Are Tax Rates in Japan Higher Compared to Other Countries?

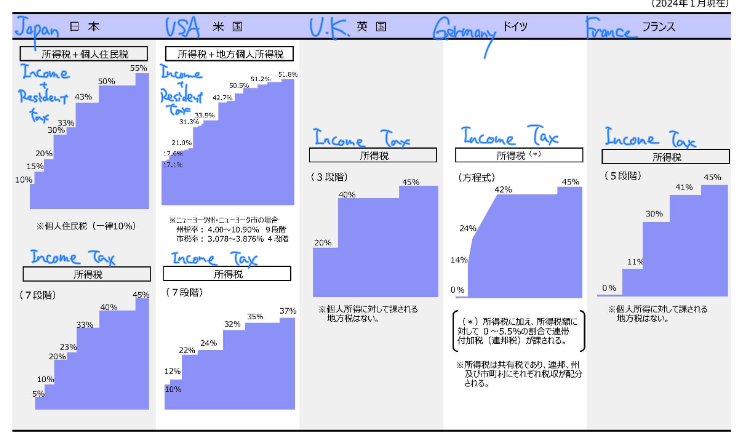

People say that tax rates in Japan are high, but are they? Below is a chart by the Ministry of Finance comparing Japan’s tax rates with those of the U.S., the U.K., Germany, and France.

I am not saying it is low, but I believe there are problems in the discussion. They are,

Point

It is not enough to discuss only the range of tax rates.

You can receive estimated deductions, such as employment income in Japan.

We need to compare the tax rate and tax rate category with your country’s tax rate.

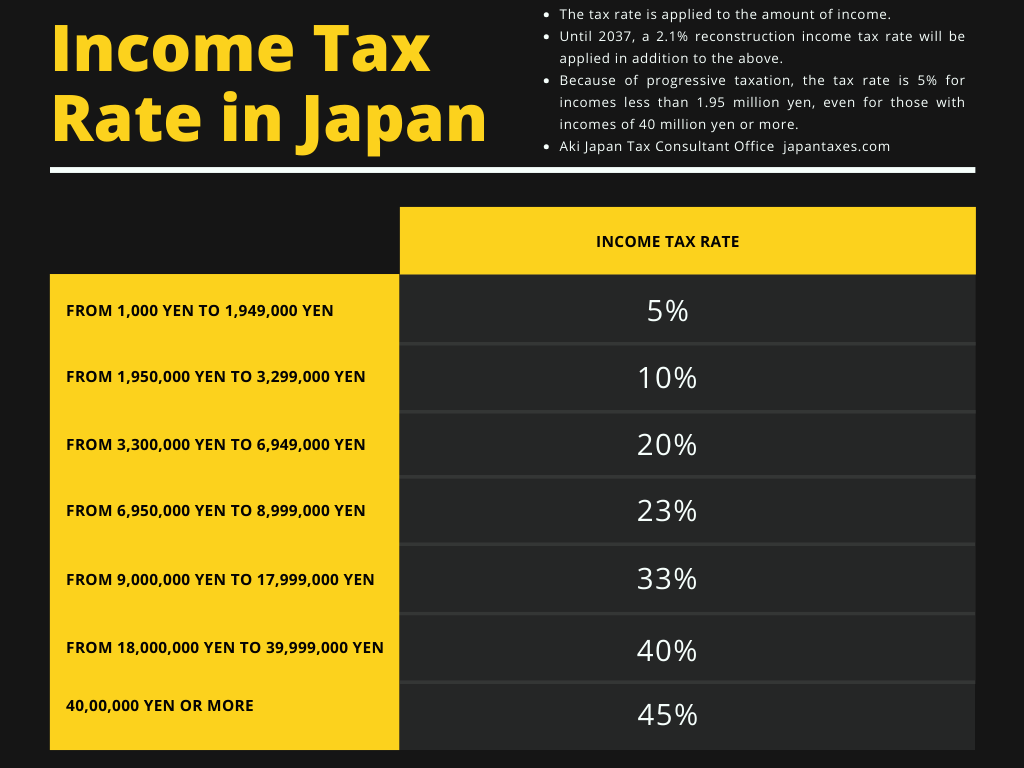

Tax Rates in Japan: Latest Information and Details

Now, let’s look at tax rates in Japan.

The thing is, we need to control our incomes by using various methods.

Understanding Japan’s Tax System: Available Deductions

If you are an employee in Japan, it is important to understand the deduction for employment income. Some of the people who consulted with me because they felt they were paying too much income tax did not have that high of a tax burden.

A deduction for employment income is not the actual amount paid.

You can deduct even if you are not making the expenditure.

You may wear a suit, buy stationery, or drink with colleagues if you are an employee. These expenses are deducted up to an estimated JPY650,000~2,200,000. No receipts are required. You do not have to use the money.

Recently, it has even been argued that this deduction is too favorable compared to self-employed.

The company automatically adjusts the deduction for employment income, so there is no need to file a tax return on your own.

Break-Even Point for Incorporation in Japan

If you are wondering, the guideline for considering incorporation is 10 million yen in sales. This is not because of the income tax rate but because you would be a taxpayer of the consumption tax.

If you set up a corporation, you can be exempt from consumption tax for two years, although there are some conditions.

Another point is when profits exceed 8 million yen. In this case, the corporate tax rate and the income tax rate plus the resident tax rate may exceed the corporate tax rate.

Note that income tax rates are progressive. For corporations, the corporate tax rate is generally 23.2%. However, for small and medium-sized corporations, the tax rate is reduced to 15% for the portion of the income of 8 million yen or less per year for each fiscal year beginning between April 1, 2012, and March 31, 2025 (the regular rate is 19%).

In addition to the target annual income of 10 million yen, incorporation should also be considered when profits (business income) exceed 8 million yen. Once the profit exceeds 8 million yen, the tax burden, such as income tax and resident tax, is likely lower for a corporation than for a sole proprietorship.

However, after incorporation, there will still be issues with paying salaries and spending money as desired by the corporation. You should simulate how you would pay out the amount of compensation.

In these situations, you should consult a Japanese tax accountant thoroughly. If you have any questions or concerns, please contact us.

Source: National Tax Agency, “No. 2260 Income Tax Rates.”

Source: Ministry of Internal Affairs and Communications, “Individual inhabitant tax

Keyword

What is the tax rate in Japan?

tax rate japan