

We are told that the reason for raising this quota is to accommodate the recent price increases after Corona.

People affected

Freelancer

For individuals, even entertainment expenses could be deducted from business income as necessary expenses if they are business-related. Although the impact is not that great, if the expense is classified as entertainment, it tends to be checked more strictly.

The fact that the 10,000 yen judgment can be included in the conference fee is a relaxation.

One-person president, small and medium-sized corporations

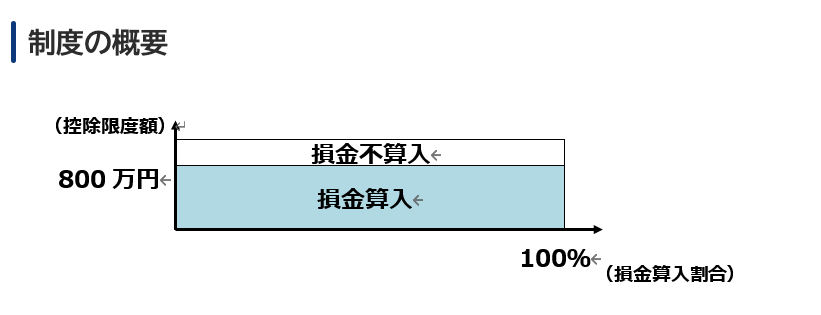

Small and medium-sized corporations can choose between (1) full deductibility of entertainment expenses, etc., up to 8 million yen, and (2) 50% deductibility of entertainment expenses and food and beverage expenses. The following illustration is an illustration.

My impression is that there are not that many companies that use 8,000,000 yen as a tax-deductible expense. Therefore, increasing the amount that can be included in meeting expenses is highly significant compared to entertainment expenses.

Large corporation

The company has capital in excess of 100 million yen. In principle, entertainment expenses are not deductible. However, 50% of entertainment expenses can be applied to deductible expenses for corporations other than small and medium-sized corporations (limited to corporations with capital, etc., of 10 billion yen or less as of the last day of the fiscal year).

The impact could be that the threshold for using internal expenses would be raised to 10,000 yen instead of 5,000 yen.

It is also mitigation and can be a reason to allow employees to spend that much.

Where can I use it?

As stated above, this amendment will allow us to limit the money we can spend on meeting expenses.

For example, in Tokyo, a fancy lunch with a business partner may cost more than 5,000 yen, which may be more than you would spend if you were going alone but maybe more than you would spend if you were going with a business partner to fix a problem while having a little chat. These items can now be included in the meeting expenses instead of entertainment expenses.

Recommendations as a tax advisor

In my experience, the most significant advantage of the new rule is that it expands the scope of use of the expense as a meeting expense. By recording entertainment expenses as meeting expenses, the scope of deductibility of such costs is expanded.

The accounting staff or a single president who is well versed in accounting must rigorously examine the ¥5,000 judgment for entertainment expenses.

This revision will substantially reduce the tax burden.

Notes on description

A clear distinction must be made between entertainment and meeting expenses, and this provision must be preserved in a document stating the following.

Recording of entertainment expenses

- Date of eating/drinking, etc.

- Names of customers, suppliers, and other parties related to the business who participated in the food and beverage, etc., and their relationship to the food and drink, etc.

- Number of persons who participated in eating, drinking, etc.

- The amount of expenses incurred for the food and beverage, etc., the name and address of the restaurant, etc. (If the name or address is not clear because the restaurant does not exist, the name and address of the payee as shown on the receipt, etc.)

- Other items necessary to clarify that the expenses are for food and beverages, etc.

In Summary.

The new entertainment expense deductibility rules are intended to broaden the window in which entertainment expenses can be determined as meetings rather than entertainment expenses.

Properly understood and utilized, it can be expanded as a meeting expense and reduce the tax burden. Let’s ensure that the changes are correctly understood and that they are helpful financially and in terms of employee benefits.